Top Investment-Grade Pre-Owned Designer Handbags for 2025

In 2025, investment-grade handbags like the Hermès Birkin, Hermès Kelly, Chanel Classic Flap, and other top bags stand out as the best investment handbags 2025, capturing the attention of both collectors and style enthusiasts. These pre-owned luxury bags consistently show strong value retention, with data revealing that the global market for luxury leather goods will reach $82.71 billion and revenue per capita will rise to $10.59 by 2025.

Metric / Year | 2023 (USD) | 2024 (Projected USD) | 2025 (Projected USD) |

|---|---|---|---|

Average Revenue per Capita for Luxury Leather Goods (includes handbags) | 9.86 | 10.59 | 10.59 |

Global Market Size for Luxury Leather Goods (billion USD) | N/A | 79.36 | 82.71 |

Luxury Goods Sales Growth (Top 100 companies) | N/A | N/A | ~20% (FY2022 data) |

Net Profit Margin (Top 100 companies) | N/A | N/A | 13.40% (FY2022 data) |

Return on Assets (ROA) (Top 100 companies) | N/A | N/A | 9.50% (FY2022 data) |

Collectors often favor second-hand designer bags such as the Dior Saddle Bag or Gucci Jackie 1961 for their rarity and iconic status. The value retention of highly coveted bags like the Birkin remains impressive, with some rare editions appreciating over 1200% in a decade.

Modern platforms and expert authentication have made it easier than ever to buy pre-owned designer handbags with confidence. For those seeking both timeless style and strong financial returns, the world of pre-loved designer bags and second-hand luxury handbags offers a unique blend of elegance, security, and opportunity.

Key Takeaways

Top designer handbags like Hermès Birkin, Kelly, Chanel Classic Flap, and Dior Saddle Bag hold strong investment value due to their brand heritage and rarity.

Authenticity and excellent condition are crucial for maintaining and increasing the resale value of pre-owned luxury bags.

Limited editions and rare colors boost demand and can lead to significant price appreciation over time.

The luxury handbag market is growing steadily, supported by trusted resale platforms and advanced authentication technologies.

Smart buyers focus on classic styles, verify authenticity, and patiently choose pieces to enjoy both style and lasting financial returns.

What Makes Investment-Grade Handbags a Smart Choice

Brand Reputation and Heritage

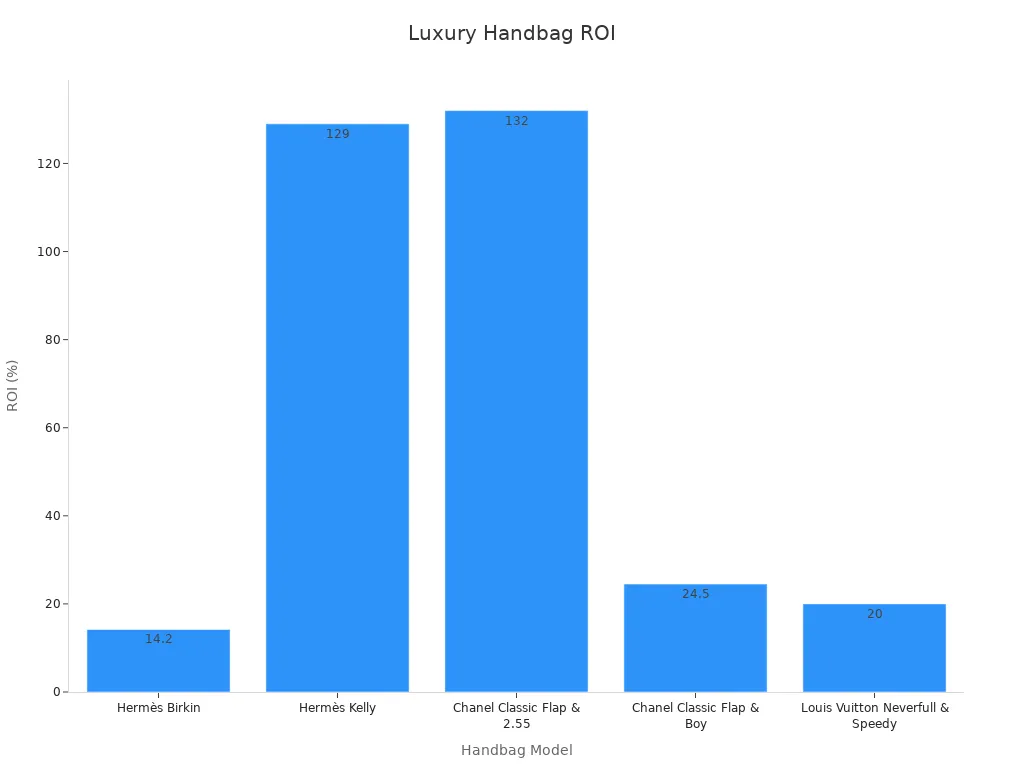

Brand reputation and heritage form the foundation of any successful luxury fashion investment. The world’s most coveted second-hand designer bags—such as the Hermès Birkin, Chanel Classic Flap, and Louis Vuitton Neverfull—have earned their status through decades of impeccable craftsmanship, exclusivity, and cultural significance. These brands consistently deliver investment pieces that transcend fleeting trends, offering both emotional and financial rewards. Historical data reveals that the Hermès Birkin has achieved an average annual appreciation of 14.2% over several decades, while the Chanel Classic Flap has increased in value by 132% over ten years. The table below highlights the remarkable performance of these icons:

Brand | Handbag Model | Historical Appreciation / ROI | Additional Notes |

|---|---|---|---|

Hermès | Birkin | Average annual increase of 14.2% | Ultimate luxury; Himalayan Birkin fetched ~$372,600 at auction |

Hermès | Kelly | 129% increase in value over the past decade | Iconic status; strong resale value |

Chanel | Classic Flap & 2.55 | 132% increase over ten years | Timeless design; strong investment returns |

Chanel | Classic Flap & Boy | 24.5% ROI in 2021 | Recent strong performance |

Louis Vuitton | Neverfull & Speedy | Maintained/increased value; Neverfull up 20% (2021-22) | Classic models with enduring appeal |

Luxury brands with storied legacies inspire trust and desire, making their handbags reliable choices for designer bag investments and luxury fashion investments alike.

Condition and Authenticity

Condition and authenticity play a pivotal role in the value retention of second-hand handbags. Buyers seek assurance that their chosen piece is genuine and well-preserved. Reputable resale platforms employ expert authenticators who meticulously examine every detail, from stitching to hardware, to guarantee authenticity. Maintaining a handbag in pristine condition—through careful storage, regular cleaning, and preserving original packaging—can significantly boost its resale value. Collectors and style enthusiasts alike prioritize proof of authenticity, such as receipts or serial numbers, knowing that even a hint of doubt can diminish a bag’s worth. This focus on authenticity and condition ensures that second-hand luxury handbags remain trusted investment-grade handbags for years to come.

Rarity and Limited Editions

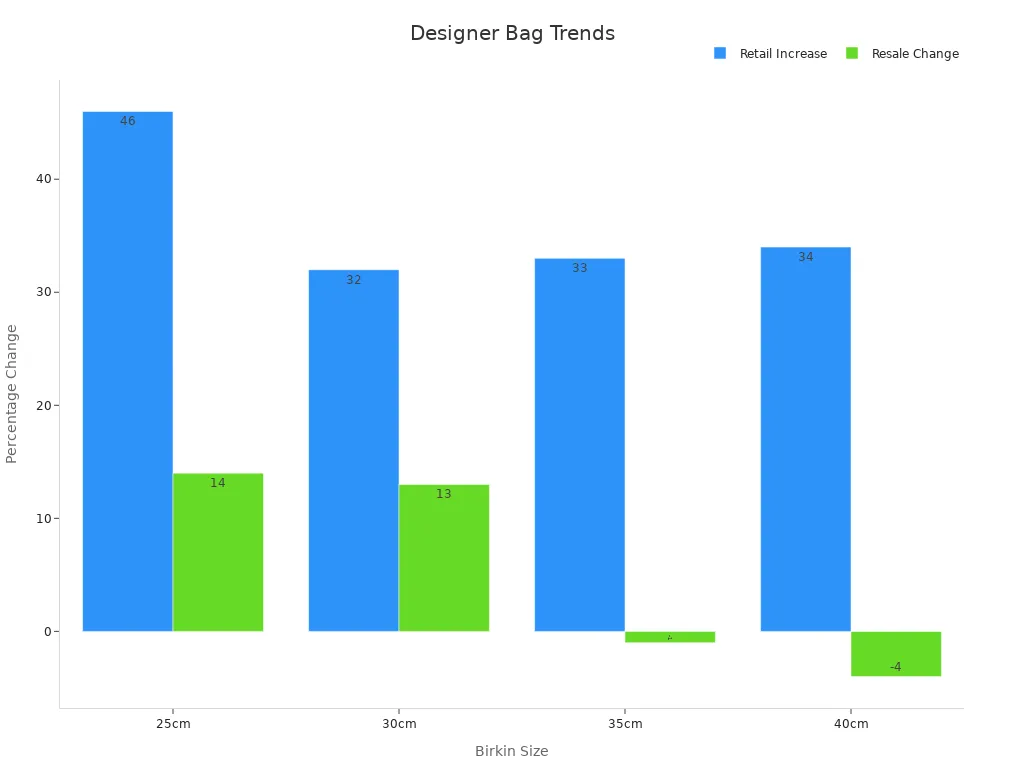

Rarity and limited editions elevate second-hand designer bags from beautiful accessories to sought-after investment pieces. Scarcity drives demand, and limited production runs or discontinued colorways often lead to dramatic price increases on the secondary market. For example, a Hermès Birkin 35 once owned by Jane Birkin sold for nearly eight times its original estimate at auction, while the Dior Saddle Bag’s reissue sparked a 40% surge in resale prices since 2019. The chart below illustrates how rarity and exclusivity fuel appreciation across top brands:

Luxury brands tightly control distribution, ensuring that only a select few can access the most coveted models. This exclusivity, combined with the growing appeal of sustainability and the circular economy, makes second-hand luxury handbags not only a statement of style but also a wise financial move. For those who value both individuality and smart investing, rare and limited-edition bags offer unmatched potential for value retention and long-term growth.

Market Trends and Resale Value

The luxury handbag market continues to evolve, shaped by shifting consumer preferences and global economic forces. Analysts value the global luxury handbag market at $28.64 billion in 2024, with projections indicating an 8.2% compound annual growth rate through 2032. This robust outlook highlights the enduring appeal of designer handbags as both fashion statements and investment assets.

Personalization and customization have become defining features, with brands like Louis Vuitton expanding bespoke services such as “LV By You.”

Celebrity collaborations, such as the Dior x Rihanna limited-edition collection, sell out rapidly and drive up secondary market demand.

Gender-neutral handbag lines from houses like Bottega Veneta and Gucci reflect a broader, more inclusive approach to luxury.

The luxury resale market is thriving, as seen in the launch of dedicated consignment services focused on designer handbags.

Limited-edition and collaboration pieces often command high resale values, especially when they sell out quickly.

Europe remains the dominant region due to heritage brands and luxury tourism, while North America shows the fastest growth, fueled by rising disposable income and celebrity influence.

Brands face challenges from high prices, prompting some to introduce more accessible luxury lines or manage price increases strategically.

Leading brands like Louis Vuitton and Hermès have expanded production capacity, signaling sustained demand and intensifying competition.

Market trends and statistical analyses reveal that investment grade status in luxury assets often correlates with positive market sentiment and access to exclusive financial facilities. Downgrades from investment grade can trigger negative stock returns, underscoring the sensitivity of the market to shifts in perceived value. While these studies focus on financial instruments, they illustrate how market trends and resale value perceptions influence the desirability and status of luxury handbags as investment-grade assets.

Buyers and collectors now view luxury handbag resale value as a key consideration, especially as the secondary market matures and offers greater transparency. The rise of dedicated resale platforms and authentication services has made it easier to track handbag market trends and make informed decisions. As a result, savvy investors and style enthusiasts alike recognize that the right pre-owned designer bag can offer both lasting style and impressive financial returns.

Thoughtful collectors know that following market trends and understanding resale dynamics can transform a beautiful accessory into a wise, enduring investment. Choosing timeless pieces and monitoring the evolving luxury landscape ensures every purchase remains both a joy to carry and a smart addition to any collection.

Hermès Birkin: The Ultimate Pre-Owned Luxury Bag

Quick Stats and Key Features

The Hermès Birkin stands as a symbol of ultimate luxury and meticulous craftsmanship. Each Birkin bag is handmade by a single artisan, often requiring 18 to 25 hours or more, especially when crafted from rare materials like crocodile skin. Hermès employs only about 200 skilled craftsmen annually, ensuring that every handbag meets the highest standards of quality and exclusivity. The brand enforces a strict queue system, making the Birkin notoriously difficult to acquire at retail. Notable features include:

Premium materials such as Togo, Epsom, and exotic leathers

Hand-stitched construction for durability and beauty

Palladium or gold-plated hardware

Discreet branding and timeless design

Sizes ranging from 25cm to 40cm, catering to diverse tastes

The Himalayan Nilo crocodile Birkin, one of the rarest models, fetched $185,000 at auction, highlighting the extraordinary value of select editions.

Why the Birkin Leads Investment-Grade Handbags in 2025

The Birkin continues to lead investment-grade handbags in 2025 due to its unmatched scarcity, enduring appeal, and robust secondary market performance. Hermès maintains exclusivity by limiting production and avoiding mass marketing, celebrity endorsements, or discounts. The brand’s 2019 revenues exceeded $8.3 billion, with profits over $1.8 billion, reflecting its strong market position. Recent research shows that Birkin resale prices often surpass retail by 11% to 34%, with some models appreciating 52% year-over-year. Over the past 35 years, the average annual return for a Birkin has reached approximately 14.2%, outperforming traditional assets like gold and even stocks in certain periods. This resilience, even during economic downturns, makes the Birkin a cornerstone for those seeking a hermès birkin investment or a standout among pre-owned luxury bags.

Investment Asset | Average Annual Return | Key Factors |

|---|---|---|

Hermès Birkin Bags | Limited supply, superior craftsmanship, exclusivity, high resale | |

Gold | ~6.5% | Safe haven, modest returns |

Stocks (S&P 500) | ~10% | Higher volatility, traditional investment |

Smart Buying Tips

Buyers should approach the Birkin market with care and discernment. Condition, color, and rarity significantly influence value. Neutral tones like black, gold, and etoupe remain perennial favorites, while limited editions and exotic leathers command premium prices. Always request authentication and provenance documents before purchasing. Trusted resellers and expert authentication services help ensure a genuine investment. For those new to investment-grade handbags, patience pays off—waiting for the right piece can yield both style satisfaction and impressive returns.

A thoughtful approach to collecting ensures each Birkin not only elevates a wardrobe but also preserves its value for years to come.

Hermès Kelly: Timeless Second-Hand Designer Bag

Quick Stats and Key Features

The Hermès Kelly stands as a masterpiece of design and craftsmanship, instantly recognized for its structured silhouette and elegant simplicity. Each Kelly bag requires up to 25 hours of meticulous handwork by a single artisan, ensuring every detail meets the highest standards. The bag features a trapezoidal shape, a single top handle, and a distinctive turn-lock closure. Sizes range from the petite Mini Kelly (20cm) to the classic 25cm and 28cm, with both Sellier (rigid) and Retourne (softer) constructions available. Popular materials include Togo and Epsom leather, while hardware options such as palladium and gold add a touch of personal flair. Collectors often seek out rare color and hardware combinations, as well as special order editions, which further enhance the Kelly’s exclusivity.

Investment Appeal of the Kelly Bag

The Hermès Kelly enjoys a reputation as one of the most coveted second-hand designer bags in the world. Its iconic status, forever linked to Grace Kelly, and its limited production create a sense of exclusivity that drives demand. On leading resale platforms, Hermès ranks among the top brands for value retention, with the Kelly often commanding prices well above retail—especially in popular sizes like 25cm and Mini/20cm. Some listings show asking prices up to double the original retail, reflecting the bag’s strong appreciation. Neutral tones such as Black or Gold, particularly in Togo or Epsom leather, remain highly sought after and frequently achieve the highest resale values. Annual appreciation rates for select Hermès bags reach up to 14%, and the Kelly benefits from this trend due to its rarity and timeless appeal. Condition plays a crucial role, with pristine or like-new bags fetching the highest returns. Special order and rare versions command significant premiums, making the Kelly a standout among timeless investments in luxury fashion.

Popular Kelly sizes (25cm, Mini/20cm) often sell for up to twice their retail price.

Rare color and hardware combinations increase desirability and value.

Neutral tones in Togo or Epsom leather are especially coveted.

Some Hermès bags appreciate by up to 14% annually.

Condition and exclusivity drive premium resale prices.

Smart Buying Tips

Collectors seeking a Hermès Kelly should prioritize authenticity and condition above all else. Trusted resellers and expert authentication services provide peace of mind, ensuring each purchase is genuine. Buyers should focus on classic sizes and neutral colors, as these consistently hold their value and appeal to a broad audience. Patience often rewards the discerning collector, as rare editions and special orders may take time to surface on the secondary market. Keeping original packaging, receipts, and accessories enhances resale potential. For those who view fashion as both art and asset, the Kelly offers a blend of elegance and investment potential that few other bags can match.

The Hermès Kelly remains a symbol of refined taste and thoughtful collecting. Choosing wisely today can bring both daily joy and lasting value for years to come.

Chanel Classic Flap: Iconic Investment-Grade Handbag

Quick Stats and Key Features

The Chanel Classic Flap stands as a true icon in the world of luxury accessories, instantly recognized for its quilted leather, double C turn-lock, and elegant chain strap. This handbag, especially in small and medium sizes, has become a symbol of timeless style and enduring value. Chanel’s artisans craft each Classic Flap using 278 meticulous steps, a process that reflects the brand’s commitment to excellence and heritage. The bag’s structure, available in both lambskin and caviar leather, offers versatility for both day and evening wear. Chanel’s dedication to quality extends beyond the atelier, with exclusive after-sales services and a five-year warranty that further elevate the ownership experience.

Quilted leather exterior with signature double C clasp

Chain and leather interwoven strap for shoulder or crossbody wear

Available in multiple sizes and finishes

Crafted through a process requiring years of skilled labor

Why the Classic Flap Remains a Top Pre-Owned Luxury Bag

The Chanel Classic Flap continues to outperform many other pre-owned luxury bags, both in desirability and financial return. Over the past five years, the Medium Classic Flap saw its retail price soar from $5,800 in 2019 to $10,200 in 2024—a remarkable 75% increase. Chanel’s regular price adjustments, often ranging from 5% to 15% annually, have fueled strong appreciation in the resale market. Vintage and limited-edition Classic Flaps frequently command prices at or above retail, with some rare models selling for multiples of their original cost. The table below highlights the consistent upward trend in value:

Year/Period | Price Increase (%) | Retail Price (USD) | Notes |

|---|---|---|---|

May 2020 | 5-17% | N/A | Across various Chanel styles including Classic Flap |

July 2021 | 10-15% | N/A | Flap bags surged by 15% |

March 2024 | 6-8% | $10,800 (Medium Flap) | Classic Flap bags now retail above $10,000 |

Vintage/Resale | N/A | $7,000 - $10,600+ | Vintage and limited editions sell at or above retail |

Collectors and investors alike recognize the Classic Flap as one of the most reliable investment-grade handbags, with well-maintained pieces consistently appreciating in value.

Smart Buying Tips

Buyers seeking a Chanel Classic Flap should prioritize condition and authenticity, as these factors drive long-term value. Choosing classic colors such as black or beige ensures broad appeal and strong resale potential. Purchasing from trusted sources with expert authentication protects against counterfeits and preserves investment integrity. Keeping original packaging, authenticity cards, and receipts enhances future resale opportunities. For those building a collection of pre-owned luxury bags, patience and attention to detail often yield the most rewarding acquisitions.

A Chanel Classic Flap offers more than just a beautiful accessory—it represents a thoughtful investment in timeless style and enduring craftsmanship. Choosing wisely today can bring both daily joy and lasting confidence in every ensemble.

Chanel Boy Bag: Modern Second-Hand Designer Bag

Quick Stats and Key Features

The Chanel Boy Bag, introduced in 2011, quickly became a modern icon in the world of luxury handbags. Its bold, boxy silhouette and chunky chain strap set it apart from the classic Chanel Flap, offering a fresh, androgynous twist that appeals to both new collectors and seasoned enthusiasts. The Boy Bag features a structured body, signature push-lock clasp, and comes in a variety of sizes, leathers, and finishes. Chanel’s artisans craft each piece with meticulous attention to detail, ensuring durability and a luxurious feel. The bag’s versatility allows it to transition seamlessly from day to night, making it a favorite for those who value both function and fashion.

Investment Potential for 2025

Several trends highlight why the Chanel Boy Bag stands out as a smart choice for collectors and investors in 2025:

The Boy Bag, launched in 2011, represents Chanel’s move toward modern, gender-neutral design.

Chanel consistently ranks among the top luxury handbag brands for strong resale performance.

Luxury handbag prices closely follow retail market trends, with Chanel’s share price fluctuations influencing demand.

The Boy Bag is expected to maintain or increase its resale value, supported by Chanel’s brand strength and exclusivity.

Brand legacy, limited availability, and steady demand all contribute to the Boy Bag’s appeal as an investment.

While precise appreciation percentages for 2025 are not available, qualitative trends remain positive.

Currently, the Boy Bag commands over $5,000 on the second-hand market, more than doubling its original retail price of about $2,500. Chanel’s strategic price increases and focus on exclusivity since 2019 have further strengthened its financial return. Many Chanel bags retain around 90% of their value, and the Boy Bag, as a newer model, continues to hold or even appreciate in value. Its modern design and the prestige of the Chanel name ensure that it balances style with financial reward, making it a compelling option for those seeking both beauty and smart investment potential.

Smart Buying Tips

Collectors should prioritize condition and authenticity when searching for a pre-owned Chanel Boy Bag. Choosing classic colors such as black, beige, or navy often results in stronger resale value. Buyers benefit from working with trusted resellers who provide authentication and detailed provenance. Retaining original packaging, authenticity cards, and receipts can enhance future resale opportunities. For those building a thoughtful collection, patience and attention to detail will help secure a Boy Bag that brings both daily joy and lasting value.

The Chanel Boy Bag embodies the spirit of modern luxury—confident, versatile, and enduring. Investing in a piece that feels both personal and timeless can inspire confidence and elevate any wardrobe for years to come.

Louis Vuitton Speedy and Neverfull: Versatile Pre-Owned Luxury Bags

Quick Stats and Key Features

Louis Vuitton’s Speedy and Neverfull bags have become icons in the world of luxury accessories. The Speedy, introduced in the 1930s, features a compact, barrel-shaped silhouette with sturdy top handles and the signature LV monogram canvas. The Neverfull, launched in 2007, offers a spacious, open-top tote design with slim leather straps and a secure side lacing detail. Both models come in a range of sizes and materials, including classic Monogram, Damier Ebene, and Damier Azur. These bags remain lightweight, durable, and highly functional, making them favorites for daily use and travel.

Model | Launch Year | Notable Features | Popular Sizes |

|---|---|---|---|

Speedy | 1930s | Barrel shape, zip closure | 25, 30, 35, 40 cm |

Neverfull | 2007 | Open tote, side laces, roomy | PM, MM, GM |

Why These Second-Hand Designer Bags Hold Value

Collectors and style enthusiasts consistently seek out the Speedy and Neverfull on the pre-owned luxury bags market. These handbags hold their appeal due to their timeless design, practicality, and the enduring reputation of the Louis Vuitton brand. Limited editions, seasonal prints, and collaborations often drive up demand, resulting in strong resale value for well-maintained pieces. The brand’s commitment to quality ensures that even older bags retain their structure and charm, making them reliable choices for those who value both style and investment potential. Many buyers appreciate how these bags transition seamlessly from casual outings to more formal occasions, reflecting a lifestyle of effortless elegance.

Note: The Speedy and Neverfull often sell quickly on the resale market, especially in classic patterns and excellent condition.

Smart Buying Tips

Buyers should focus on condition, authenticity, and provenance when selecting a Speedy or Neverfull. Choosing classic colorways and popular sizes increases the likelihood of strong resale performance. Trusted sources and expert authentication services help ensure each handbag is genuine. Retaining original accessories, such as dust bags and receipts, can further enhance future resale opportunities. For those building a thoughtful wardrobe, investing in these Louis Vuitton classics offers both daily versatility and long-term value.

A well-chosen Speedy or Neverfull can become a trusted companion for years, blending practicality with the quiet confidence that comes from owning a true piece of luxury heritage.

Dior Saddle Bag: Investment-Grade Comeback

Quick Stats and Key Features

The Dior Saddle Bag, first introduced in 1999, stands as a testament to the power of iconic design and creative revival. Its instantly recognizable silhouette, inspired by equestrian saddles, features a curved body, short strap, and bold hardware, often adorned with the signature “D” charm. Dior offers the Saddle Bag in a variety of materials, including smooth calfskin, embroidered canvas, and exotic leathers, with both classic and seasonal colorways available. The bag’s compact size and unique shape make it a statement piece, while its adjustable strap and magnetic flap closure add practical appeal for daily wear. Collectors often seek out limited editions and vintage releases, which showcase the artistry and innovation that define Dior’s heritage.

What Makes the Saddle Bag a Smart Investment in 2025

The Saddle Bag’s resurgence in recent years highlights its remarkable investment potential. After Dior’s high-profile relaunch campaign in 2018, the Saddle Bag’s price soared by 300% within just twelve months, a rare feat in the luxury market. The table below illustrates key factors that set the Saddle Bag apart from other designer handbags:

Evidence Aspect | Details |

|---|---|

Price Appreciation | Dior Saddle Bag price rose by 300% in 12 months before July 2018 relaunch campaign. |

Resale Value on Rebag | Sells for close to 75% of current retail price, outperforming average luxury bag depreciation. |

Vintage Versions Resale | Maintain about 30% of their market value. |

Average Luxury Bag Depreciation | Most lose 40-60% of value within a year after launch. |

Marketing Strategy | Dior used ~100 influencers, generating $3.5 million earned media value in Q3 2018. |

Market Demand Drivers | Vintage revival trend and millennials' interest in heritage styles sustain demand. |

Recent sales reports reveal that, while many Dior bags experience significant depreciation, the Saddle Bag defies this trend. Strategic marketing, celebrity endorsements, and a renewed appreciation for vintage aesthetics have fueled its comeback. The Saddle Bag now commands strong resale prices, often outperforming other models in the Dior lineup. This renewed desirability, coupled with the growing secondhand luxury sector, positions the Saddle Bag as a standout among pre-owned luxury bags for 2025.

Smart Buying Tips

Collectors seeking to invest in a Dior Saddle Bag should focus on authenticity, condition, and provenance. Choosing classic colorways or limited-edition collaborations can enhance long-term value. Buyers benefit from working with trusted resellers who provide expert authentication and detailed documentation. Retaining original packaging and accessories further supports future resale opportunities. Monitoring market trends and acting decisively when a rare or well-preserved piece appears can make all the difference. For those who appreciate both artistry and investment, the Saddle Bag offers a unique blend of nostalgia and modern appeal.

A thoughtfully chosen Saddle Bag not only elevates a wardrobe but also serves as a reminder that true style endures. Investing in pieces with history and heart inspires confidence and brings lasting joy to every collection.

Gucci Jackie 1961: Classic Second-Hand Designer Bag

Quick Stats and Key Features

The Gucci Jackie 1961 stands as a testament to enduring style and the power of reinvention. First introduced in 1961, this handbag quickly became synonymous with Jackie Kennedy Onassis, whose effortless elegance set a global standard. The bag’s signature curved half-moon shape, piston closure, and sleek shoulder strap create a silhouette that feels both classic and modern. In 2020, Gucci’s creative director Alessandro Michele revived the Jackie 1961, updating it with smaller sizes and vibrant new colors while preserving its original spirit. Today, collectors can find the Jackie 1961 in smooth leather, GG Supreme canvas, and even exotic finishes, each crafted with meticulous attention to detail.

Investment Appeal of the Jackie 1961

The Jackie 1961’s investment appeal lies in its timeless design and cultural resonance. Gucci’s marketing campaigns have highlighted the bag’s heritage, targeting both younger trendsetters and seasoned collectors who appreciate classic luxury. While digital engagement for these campaigns remains moderate, the true strength of the Jackie 1961 emerges in its cross-generational desirability and steady sales performance. The bag’s association with high-profile projects, such as the film "House of Gucci," has further elevated its visibility and desirability in the market for pre-owned luxury bags. Compared to other icons, the Jackie 1961 holds its own in terms of resale value and scarcity. The table below offers a comparative snapshot:

Handbag Model | Resale Value Highlights | Scarcity Indicators | Additional Notes |

|---|---|---|---|

Gucci Jackie 1961 | Strong resale value, timeless appeal | Implied scarcity, iconic status, 2020 relaunch | Mentioned alongside Chanel classics for high resale activity |

Hermès Birkin | Up to $32,000 resale after $11,400 retail | Extremely scarce, secretive production | Average annual appreciation of 14%; requires purchase history |

Collectors recognize that the Jackie 1961’s enduring legacy and periodic revivals help sustain its value, making it a reliable choice for those seeking both style and smart investment.

Smart Buying Tips

Buyers should prioritize condition and authenticity when searching for a Jackie 1961. Classic colorways and limited-edition releases often command the highest resale prices. Trusted resellers and expert authentication services provide peace of mind, ensuring each acquisition is genuine. Retaining original packaging and documentation can further enhance future value. For those building a thoughtful collection, patience and a discerning eye will help uncover a Jackie 1961 that brings both daily joy and lasting confidence.

The Gucci Jackie 1961 reminds collectors that true style never fades. Investing in pieces with a rich story and timeless design inspires a wardrobe that feels both personal and enduring.

How to Buy and Authenticate Pre-Owned Luxury Bags

Assessing Condition and Value

A thoughtful approach to evaluating second-hand designer bags begins with a meticulous inspection of every detail. Buyers should examine logo alignment, stitching uniformity, and the quality of hardware, as these elements often reveal the true craftsmanship behind pre-owned items. Checking provenance through date codes and sales history adds another layer of reassurance, confirming the authenticity and origin of each piece. Many collectors rely on professional authentication services that utilize advanced technology, such as AI-driven tools, to compare images against extensive databases. This objective process enhances accuracy and helps buyers avoid costly mistakes. With the rise of sustainable fashion and the growing value of pre-owned luxury bags, careful assessment has become essential for anyone considering a pre-owned handbag investment.

Trusted Sources and Marketplaces

Selecting the right marketplace can make all the difference when searching for second-hand treasures. Leading platforms have established rigorous authentication protocols, ensuring that buyers receive only genuine pre-owned items. The table below highlights several trusted marketplaces and their key features:

Marketplace | Authentication & Trust Features | Pros | Cons | Commission/Fees |

|---|---|---|---|---|

The RealReal | Full authentication, handles selling process | Trusted, authenticity guarantee | High commissions, limited pricing | 15%-40% commission |

Vestiaire Collective | Strict authentication, sustainability focus | Seller pricing control, buyer trust | Lower offers encouraged | Variable fees |

Rebag | Authentication guarantee | Upfront pricing, designer bag focus | Lower buyout offers | Competitive rates |

eBay | Authenticity Guarantee tool | Global reach, auction format | High competition, not luxury-focused | 9%-15% final value fee |

StockX | Authentication guarantee | Bid-ask pricing, competitive prices | Growing presence in handbags | 3% seller fee |

myGemma | Strong authentication focus | Niche luxury audience, buyer trust | Limited exposure | 5%-20% commission |

The Luxury Closet | Strong authentication, high-end brands | Global reach, trusted for luxury items | High commission rates, niche audience | 15%-40% commission |

These platforms have earned the trust of buyers by offering documented certificates, financial safeguards, and transparent processes. Their commitment to authenticity and consumer protection supports the growing demand for second-hand and pre-owned items.

Spotting Fakes and Ensuring Authenticity

The risk of counterfeit goods remains a significant concern in the world of second-hand luxury. Multi-layered authentication, combining expert authenticators and AI technology, now delivers high accuracy and rapid results—sometimes within minutes. Many platforms provide free digital certificates as proof of authenticity, which protect buyers and sellers alike. Mobile apps offer 24/7 access to expert authentication, while partnerships with reputable marketplaces further enhance confidence. Statistical data reveals that 52% of luxury handbags submitted for authentication were counterfeit, underscoring the importance of rigorous verification. Entrupy’s AI-driven process, for example, analyzes millions of data points and issues widely recognized certificates, offering a money-back guarantee if errors occur. Fashionphile and similar trusted platforms reinforce the value of reliable authentication, ensuring that every second-hand purchase brings peace of mind and lasting satisfaction.

A discerning eye, paired with trusted technology and reputable sources, transforms the search for pre-owned luxury bags into a journey of confidence and discovery. Each carefully chosen piece becomes not just an accessory, but a reflection of thoughtful style and enduring value.

Caring for Investment-Grade Handbags

Storage and Handling Tips

Proper storage and careful handling form the foundation of handbag longevity. Collectors often choose cool, dry environments away from direct sunlight to prevent fading and moisture damage. Many prefer to store bags upright, using soft dust bags or breathable covers to shield delicate leather from dust and scratches. To help maintain the original shape, they gently fill bags with acid-free tissue or soft inserts. Handles and straps should rest naturally, never hanging for long periods, as this can cause stretching or distortion. When moving or displaying a prized piece, clean hands and a gentle touch help preserve the finish and hardware.

Tip: Rotate handbags in regular use to avoid excessive wear on any single piece, allowing each to rest and recover its structure.

Cleaning and Maintenance

Regular cleaning and thoughtful maintenance ensure that investment-grade handbags retain their beauty and value. Many collectors rely on specialized leather care products—conditioners, cleaners, and protectants—to keep leather supple and vibrant, protecting against moisture and UV exposure. Professional cleaning services use advanced techniques to remove dirt and stains without harming delicate finishes. Restoration experts can repair worn corners, replace hardware, or restore original color, often using eco-friendly products and modern dyeing methods. This approach not only revives the appearance but also extends the lifespan of cherished pieces.

Use gentle, pH-balanced cleaners designed for luxury leather.

Apply conditioners periodically to prevent drying and cracking.

Seek professional restoration for significant wear or color loss.

Consider dyeing services to refresh or personalize vintage bags.

Preserving Value Over Time

Preserving the value of a luxury handbag requires ongoing attention and a mindful approach. Owners who keep original packaging, receipts, and authentication cards often see higher resale returns. Regular inspections help catch early signs of wear, allowing for timely repairs. Many now embrace sustainable practices, choosing restoration over replacement to honor both craftsmanship and environmental responsibility. By investing in professional care and thoughtful storage, collectors ensure that each handbag remains a source of pride and a lasting asset—ready to inspire future generations of style enthusiasts.

A well-cared-for handbag tells a story of appreciation and intention, reminding its owner that true luxury endures through mindful stewardship and gentle hands.

Investing in second-hand designer handbags such as the Birkin, Kelly, Classic Flap, Boy Bag, Speedy, Neverfull, Saddle Bag, and Jackie 1961 brings both enduring style and strong financial potential. Market reports confirm that these investment pieces often outperform traditional assets, with value retention driven by brand heritage, rarity, and careful maintenance.

Designer Bag | Brand | Price Range (Second-hand) | Value Retention / Appreciation |

|---|---|---|---|

Hermès Birkin 30 | Hermès | 130%+ of original price | |

Chanel Classic Flap Medium | Chanel | $5,000 - $9,000 | 100-120% of original price |

Louis Vuitton Speedy 25 | Louis Vuitton | $800 - $1,200 | 80-90% of original price |

Key factors for success include:

Choosing luxury brands with proven prestige

Prioritizing condition and authenticity

Monitoring market trends and timing resale wisely

The second-hand luxury market continues to expand, supported by AI authentication and growing consumer confidence. With thoughtful choices, each investment piece can become both a wardrobe staple and a lasting asset.

A well-chosen second-hand bag tells a story of personal style and smart investment, inspiring confidence with every carry.

FAQ

How can buyers ensure the authenticity of a pre-owned designer handbag?

Buyers should request authentication certificates and original receipts. Trusted resellers often use advanced technology and expert teams to verify each item. Authenticity cards, serial numbers, and detailed provenance provide additional assurance. A careful review of stitching, hardware, and branding helps confirm genuine craftsmanship.

What factors most influence the resale value of a luxury handbag?

Condition, brand reputation, rarity, and color all play significant roles. Bags in pristine condition with original packaging and documentation command higher prices. Limited editions and classic colorways often see stronger demand. Market trends and seasonal popularity also affect resale performance.

Is it possible to restore or repair a vintage designer bag?

Professional restoration services can clean, repair, and even recolor luxury handbags. Skilled artisans address worn corners, faded leather, or damaged hardware. Many collectors choose restoration to preserve both beauty and value, ensuring each piece remains a cherished part of their wardrobe.

How should collectors store investment-grade handbags to maintain their value?

Collectors store handbags upright in cool, dry spaces away from sunlight. They use dust bags, acid-free tissue, and avoid hanging straps to prevent stretching. Regular inspections and gentle handling help maintain structure and finish, supporting long-term value and lasting elegance.

Why do some pre-owned handbags appreciate in value over time?

Iconic designs, limited production, and enduring brand prestige drive appreciation. When demand exceeds supply, prices rise on the secondary market. Bags with cultural significance or celebrity associations often become highly sought after, transforming them into true investment pieces.

Thoughtful care and informed choices allow every collector to enjoy both the beauty and the legacy of their favorite handbags, inspiring confidence with each elegant carry.

A Thoughtful Edit: Redefining Luxury for the Modern Wardrobe

In today’s world, luxury isn’t just about labels, it’s about intention woven into every stitch, and that’s exactly the philosophy we live by at PlushPast. We believe a modern wardrobe thrives on thoughtfully chosen, pre-loved pieces that carry a story, from impeccably authenticated classics to hidden gems unearthed for their enduring elegance. It’s the quiet confidence of timeless silhouettes paired with the conscious satisfaction of sustainable choices, all grounded in the trust you feel when you know quality and comfort aren’t compromised. This is the new standard of luxury: a curated edit that feels as good in your hands as it does in your heart, season after season.

Disclaimer: The information provided on www.plushpast.com is for general informational purposes only and does not constitute professional fashion, legal, or authenticity advice. While PlushPast strives to ensure all content is accurate and trustworthy, visitors should exercise personal judgment and conduct their own research when making purchasing decisions. PlushPast does not guarantee the accuracy of third-party information and disclaims any liability for decisions made based on the content presented on this website.