Tech Sector Equity Forecasts: AI, Cybersecurity, and Cloud Adoption Trends

Understanding tech sector equity forecasts remains essential for investors and business leaders as digital transformation accelerates.

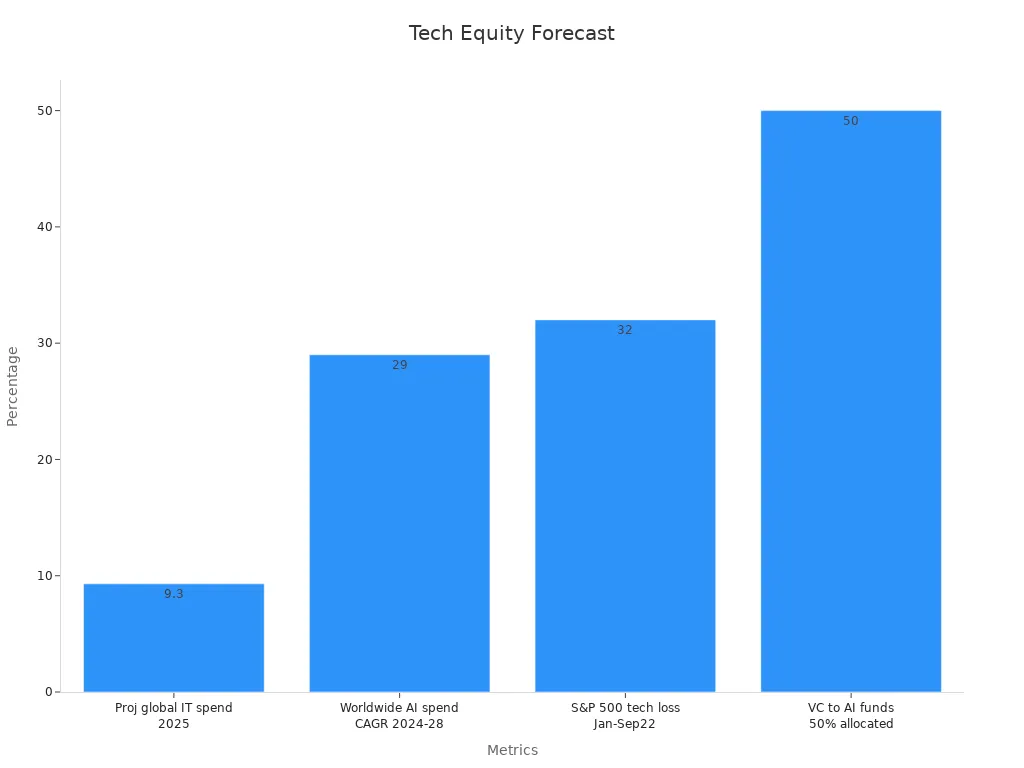

Nearly half of all venture capital now targets AI, while IPO and M&A activity bring liquidity opportunities.

Projected global IT spending growth for 2025 stands at 9.3%, with double-digit expansion in data center and software segments.

Digital transformation drives demand for advanced cybersecurity and cloud computing solutions.

Trends in AI, cybersecurity, and cloud computing require leaders to adopt data-driven approaches, as 65% of organizations now use or explore AI for analytics. They see measurable gains in profitability, agility, and strategic decision-making.

Key Takeaways

AI, cybersecurity, and cloud computing drive strong growth and innovation in the tech sector, creating new investment opportunities despite market volatility.

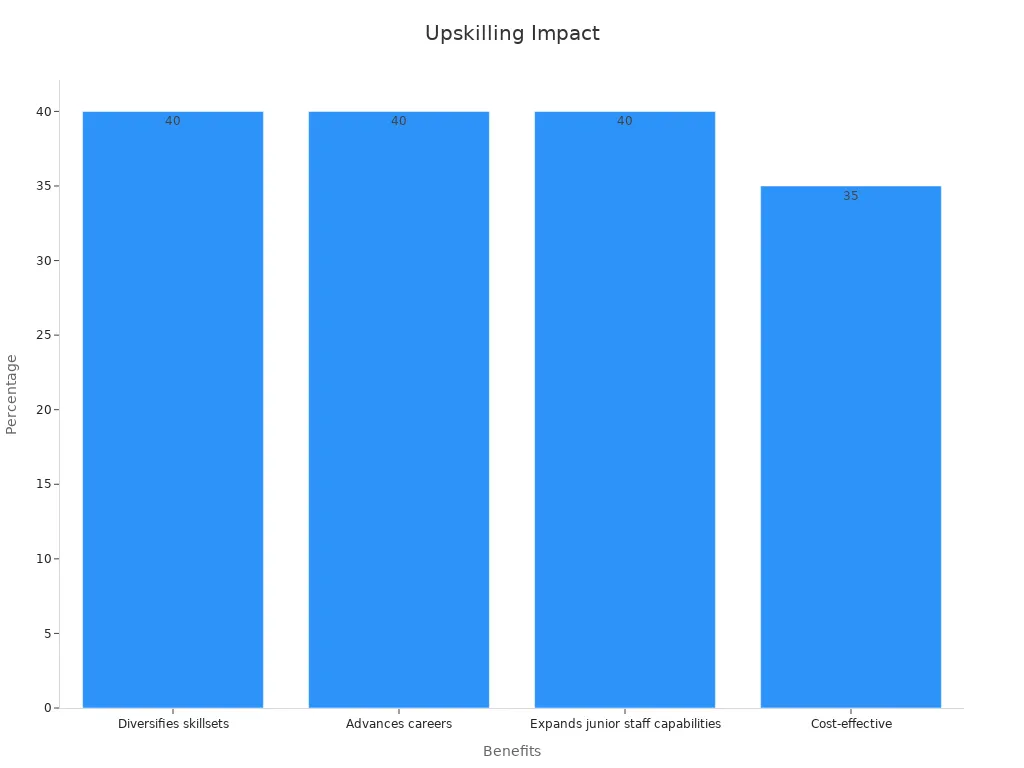

Investing in workforce upskilling and adopting data-driven, scalable AI and cloud strategies help organizations stay competitive and manage risks effectively.

Balancing innovation with regulatory compliance and cost management ensures sustainable success amid evolving policies and global challenges.

Tech Sector Equity Forecasts

Market Overview

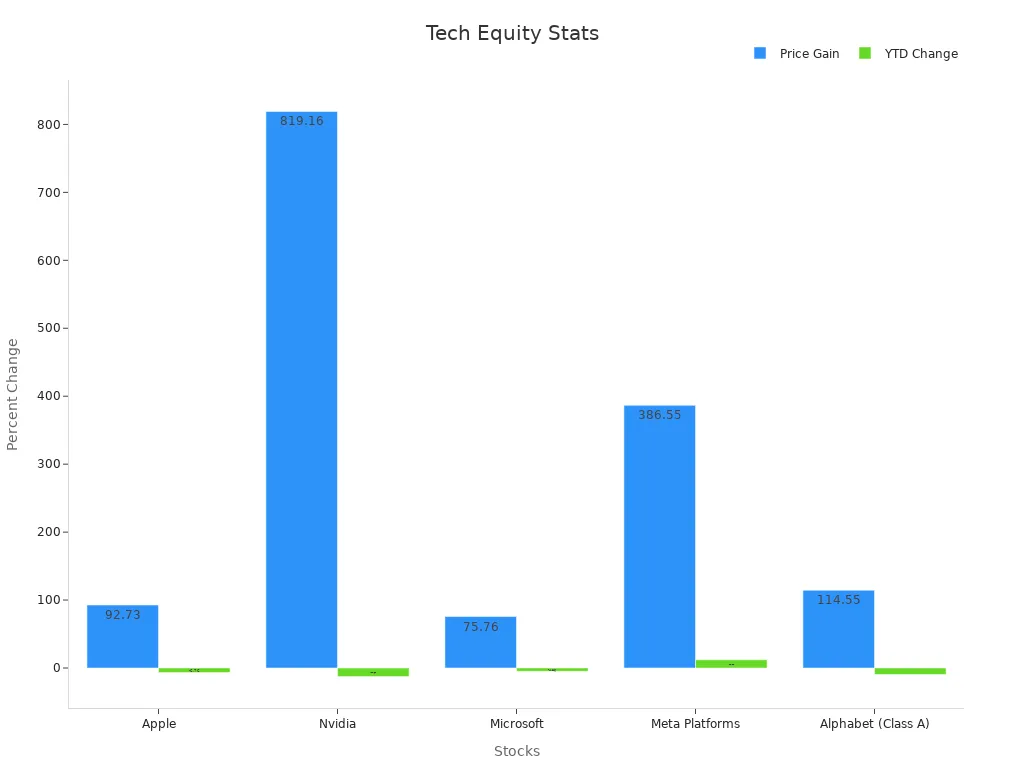

The tech sector equity forecasts for 2025 reflect a landscape shaped by rapid digital transformation, evolving policy, and shifting investor sentiment. The New York Stock Exchange now hosts companies with a combined market capitalization near $32 trillion, a figure that surpasses the GDP of most countries. This immense scale highlights the influence of technology companies on global markets. Despite ongoing geopolitical tensions and recession concerns, major stock indices posted strong gains through 2023 and 2024, driven by the momentum of firms advancing ai, cybersecurity, and cloud computing. However, the start of 2025 brought a reversal for some of the largest names, with the Information Technology and Communication Services sectors underperforming the broader S&P 500. The S&P 500’s Information Technology sector, which makes up about 40% of the index, recorded a total return of -4.42% year-to-date, compared to the S&P 500’s -0.45%. This underperformance underscores the volatility and outsized impact of leading tech stocks.

A closer look at individual companies reveals significant price swings. For example, Nvidia soared by over 800% from 2023 to 2024, only to decline by more than 12% in early 2025. Apple, Microsoft, and Alphabet also experienced notable pullbacks after periods of exceptional growth. These movements reflect both the promise and the risk inherent in tech sector equity forecasts, especially as digital transformation accelerates and new technologies reshape business models.

Key Drivers

Several factors drive current trends in tech sector equity forecasts.

Ownership Structure and Innovation: Equity ownership concentration shows an inverted U-shaped relationship with innovation performance. Both very low and very high concentration levels can hinder innovation, while balanced ownership supports better governance and resource allocation.

R&D Investment: Companies that prioritize research and development tend to outperform peers, especially in ai and cybersecurity. R&D investment links ownership patterns to innovation outcomes, fueling breakthroughs in digital transformation.

Market Competition: Competitive pressures moderate the effects of ownership concentration, shaping how companies allocate resources and pursue growth.

Policy and Regulation: Mentions of “deregulation” in Q4 earnings calls increased twentyfold compared to the previous four-year average. This signals a shift in policy focus that could stimulate capital expenditure in technology and related sectors.

Valuation and Concentration Risk: The Information Technology sector trades at a price-to-earnings ratio of 27.7x, well above the S&P 500’s 22x, approaching levels seen during the dot-com bubble. A handful of dominant firms, sometimes called the “Magnificent 7,” now drive much of the sector’s performance, increasing both opportunity and risk for investors.

BlackRock’s analysis, which draws on conference call transcripts, geolocation, and shipping data, reveals that ai-related sectors in Asia show different performance patterns compared to their U.S. counterparts. Correlations for hardware and semiconductors hover around 64%, while ai applications and physical ai see correlations closer to 38%. This divergence highlights the importance of regional trends and sector-specific dynamics in shaping tech sector equity forecasts.

Challenges

The path forward for tech sector equity investments remains complex.

Inflation and rising interest rates compress valuations and increase financing costs, prompting private equity firms to favor equity-heavy deals over debt.

Macroeconomic volatility and geopolitical uncertainty complicate cross-border investments and regulatory compliance, especially for companies with global supply chains.

Tariffs present a significant challenge, with technology firms facing rates as high as 34% on China and 46% on Vietnam. Apple’s gross margin, for instance, could shrink by up to 9% if tariffs on China are absorbed.

Stricter investment screening and regulatory scrutiny in the U.S. and EU add further complexity, affecting deal-making and growth opportunities in ai, cybersecurity, and cloud computing.

Market correction and elevated bond yields have challenged the sustainability of prior bull market gains, emphasizing the need for skilled security selection and adaptability.

Note: Investors and business leaders should focus on diversification and adaptability, as policy uncertainty and global trade tensions continue to shape the outlook for tech sector equity forecasts. Maintaining a balanced approach can help navigate the risks and seize opportunities that arise from ongoing digital transformation.

AI Trends

AI Investment

AI investment continues to reshape the tech sector, with capital flowing into both generative and applied ai solutions at an unprecedented rate. In 2023, financial services alone spent $35 billion on ai, and projections indicate the global ai in finance market will reach $190.33 billion by 2030, growing at a 30.6% CAGR. Nearly every company in the sector plans to increase ai investments, and 75% rate their ai capabilities as industry-leading or average. The following table highlights key metrics that illustrate ai’s expanding market impact:

Metric / Indicator | Value / Statistic |

|---|---|

AI spending in financial services (2023) | $35 billion |

Projected global AI in finance market size by 2030 | $190.33 billion |

Compound Annual Growth Rate (CAGR) (2024-2030) | 30.6% |

Accuracy of AI-driven stock price predictions | Nearly 80% |

AI-powered hedge funds' returns vs. global industry avg | Almost triple |

AI adoption in financial institutions (2022) | 45% |

Expected AI adoption in financial institutions (2025) | 85% |

Financial institutions reporting positive revenue impact | 86% |

Financial institutions reporting cost reduction | 82% |

Companies planning increased AI investments | 97% |

Financial service companies rating their AI capabilities | 75% consider industry-leading or average |

Venture capital and private equity now prioritize ai, with one in four U.S. startups focused on ai and 80% of funding for ai-native companies concentrated in Silicon Valley, Beijing, and Paris.

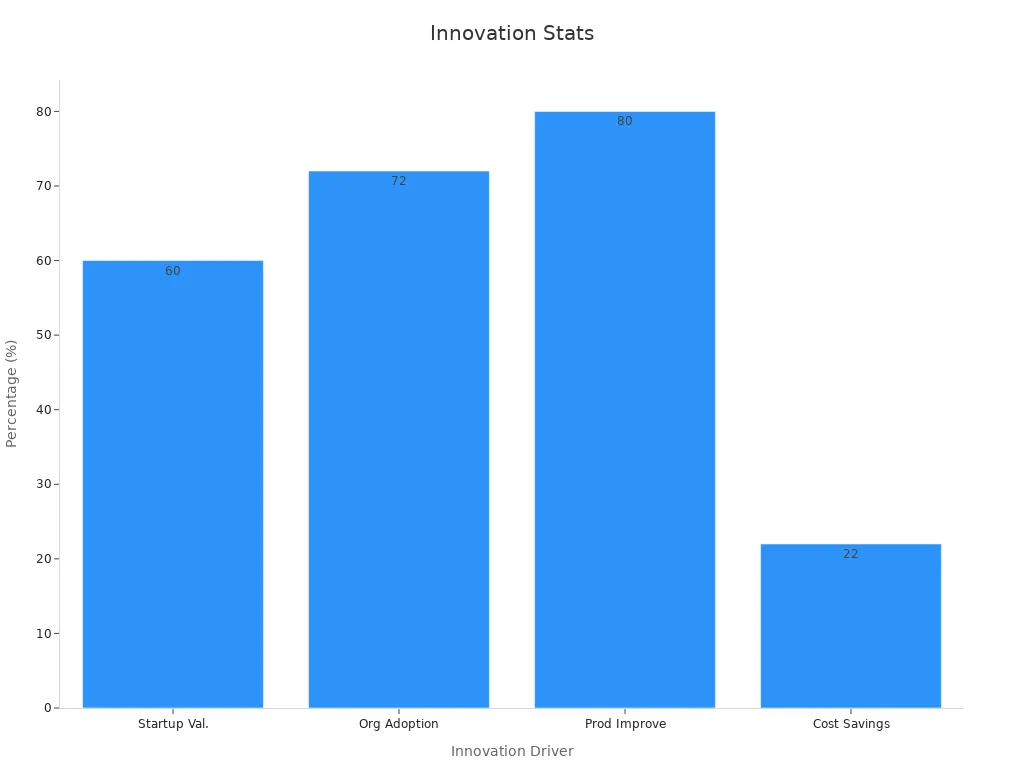

Adoption Rates

Adoption of ai solutions has accelerated, especially in generative ai. By early 2024, 65% of organizations reported using generative ai, nearly double the previous year. Professional services, fintech, and banking lead in adoption, while manufacturing and government lag due to integration challenges. Businesses adopting generative ai report average cost savings of 15.2%, and financial services achieve ROI multiples exceeding 4x. Notably, 92% of Fortune 500 companies leverage OpenAI’s technology, and the generative ai market is set to grow at a 46% CAGR, reaching $356 billion by 2030.

Innovation Drivers

Several factors drive innovation in ai. Investment in generative ai reached $25.2 billion in 2023, and total ai investment hit $92 billion in 2022. Ai startup valuations stand 60% higher than non-ai peers, reflecting strong investor confidence. The sector expects ai to contribute $15.7 trillion to the global economy by 2030. Productivity gains reach up to 80% for staff using ai, and operational cost savings average 22%. The demand for advanced chips and diversified ai models fuels further growth.

AI Challenges

Despite rapid progress, organizations face significant challenges. Talent shortages in ai and machine learning persist, making recruitment and retention difficult. Upskilling and reskilling remain essential, with companies like Microsoft partnering with education providers to scale ai expertise. Integrating ai with legacy IT systems often requires costly upgrades or hybrid cloud solutions. Scaling ai systems demands robust infrastructure and careful management of model drift. Energy consumption also rises as ai automation expands, prompting investments in renewable energy and efficient data centers.

Leaders who embrace continuous learning and invest in scalable ai infrastructure position their organizations to thrive as ai trends evolve. The future belongs to those who adapt, innovate, and build resilient teams ready for the next wave of ai solutions.

Cybersecurity Outlook

Market Growth

Cybersecurity stands at the forefront of digital transformation, with market expansion accelerating as organizations confront increasingly complex risks. The sector’s total addressable market now approaches $1.5 trillion, and analysts project a compound annual growth rate of 14.3% through 2032. Managed services lead with a 12.4% annual growth rate, while companies like SentinelOne report revenue surges of 70% year-over-year. The banking and financial services sector dominates due to frequent data breaches, and North America maintains the largest market share. Asia Pacific, however, shows the fastest growth, fueled by rising internet penetration and a surge in cyber-attacks.

A recent table highlights the sector’s trajectory:

Metric | Value | Timeframe |

|---|---|---|

Projected CAGR | 14.3% | 2024 to 2032 |

Market Size (2023) | USD 172.24 billion | 2023 |

Projected Market Size (2032) | USD 562.72 billion | 2032 |

Threat Landscape

The threat landscape continues to evolve, challenging even the most advanced cybersecurity teams. Global cybercrime losses are projected to reach $10.5 trillion by 2025, up from $6 trillion in 2021. Data breaches now cost organizations an average of $4.88 million, with ransomware attacks averaging $5.13 million per incident. Phishing remains the most expensive attack vector, costing $4.9 million on average.

Organizations increasingly turn to ai-enabled cybersecurity, with 80% of industrial professionals planning to expand AI use for predictive analytics, threat detection, and security automation. However, 68% report integration challenges, and only 28% express strong confidence in AI-based solutions. Concerns about excessive reliance, manipulation, and data privacy persist, highlighting the need for balanced, human-guided approaches to ai-augmented threat detection.

Regulation

Regulatory oversight shapes cybersecurity evolution, compelling organizations to adopt best practices such as risk assessments, multi-factor authentication, and incident response planning. Frameworks like GDPR, PCI-DSS, and HIPAA drive proactive risk reduction and stakeholder trust. In the U.S., new SEC rules require public companies to disclose material cybersecurity incidents and detail risk management practices.

Continuous monitoring, transparent reporting, and comprehensive documentation now define regulatory compliance.

The EU AI Act introduces a seven-step governance model for high-risk AI use cases, emphasizing data quality, human oversight, and fail-safe mechanisms. These evolving policies ensure that cybersecurity remains a board-level priority and that organizations address both current and emerging risks.

Skills Gap

A persistent skills gap threatens the effectiveness of cybersecurity programs. Over 66% of organizations report shortages of qualified professionals, and 90% acknowledge gaps within their security teams. Budget constraints, layoffs, and hiring freezes exacerbate the problem, while nearly half of cybersecurity professionals experience burnout.

AI, cloud computing, and zero trust architectures represent the biggest skills shortfalls. The 2024 IBM Data Breach Report found that insufficient staffing increases breach costs by $1.76 million on average. As cybersecurity evolution accelerates, organizations must invest in workforce development and foster a culture of continuous learning to close these gaps and build resilience.

The future of cybersecurity will depend on adaptive strategies, robust regulatory compliance, and a skilled workforce ready to meet the challenges of a rapidly changing threat environment.

Cloud Adoption

Cloud Strategies

Organizations now view cloud adoption as a strategic imperative, not just a technical upgrade. They design cloud strategies to align with business goals, focusing on agility, scalability, and innovation. Many enterprises shift from capital expenditures to operational expenditures, improving cash flow and budget flexibility. Teams collaborate across finance, operations, and engineering to manage cloud spending and optimize investments. The FinOps framework has gained traction, fostering financial accountability and data-driven decision-making. Companies use pricing calculators and cost management platforms to understand cost-to-benefit ratios, while governance practices such as tagging standards and automated cleanup of unused resources help control costs and maximize value.

Security and Compliance

Security and compliance remain top priorities in cloud computing. Organizations measure performance using several key metrics:

Adherence to standards like GDPR and HIPAA.

Audit trail completeness for accurate logging.

Multi-factor authentication to prevent unauthorized access.

Patch management effectiveness and continuous monitoring.

Infrastructure security, including firewall performance and network traffic monitoring.

Data encryption and loss prevention.

Application vulnerability scans and authentication effectiveness.

Clear governance and shared responsibility models between providers and customers.

These practices ensure robust risk management and regulatory adherence, supporting trust and resilience in cloud environments.

Cost and ROI

Cloud adoption delivers measurable financial benefits. A McKinsey study of 43 major banks found an average ROI of 196% over five years, with a median payback period of 2.3 years. Forty percent of this value comes from cost savings, while 60% results from revenue growth through improved customer experience and faster innovation. However, about 27% of cloud spend is wasted due to idle resources and pricing complexity. Effective strategies include workload assessment, FinOps adoption, and continuous cost tracking. The table below summarizes the impact of cost-benefit analysis and cloud accounting on financial management:

Path | Significance | Effect | Interpretation |

|---|---|---|---|

CBA → FM | Significant | β = 0.314 | Cost-benefit analysis improves financial management |

CBA → CA | Not significant | N/A | Financial rationale alone does not drive cloud adoption |

CA → FM | Significant | β = 0.401 | Cloud accounting adoption boosts financial management |

Sustainability

Sustainability drives many cloud adoption decisions. Cloud migration can reduce carbon emissions by up to 84%, with regional reductions ranging from 65% in Brazil to 88% in Europe. Cloud-powered technologies could remove 59 million tons of carbon dioxide annually, equivalent to taking 22 million cars off the road. Providers invest in renewable energy, low-carbon materials, and innovative cooling methods to further reduce environmental impact. Running workloads in the cloud often proves several times more energy efficient than on-premises solutions, supporting both business and environmental goals.

Forward-thinking organizations recognize that cloud computing not only enhances operational efficiency but also advances sustainability and resilience. By aligning cloud strategies with business objectives and environmental stewardship, leaders position their enterprises for long-term success.

Cross-Sector Insights

Workforce Upskilling

Organizations across the technology landscape recognize that workforce upskilling drives performance and resilience. Nearly all technology roles now evolve due to ai, with 92% requiring new skills. A global consortium of industry leaders—including Cisco, IBM, Microsoft, Google, Intel, and SAP—commits to training over 95 million people in the next decade. Their programs focus on ai literacy, data analytics, prompt engineering, and critical thinking. Cisco aims to train 25 million in cybersecurity and digital skills by 2032, while IBM and Intel each target 30 million for ai upskilling by 2030. Cross-skilling empowers teams to adapt, reduces bottlenecks, and fosters collaboration. For example, a cloud engineer with cybersecurity expertise can integrate security from the outset, and a developer fluent in ai can spot automation opportunities early. This approach builds versatile technologists who can navigate rapid digital transformation.

ROI Measurement

Measuring the return on investment for technology initiatives requires clear, quantitative metrics. Teams track code deployment frequency, bug resolution time, and change failure rates to assess velocity, quality, and efficiency. A fintech case study showed that process optimization led to a 47% increase in team velocity and a 52% reduction in costs within a year.

Metric Category | Improvement | Timeframe |

|---|---|---|

Team Velocity | 47% increase | 6 months |

Code Quality | 35% enhancement | 3 months |

Resource Efficiency | 28% optimization | 4 months |

Cost Reduction | 52% savings | 12 months |

Customer-centric metrics such as acquisition cost, lifetime value, and churn rate further clarify the impact of ai and cybersecurity investments on business outcomes.

Regulatory Impact

Policy changes continue to reshape the technology sector. The Federal Trade Commission’s leadership shift in 2025 reduced antitrust enforcement and prioritized cybersecurity, ai regulation, and data privacy. This pivot led to improved performance for major tech stocks, as investors favored companies with strong compliance records. Regulatory complexity has grown by 300% since 2008, fueling the rise of compliance technology. Automated audit processes now cut preparation time by 60% and costs by 40%. In healthcare, compliance automation reduced incidents by 78%. These trends highlight how regulatory evolution drives innovation, risk management, and operational efficiency across digital transformation initiatives.

Leaders who invest in upskilling, measure ROI rigorously, and adapt to regulatory shifts position their organizations for sustainable growth in a rapidly changing tech landscape.

Leaders in technology should focus on these priorities for future success:

Invest in robust data architecture to support scalable ai and cloud computing.

Embrace federated security and zero trust models in cybersecurity.

Build integrated, ai-ready data systems and foster a culture of data-driven decision-making. Ongoing monitoring of trends ensures organizations adapt and thrive.

FAQ

What factors most influence tech sector equity forecasts in 2025?

Analysts see digital transformation, rapid AI adoption, and evolving cybersecurity as primary drivers. Market volatility and regulatory changes also shape tech sector equity forecasts and investment strategies.

How do organizations address the growing threat landscape in cybersecurity evolution?

They implement ai-enabled cybersecurity, invest in workforce upskilling, and adopt ai-augmented threat detection. These actions help organizations adapt to new threats and support ongoing cybersecurity evolution.

Why does cloud computing remain essential for digital transformation?

Cloud computing enables scalable ai solutions, supports rapid innovation, and improves operational efficiency. Organizations rely on cloud platforms to accelerate digital transformation and respond to shifting market trends.

Leaders who embrace continuous learning and invest in adaptable technology position their organizations to thrive as digital transformation accelerates.

Staying Ahead in Tech

As digital transformation reshapes global markets, understanding tech sector equity forecasts has become a cornerstone of long-term wealth creation. From AI and cloud computing to cybersecurity, the pace of innovation offers both opportunity and complexity. With global IT spending set to grow nearly 10% in 2025 and venture capital pouring into next-generation technologies, investors must navigate shifting valuations, regulatory shifts, and emerging risks with precision. At VASRO, we view this landscape not through hype, but through insight—focusing on the data, trends, and structural changes that truly drive value. Smart investing in tech today means staying grounded in fundamentals while being agile enough to adapt, a balance that separates short-term speculation from enduring success.

Disclaimer: The information provided on www.vasro.de is for general informational purposes only and does not constitute investment advice or a recommendation to invest in any particular asset or market. VASRO GmbH does not offer personalized investment advice, and the content on this website should not be relied upon as such. Visitors are encouraged to seek independent financial advice tailored to their specific circumstances before making any investment decisions. VASRO GmbH disclaims any liability for investment decisions made based on the information presented on this website.