Rolex vs. Patek Philippe: Which Watch Holds Its Value Better?

When comparing Rolex vs. Patek Philippe, it’s clear that both brands dominate the luxury watch market, but they shine in different ways. Rolex stands out for its unmatched global recognition and high demand, making it a top choice for short-term resale. With nearly 1 million watches produced annually, Rolex maintains its prestige through limited retail availability, which fuels its resale potential. On the other hand, Patek Philippe excels in long-term value retention. Rare pieces, like the Grandmaster Chime Ref. 6300A-010, which sold for $31 million in 2019, highlight the brand’s investment appeal. Whether buyers prioritize short-term gains or long-term growth, their choice ultimately depends on personal goals.

Key Takeaways

Rolex watches are great for quick resale because many people want them.

Patek Philippe keeps its value longer, perfect for serious collectors.

Both brands are special: Rolex is easier to get, Patek Philippe is rarer.

Buying luxury watches can add variety to your investments and lower risks.

Pick Rolex or Patek Philippe based on your goals and what you like.

Rolex vs. Patek Philippe: Brand Histories and Philosophies

Rolex: Precision and Accessibility

Rolex has built its reputation on precision and accessibility, making it one of the most recognized names in luxury watchmaking. The brand’s journey began with groundbreaking innovations like the Oyster, the world’s first waterproof wristwatch. This innovation set the stage for Rolex to become a symbol of durability and reliability. Over the decades, Rolex has consistently emphasized its heritage and pioneering achievements, which resonate with both collectors and first-time buyers.

The brand’s milestones reflect its commitment to precision and innovation. For instance, the introduction of the Day-Date model in 1956 showcased Rolex’s ability to combine functionality with elegance. The table below highlights key moments in Rolex’s evolution:

Year | Milestone | Description |

|---|---|---|

1950s | Economic Growth | Increased consumer spending led to the launch of luxurious, advanced models. |

1956 | Day-Date Introduction | Featured both date and day display, a first in watchmaking. |

Late 20th Century | Quartz Revolution | Integrated quartz technology, enhancing precision and reliability. |

Rolex watches are also known for their exceptional performance. Each timepiece undergoes rigorous in-house testing to achieve the Superlative Chronometer Certification, ensuring an accuracy of -2/+2 seconds per day. This level of precision, combined with the brand’s global appeal, positions Rolex as a leader in the luxury watch market. By maintaining a balance between exclusivity and accessibility, Rolex has made its watches a valuable investment for enthusiasts worldwide.

Patek Philippe: Exclusivity and Craftsmanship

Patek Philippe, on the other hand, represents the pinnacle of exclusivity and craftsmanship in luxury watchmaking. The brand’s philosophy revolves around creating timeless pieces that are as much works of art as they are functional timekeepers. Unlike Rolex, Patek Philippe produces a limited number of watches annually, enhancing their rarity and appeal among collectors.

The brand’s commitment to craftsmanship is evident in its attention to detail and the complexity of its movements. Patek Philippe has a long history of producing highly complicated watches, such as perpetual calendars and minute repeaters, which showcase its technical expertise. This dedication to innovation has earned the brand numerous accolades, including awards at the World’s Fair in 1853 and 1855.

Collectors value Patek Philippe watches not only for their craftsmanship but also for their ability to retain and even appreciate in value over time. This makes them a sought-after choice for those looking to make a long-term investment. The brand’s exclusivity and prestige are further reinforced by its meticulous production standards, ensuring that each watch is a masterpiece.

In the world of luxury watches, Patek Philippe stands out for its unparalleled craftsmanship and exclusivity. Whether it’s the intricate design of its movements or the limited production numbers, every aspect of a Patek Philippe watch reflects the brand’s dedication to excellence.

Patek Philippe vs Rolex: Resale Value and Investment Potential

Rolex Models with High Resale Value

Rolex watches are renowned for their exceptional resale value, often outperforming other luxury brands in the short term. This is largely due to their iconic designs, robust build quality, and widespread demand. Certain Rolex signature models, such as the Submariner, Daytona, and GMT-Master II, consistently fetch high prices in the secondary market. For instance, the GMT-Master II "Root Beer" saw an astounding 433% price increase in 2024, while the "Pepsi" model appreciated by 134.8%. These figures highlight the lucrative investment opportunity Rolex offers for those seeking short-term gains.

Rolex Model | Price Increase (%) | Year |

|---|---|---|

Batman | 10% | 2024 |

Root Beer | 433% | 2024 |

Pepsi | 134.8% | 2024 |

Hulk | Flat growth | 2024 |

The collectability factor of Rolex watches also plays a significant role in their resale value. Limited-edition releases and discontinued models often appreciate in value, making them a better investment for those looking to capitalize on market trends. PlushPast, a trusted marketplace for authenticated luxury items, offers a curated selection of Rolex watches, ensuring buyers access to these high-demand pieces.

Patek Philippe Models with Long-Term Investment Appeal

Patek Philippe stands out in the luxury watchmaking world for its long-term investment potential. The brand's limited annual production of approximately 62,000 watches ensures exclusivity, which drives demand and helps these timepieces appreciate in value over time. Models like the Grandmaster Chime and Sky Moon Tourbillon have reached millions at auction, underscoring their status as principal investment pieces.

From 2017 to 2022, Patek Philippe watches delivered an impressive 207% return on investment. The Nautilus and Aquanaut collections, in particular, are celebrated for their strong appreciation rates, often ranging from 20-40% within just a few years of release. This makes Patek Philippe signature models a lucrative investment opportunity for collectors and investors alike.

PlushPast provides access to these timeless masterpieces, offering both new and pre-owned Patek Philippe watches that cater to discerning buyers seeking long-term value.

Comparing Resale Trends Between Rolex and Patek Philippe

When comparing Rolex vs. Patek Philippe, both brands excel in value retention but cater to different investment goals. Rolex dominates the short-term resale market, with models like the Daytona and GMT-Master II consistently achieving high premiums. In contrast, Patek Philippe watches, particularly vintage and complicated models, are better suited for long-term investments due to their rarity and craftsmanship.

Rolex watches often lead in short-term resale value, driven by their global recognition and high demand.

Patek Philippe models appreciate in value over time, with some achieving record-breaking auction prices.

Both brands benefit from their storied histories and reputations, making them staples in the luxury watch market.

Ultimately, the choice between Rolex and Patek Philippe depends on individual priorities. Whether seeking short-term gains or a long-term store of value, PlushPast offers a wide range of luxury watches to meet every collector's needs.

Factors Influencing Value Retention in Rolex vs Patek Philippe

Brand Prestige and Market Demand

Brand prestige plays a significant role in determining the value of luxury watches. Rolex and Patek Philippe both enjoy unparalleled reputations in the luxury watchmaking world, but their appeal stems from different factors. Rolex is synonymous with global recognition and reliability, while Patek Philippe is revered for its exclusivity and craftsmanship. These distinctions influence how each brand retains value in the market.

Market demand further amplifies this effect. Watches associated with celebrities or featured in popular media often experience spikes in resale value. For example, the Rolex Daytona gained immense popularity after being linked to Paul Newman, while Patek Philippe's Nautilus became a collector's dream following its discontinuation. The table below highlights key factors influencing value retention:

Factor | Impact on Value |

|---|---|

Brand prestige | Higher-tier brands generally hold value better |

Rarity | Limited production runs command premiums |

Condition | Original parts and minimal wear maximize value |

Box and papers | Complete sets command 15-30% premium |

Popularity | Media exposure or celebrity association boosts demand |

Production Numbers and Scarcity

Production numbers directly impact the scarcity and desirability of luxury watches. Rolex produces nearly one million watches annually, yet demand consistently outpaces supply. This controlled scarcity creates long waiting lists for popular models like the Submariner and Daytona, driving up their resale value.

Patek Philippe, on the other hand, takes a more exclusive approach, producing only about 62,000 watches each year. This limited output ensures that their timepieces remain rare and highly sought after. Collectors often gravitate toward rare models, which tend to appreciate in value over time. For instance, the Patek Philippe Nautilus 5711/1A-010 saw a 200% price increase after its discontinuation was announced. Scarcity not only enhances desirability but also solidifies these watches as a better investment for long-term collectors.

Craftsmanship and Innovation

The craftsmanship and innovation behind a watch significantly influence its value retention. Rolex focuses on precision and durability, ensuring that each watch meets the Superlative Chronometer Certification. This commitment to quality makes Rolex watches reliable and appealing to a broad audience.

Patek Philippe, however, elevates craftsmanship to an art form. Their watches often feature intricate complications like perpetual calendars and minute repeaters, showcasing unparalleled technical expertise. This level of detail and innovation makes Patek Philippe watches highly collectible and valuable over time. While Rolex emphasizes robust performance, Patek Philippe captivates collectors with its artistry and exclusivity, making both brands leaders in luxury watchmaking.

Collectability of Rolex vs. Patek Philippe Watches

Why Collectors Favor Certain Rolex Models

Rolex watches have a unique appeal among collectors, thanks to their iconic designs and consistent value retention. Models like the Submariner, Daytona, and GMT-Master II are particularly sought after. These sports models not only boast timeless aesthetics but also demonstrate exceptional durability and precision. Their popularity is further fueled by limited availability, which creates high demand in the secondary market.

Collectors often gravitate toward Rolex because of its strong brand recognition and liquidity. A survey of luxury watch enthusiasts revealed that Rolex accounts for 34% of collections in the U.S., far surpassing other brands like Omega and Breitling. The table below highlights this trend:

Brand | Popularity in Collections (%) |

|---|---|

Rolex | 34% |

Omega | 11% |

Tudor | 5% |

Seiko | 4.9% |

Breitling | 4% |

This data underscores why Rolex remains a top choice for collectors who value both prestige and resale potential.

The Appeal of Patek Philippe in the Auction Market

Patek Philippe’s collectability shines brightest in the auction market, where its rare and vintage models command record-breaking prices. For instance, a Patek Philippe 2523J sold for $8.5 million at Christie’s, while a vintage 2577 fetched CHF 114,300 at Phillips. These sales highlight the brand’s enduring appeal among serious collectors.

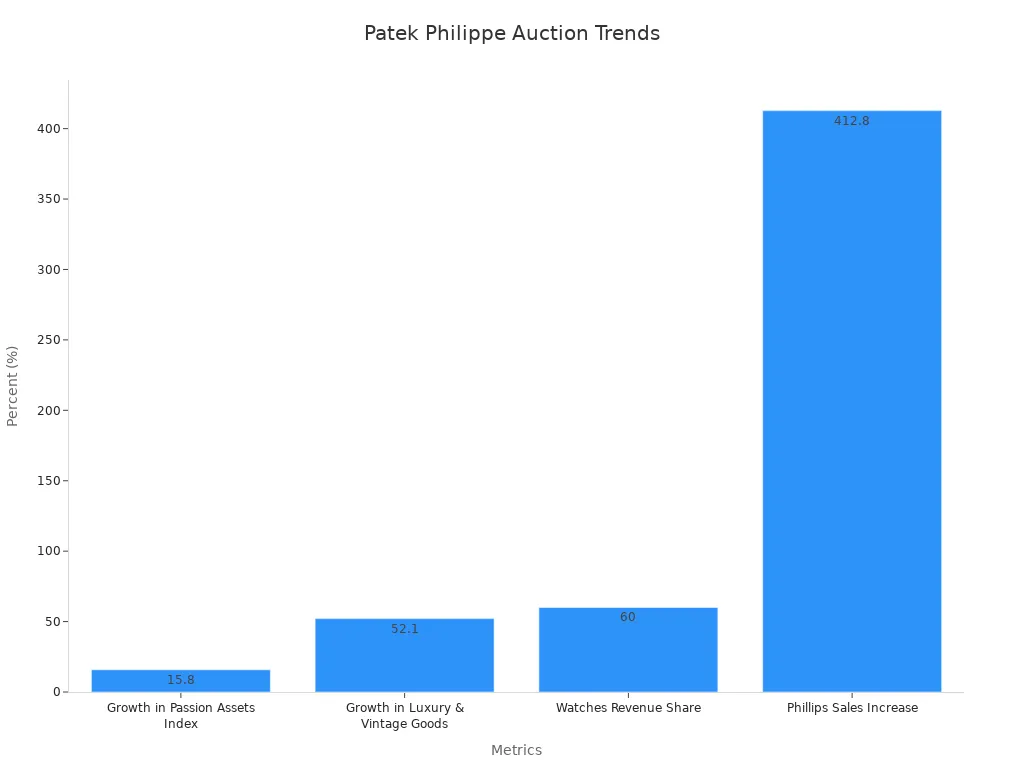

The exclusivity of Patek Philippe watches plays a significant role in their auction success. With only about 62,000 pieces produced annually, each watch becomes a coveted treasure. The table below provides insights into the luxury watch market’s growth, emphasizing Patek Philippe’s dominance:

Metric | Value |

|---|---|

Global Passion Assets Index | |

Growth in Passion Assets Index | 15.8% |

Revenue from Luxury & Vintage | $1.6 billion (2023) |

Growth in Luxury & Vintage Goods | 52.1% |

Watches Revenue Share | 60% |

Phillips Sales Increase | 412.8% |

Top Patek Philippe Sale | $8.5 million |

These figures demonstrate why Patek Philippe remains a cornerstone of luxury watch auctions, appealing to those who seek long-term investment opportunities.

Trends in Collecting Luxury Watches

The luxury watch market continues to evolve, driven by shifting consumer preferences and external influences. Social media plays a significant role, with 67% of buyers admitting it impacts their purchasing decisions. Collectors now seek watches that reflect their personal style, often inspired by fashion icons and online trends.

Rolex and Patek Philippe dominate this space, each catering to different collector priorities. Rolex sports models, like the Submariner and Daytona, are prized for their liquidity and short-term resale value. Meanwhile, Patek Philippe’s Nautilus and Aquanaut lines attract those looking for exclusivity and long-term appreciation. Extensive waitlists for these models further highlight their desirability.

As the market grows, platforms like PlushPast provide collectors with access to authenticated luxury watches, ensuring they can find the perfect piece to suit their tastes and investment goals.

Choosing between Rolex and Patek Philippe depends on what buyers value most—short-term gains or long-term growth. Rolex stands out for its widespread demand and iconic models, making it a top choice for those seeking quick resale opportunities. On the other hand, Patek Philippe excels as a long-term investment, especially for rare or limited-edition watches that appreciate over time.

Luxury watches, including these two brands, offer lower returns than equities but outperform fixed income and real estate investments. They also reduce risk and enhance portfolio diversification, making them a smart addition to any collection. The table below highlights how forecasting methods differ for short- and long-term investments:

Forecasting Method | Short-term | Long-term |

|---|---|---|

Model Type | Econometric Models | Technological Market Models |

Focus | Current market dynamics | Technological environment, legal frameworks, economic outlook |

Data Sources | Market drivers and constraints | Supply versus price trends, projected volume growth |

Ultimately, buyers should consider their goals, budget, and personal preferences when deciding between Rolex and Patek Philippe. Platforms like PlushPast make it easy to explore a curated selection of authenticated luxury watches, ensuring every collector finds the perfect piece to suit their needs.

FAQ

What makes Rolex watches so popular?

Rolex watches are known for their timeless designs, durability, and precision. Their strong brand reputation and association with success make them highly desirable. Limited availability of certain models also adds to their appeal, driving demand among collectors and enthusiasts.

Why do Patek Philippe watches hold long-term value?

Patek Philippe watches retain value due to their exclusivity and craftsmanship. The brand produces limited quantities, ensuring rarity. Intricate complications and timeless designs make these watches highly collectible, especially in the auction market.

How can buyers ensure authenticity when purchasing luxury watches?

Buyers should purchase from trusted platforms like PlushPast, which offers authenticated luxury watches. Look for original box and papers, as these add credibility and value. Avoid deals that seem too good to be true.

Are vintage watches a good investment?

Vintage watches, especially from brands like Rolex and Patek Philippe, can be excellent investments. Their rarity and historical significance often lead to appreciation in value over time. However, condition and authenticity play a crucial role in determining their worth.

What factors influence the resale value of a luxury watch?

Resale value depends on brand reputation, model popularity, rarity, and condition. Watches with complete sets (box and papers) and minimal wear typically fetch higher prices. Market trends and celebrity endorsements can also impact demand.

A Natural Extension to a Trusted Marketplace

Whether you're drawn to the timeless reliability of Rolex or the refined exclusivity of Patek Philippe, finding the right piece is only part of the journey, trusting where you find it is just as essential. In a world where authenticity and value matter more than ever, platforms like PlushPast offer a refreshing alternative. With a commitment to verified authenticity, fair pricing, and a seamless experience for both buyers and sellers, PlushPast is a curated space for those who truly appreciate luxury. From investment-grade watches to high-end fashion, jewelry, and designer bags, PlushPast brings together a global community passionate about quality, trust, and timeless style. Explore the platform to discover rare treasures or share your own with collectors worldwide, because when it comes to luxury, confidence in the source is everything.

Disclaimer:

The information provided in this article is for general informational purposes only and does not constitute professional advice, an endorsement of any product, or a guarantee of authenticity or condition for the items referenced. plushpast does not offer personalized guidance on buying or selling decisions, and the content of this article should not be relied upon as such. We strongly recommend that you conduct independent research and/or seek relevant expertise suited to your specific circumstances before making any transaction decisions. plushpast disclaims any liability arising from decisions made based on the information presented in this article.