Regulatory Changes and their Impact on Biotech Valuations through Equity Reports

Regulatory changes often send ripples through the biotech industry, creating sharp swings in company valuations. In 2023, bankruptcy filings among biotech companies more than doubled, and debt financing declined as regulatory and market pressures mounted. IPO activity stalled, with only a few companies going public, and experts link these shifts to evolving regulatory reforms and economic dynamics. Biotech valuations remain highly sensitive to policy uncertainty, as seen in the 27% decline in average IPO performance by year-end 2024. Investors and analysts closely monitor these developments, recognizing that the impact of regulatory changes extends far beyond compliance, shaping both risk and opportunity across the sector.

Key Takeaways

Regulatory changes strongly influence biotech company values by affecting drug approvals, funding, and market access.

Drug pricing laws and FDA funding shifts create challenges but also open opportunities for innovation and asset growth.

Biotech valuations are highly volatile due to uncertain regulatory approvals and political events, requiring smart risk management.

Strong patent portfolios and strategic intellectual property management boost company value and protect market position.

Successful biotech firms use early regulatory engagement, data-driven planning, and adaptive market access strategies to grow and thrive.

Regulatory Changes in Biotech

Drug Pricing Laws

Drug pricing laws continue to shape the landscape of biotechnology, influencing both drug development and investment strategies. In the United States, prescription drug prices remain over four times higher than the international average for brand-name medications. This disparity has led to significant affordability issues, with 8.2% of adults aged 18-64—over 9 million people—unable to take prescribed medication due to cost. Nearly 30% of Americans have reported skipping medication at some point for financial reasons, with vulnerable groups such as women, adults with disabilities, and the uninsured facing even greater challenges. These statistics underscore the persistent affordability crisis, which not only highlights unmet needs but also creates opportunities for innovative drug development and market entry. Interestingly, analyses show that drug pricing laws, including the Inflation Reduction Act, do not negatively impact biotech valuations. Instead, large pharmaceutical companies often respond by acquiring clinical-stage assets from smaller biotech firms, driving increased licensing activity and potentially enhancing asset values across the sector.

FDA Funding Shifts

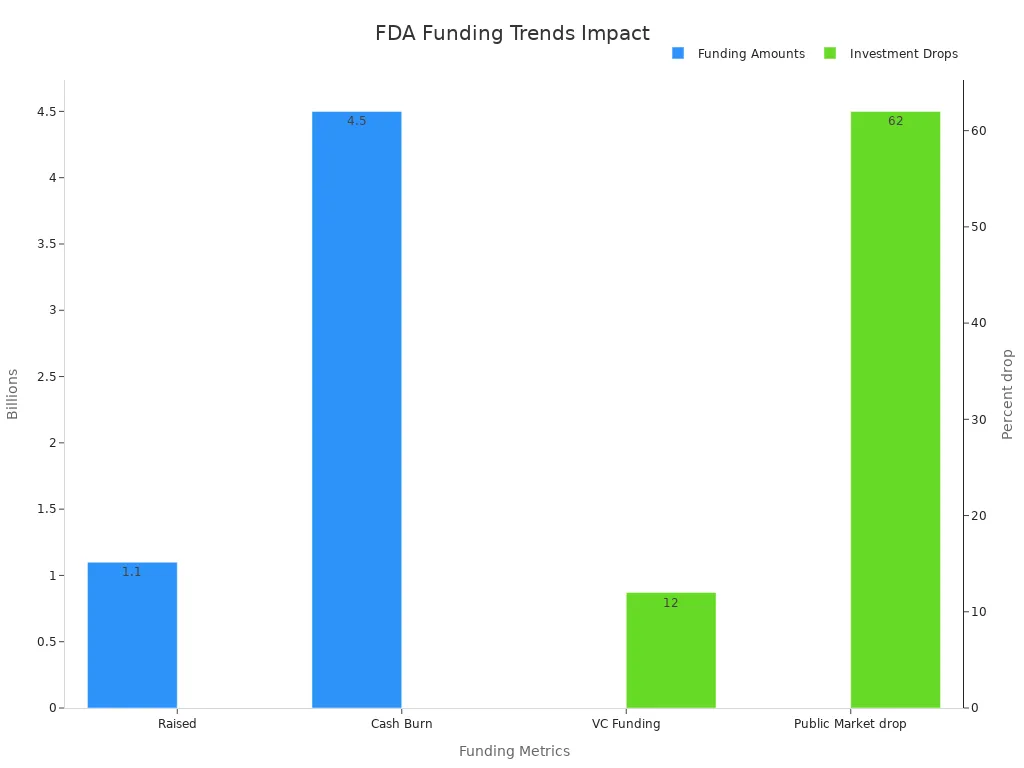

Funding changes at the FDA have introduced new complexities for biotechnology companies navigating the regulatory environment. In 2025, public biotech funding reached only $1.1 billion in May, far below the $4.5 billion monthly cash burn rate. Venture capital funding also declined by 12% year-over-year, averaging $1.9 billion per month, while public market funding dropped by 62%. These funding challenges have pressured biotech boards to consider asset sales or strategic alternatives. The FDA itself experienced significant workforce reductions, with 3,500 layoffs—representing 19% of its staff—impacting key departments such as the Office of Inspections and Investigations, CDER, and CBER. These changes have slowed drug and device approvals, increased regulatory backlogs, and delayed critical pre-IND meetings, directly affecting drug development timelines and investor sentiment. The S&P biotech index (XBI) reflected these concerns, declining as uncertainty grew. Some companies, like iTeos and Third Harmonic Bio, responded by liquidating assets or shutting down operations.

State-Level Regulations

State-level regulatory changes add another layer of complexity to the biotechnology sector. States increasingly enact their own drug pricing transparency laws, reimbursement policies, and clinical trial requirements, which can diverge from federal standards. These variations require biotech companies to adapt their drug development and commercialization strategies for each market. Regulatory bottlenecks, such as post-approval Chemistry, Manufacturing, and Controls (CMC) changes, once caused delays of up to five years. Automation and cloud-based platforms have now reduced these delays to under one year, streamlining development and regulatory compliance. The integration of AI in regulatory workflows has also accelerated Biologics License Application (BLA) filing times, as seen with Amgen’s reduction from 26 weeks to just 12 weeks, with a target of 8 weeks. These advancements, alongside the growing influence of international markets like China—now accounting for about one-third of all biotech licensing deals—demonstrate how regulatory changes and technological innovation continue to reshape the development landscape.

Regulatory changes, whether at the federal or state level, demand adaptability and strategic foresight from biotechnology leaders. Those who anticipate and respond to evolving requirements position themselves for sustainable growth and innovation.

Biotech Regulatory Landscape and Valuation

Approval Risk and Volatility

The biotech regulatory landscape shapes the fortunes of companies at every stage of drug development. Regulatory approval stands as the most significant inflection point in the valuation of biotechnology firms. Investors and analysts recognize that the path to FDA approval is fraught with uncertainty, and each milestone in the regulatory process can trigger dramatic shifts in market value. The binary nature of regulatory decisions—approval or rejection—creates a landscape where volatility is the norm rather than the exception.

Historical data underscores this volatility. For example, robust optimization and convex optimization techniques have become essential tools for managing the uncertainty and tail risk that stem from unpredictable regulatory approvals and clinical trial outcomes. These quantitative methods help construct portfolios that can withstand worst-case scenarios, reducing sensitivity to regulatory uncertainties. Machine learning models now enhance the accuracy of predicting drug candidate success rates and market returns, providing a more informed approach to portfolio optimization under regulatory risk.

Market reactions to regulatory and political events offer further evidence of this volatility. Significant stock price drops often follow political announcements or regulatory shifts. Moderna shares fell by 7.3%, Pfizer by 4.7%, Bavarian Nordic by 14%, AstraZeneca by 2.8%, Novo Nordisk by 3.4%, and Eli Lilly by 4.9% after a single regulatory event. Increased short interest in the biotech sector, such as Moderna’s record levels in 2024, reflects investor caution in the face of regulatory uncertainty. The nomination of a politically controversial figure with vaccine skepticism triggered broad sell-offs across biotech stocks, quantifying the risks associated with regulatory approval and political shifts.

The FDA’s evolving standards and resource constraints further amplify these risks. Delays in regulatory processes, shifting approval criteria, and unpredictable timelines can derail even the most promising drug development programs. Companies must navigate these challenges with agility, leveraging evidence generation and advanced analytics to anticipate and respond to regulatory headwinds. The ability to manage approval risk and volatility has become a defining factor in the valuation of biotech firms, shaping both investor confidence and strategic decision-making.

In the world of biotechnology, regulatory approval is not just a milestone—it is a crucible that tests the resilience, adaptability, and foresight of every company striving to bring new therapies to market.

Patent and IP Considerations

Patent and intellectual property (IP) considerations form another cornerstone of biotech valuation. The strength and breadth of a company’s patent portfolio can determine its competitive edge, market reach, and long-term growth prospects. In the current biotech regulatory landscape, the interplay between innovation, protection, and commercialization has never been more critical.

Recent research highlights several measurable factors that influence how patents impact valuation. AI-driven patent valuation tools, such as Innography and Thomson Innovation, analyze patent citations, claim lengths, market trends, and legal history to provide rapid, data-driven insights. These tools help companies prioritize high-value patents and optimize their portfolios, supporting evidence generation for strategic decisions. Citation velocity—the frequency with which a patent is cited over time—serves as a key indicator of a patent’s market relevance and potential licensing value. Patents with high citation velocity often represent foundational technologies and command valuation premiums.

Claim length also plays a pivotal role. Longer claims typically offer broader protection, which can increase patent value but may also attract greater legal scrutiny. The size of a patent family and the geographic scope of protection expand a company’s market reach and safeguard innovations in both emerging and established markets. Strategic IP management decisions, such as balancing continuation filings with new patent applications, directly impact portfolio strength and valuation by optimizing resource allocation and protection scope.

However, limitations exist. AI tools may struggle to assess the value of nascent or disruptive biotech technologies due to limited historical data, making human expertise indispensable for long-term strategic evaluation. Companies that excel in evidence generation and strategic IP management position themselves to maximize valuation, attract investment, and secure a sustainable competitive advantage.

The most successful biotechnology firms treat their patent portfolios not just as legal shields, but as dynamic assets that drive innovation, support regulatory approval, and unlock new opportunities for growth.

A thoughtful approach to both regulatory approval and IP strategy enables companies to navigate the complexities of the biotech regulatory landscape. By integrating advanced analytics, evidence generation, and strategic foresight, industry leaders can transform volatility into opportunity and build lasting value in a rapidly evolving sector.

Impact on Equity Valuations

Revenue Projections

Revenue projections in the biotech sector often hinge on the intricate interplay between regulatory approval, market access, and the durability of product exclusivity. Investors and analysts scrutinize these factors, knowing that a single regulatory decision can reshape a company’s entire financial outlook. The approval process, especially for innovative therapies, sets the stage for revenue growth, but the true trajectory depends on how quickly and broadly a product achieves market access.

A closer look at empirical data reveals the profound impact of regulatory frameworks on revenue models. For instance, cancer drugs demonstrate a median return of $14.50 for every dollar invested in research and development, based on an analysis of 99 FDA-approved therapies. Companies typically recover their median risk-adjusted R&D costs—about $794 million—within three years, though the timeline can extend to five years for the most expensive projects. These figures highlight the importance of swift approval and efficient market access strategies.

Aspect | Evidence / Insight |

|---|---|

Median ROI for cancer drugs | $14.50 return per $1 invested in R&D (based on 99 FDA-approved drugs) |

R&D cost recovery time | Median 3 years to recover $794 million median risk-adjusted R&D cost; up to 5 years for max $2.827 billion cost |

Post-exclusivity revenue persistence | Biologics maintain substantial revenues after patent expiry due to complex manufacturing, stringent biosimilar approval pathways, and physician/patient hesitancy |

Regulatory impact on biosimilars | Stringent biosimilar approval requirements delay market entry, moderating but not abruptly reducing originator revenues |

Market dynamics factors | Regulatory frameworks, payer policies, physician acceptance, and originator strategies shape biosimilar competition and revenue projections |

Price moderation potential | Despite high returns, price reductions could occur without undermining innovation incentives due to durable revenue streams and market barriers |

Market growth projection | Oncology drug market expected to grow from $220.80B (2024) to $518.25B (2032) at 11.3% CAGR |

R&D cost variability | Wide range from $161M to $4.54B, most estimates between $200M and $2.9B |

Policy implications | Emphasizes balancing innovation incentives with affordability through value-based pricing, negotiation, transparency, and biosimilar competition |

This table illustrates how regulatory approval, market access hurdles, and biosimilar competition collectively shape revenue projections. Biologics, for example, often retain significant revenue streams even after patent expiry, thanks to complex manufacturing requirements and cautious adoption of biosimilars by physicians and patients. Stringent regulatory approval for biosimilars delays their entry, providing originator drugs with extended market access and stable revenues. These dynamics underscore the importance of regulatory clarity and efficient market access pathways in sustaining company valuation.

The oncology drug market exemplifies this trend, with projections indicating growth from $220.80 billion in 2024 to $518.25 billion by 2032, reflecting an 11.3% compound annual growth rate. Such robust expansion depends on the timely approval of new therapies and the ability to navigate evolving market access policies. Companies that anticipate regulatory shifts and adapt their market access strategies position themselves to capture durable revenue streams and enhance their valuation.

Companies that master the art of navigating regulatory approval and market access can transform uncertainty into opportunity, building resilient revenue models that withstand competitive and policy pressures.

Risk Assessment

Risk assessment in biotech equity analysis requires a nuanced understanding of how regulatory approval, market access, and policy shifts influence both short-term volatility and long-term valuation. The sector’s inherent unpredictability stems from the binary nature of regulatory approval decisions and the evolving landscape of market access requirements. Each stage of the approval process introduces new risks, from clinical trial outcomes to payer negotiations and post-market surveillance.

Quantitative funds and institutional investors increasingly rely on advanced analytics to manage these risks. They employ continuous algorithmic analysis of clinical trials, regulatory developments, and market behavior to detect patterns and anticipate market movements. Machine learning and big data analytics enable these investors to adjust their positions dynamically, responding to emerging regulatory risks and market access challenges in real time. This adaptive approach helps mitigate the impact of sudden regulatory shifts on equity portfolios.

Statistical models such as the Fama-French three-factor and five-factor frameworks, along with the Carhart four-factor model, provide deeper insight into investment risk by incorporating factors like company size, value, profitability, investment, and momentum. These models, especially when adjusted for growth-stage firms, offer a more granular view of risk than traditional beta or CAPM approaches. However, they do not explicitly link regulatory approval or market access changes to investment risk. Instead, investors integrate qualitative assessments of the regulatory landscape and market access environment alongside quantitative models to form a comprehensive risk profile.

Key risk factors influencing biotech valuation include:

Probability of regulatory approval at each development stage

Timing and breadth of market access post-approval

Competitive dynamics, including biosimilar entry and payer negotiations

Policy changes affecting reimbursement and pricing

A robust risk assessment framework blends quantitative rigor with qualitative insight, enabling investors to anticipate the impact of regulatory approval and market access shifts on company valuation.

Ultimately, the ability to assess and adapt to regulatory and market access risks defines success in biotech equity analysis. Companies and investors who cultivate deep market intelligence and agile strategies can navigate volatility, protect valuation, and seize opportunities in a rapidly evolving landscape.

Market Access and Investment Decisions

Reimbursement Challenges

Market access remains a defining factor in shaping biotech valuations, as reimbursement challenges often determine whether innovative therapies reach patients or stall at the threshold of commercialization. Companies must navigate a complex web of regulatory hurdles, payer negotiations, and evolving pricing models. These factors directly influence investor confidence, as the ability to secure favorable reimbursement terms can make or break a product’s commercial trajectory.

A closer look at regulatory risks reveals how market access strategy adapts to shifting landscapes:

Aspect of Regulatory Risk | Evidence / Quantitative Example | Impact on Market Access Strategy |

|---|---|---|

FDA Approval Rates for Orphan Drugs | 65% approval for single rare disease orphan drugs; 15% for multiple rare diseases; 20% for rare and common diseases | Companies prioritize assets with higher approval likelihood, shaping launch planning |

Post-Market Surveillance | 3,992 drug recall events and 16,397 individual recalls (2012-2024) | Ongoing safety monitoring becomes essential for sustained market access |

Regulatory Complexity Across Agencies | Differing FDA, EMA, PMDA requirements | Firms tailor market access strategy for each region, increasing resource needs |

Regulatory Changes Impacting Pricing | Inflation Reduction Act alters reimbursement and pricing | Companies adjust negotiation tactics to maintain profitability |

Stakeholder Engagement | Early engagement with patients, advocacy groups, HCPs | Proactive risk management supports smoother market entry |

Pricing and Reimbursement Models | Value-based pricing, risk-sharing agreements, QALY metrics | Negotiation strategies evolve to secure coverage and access |

Use of RWD and RWE | Real-world data and evidence support safety and efficacy | Enhances regulatory submissions and post-market compliance |

In oncology, for example, over half of practice revenue comes from buy-and-bill drug reimbursement, requiring tailored financial value propositions. The complexity of payment models and the diversity of stakeholders—from payers to specialty pharmacies—demand early, integrated engagement and a flexible market access strategy. These dynamics shape investor confidence, as successful navigation of reimbursement challenges signals strong execution and risk management.

Capital Allocation

Regulatory uncertainty exerts a profound influence on capital allocation and the pace of mergers and acquisitions in biotechnology. After the JOBS Act of 2012 eased IPO requirements, the sector saw a surge in earlier-stage IPOs, with only 25% of companies going public between 2013 and 2016 having lead projects at Phase III or beyond. This shift increased capital availability and spurred growth in patents, clinical trials, and lab staffing. However, despite more Phase I and II studies, the number of new Phase III studies remained stable, highlighting that regulatory uncertainty and concerns about scientific rigor lead investors to discount valuations of preclinical assets. This behavior results in capital misallocation and under-allocation to high-quality, early-stage opportunities, ultimately affecting sector innovation.

Recent transaction data further illustrate how regulatory hurdles and uncertainty shape capital flows:

Aspect | Data / Description | Impact on Capital Allocation |

|---|---|---|

US M&A Deal Value (2021-2023) | Declining deal value reflects increased caution due to regulatory and macroeconomic uncertainty | |

US M&A Deal Volume (2021-2023) | 17,000+ (2021 est.), 13,241 (2023) | 22% drop in volume signals more selective capital deployment |

Sponsor-backed Transactions | 40% of value (2021-22) to 29% (2023); volume down >33% | Funding challenges and scrutiny reduce deal activity |

Regulatory Scrutiny | Extended FTC/DOJ reviews, 17 court challenges in 2023 | Longer reviews and legal risks slow large deals, increasing uncertainty |

New Merger Guidelines (2023) | Broader enforcement, scrutiny of serial acquisitions | More complex approvals require cautious capital commitment |

Sectoral Trends | Healthcare deal value and volume up ~10% YoY | Capital shifts to resilient sectors, with private equity adapting strategies |

PE Dry Powder | $2.6T globally | Capital remains available but is deployed more cautiously |

Investor confidence hinges on the ability to anticipate and adapt to these regulatory shifts. Companies that align their market access strategy with evolving reimbursement models and regulatory expectations position themselves for sustainable growth. As regulatory scrutiny intensifies, strategic capital allocation and thoughtful acquisition planning become essential for maintaining momentum in a rapidly changing environment.

In the end, those who master the art of market access and capital allocation not only weather uncertainty but also unlock new opportunities for innovation and value creation.

Case Studies and Real-World Impact

Regulatory Setbacks

Regulatory approval often acts as a double-edged sword for biotechnology companies. When the FDA rejects a new therapy or delays a decision, the impact on valuation can be immediate and severe. Many companies have experienced sharp declines in market capitalization after failing to secure regulatory approval or when clinical trial results fall short of expectations. The biotech sector saw a prolonged bear market lasting nearly 30 months, with 232 stocks trading below their cash value by late October 2023. This downturn followed a period of rapid valuation growth during the COVID-19 vaccine approvals, highlighting how quickly fortunes can change. Regulatory events, such as failed trials or unexpected FDA feedback, frequently trigger these valuation swings. Market access becomes even more challenging in these scenarios, as investors lose confidence and companies struggle to secure funding for future development. The SPDR® S&P® Biotech ETF (XBI) mirrored these fluctuations, reflecting the sector’s sensitivity to regulatory approval outcomes and broader market access dynamics.

Positive Regulatory Outcomes

Positive regulatory approval can transform a company’s prospects almost overnight. In 2023, the FDA approved a record 73 new drugs, fueling renewed investor optimism and driving a wave of mergers and acquisitions. The commercial success of innovative therapies, such as Keytruda reaching $52 billion in sales and earning its 40th FDA approval for cancer indications, demonstrates the power of regulatory approval to unlock market access and long-term revenue growth. The Inflation Reduction Act also improved market access by capping out-of-pocket costs for Medicare patients, supporting sector stability. Biotech stocks historically outperform during periods of positive regulatory momentum, as seen when the S&P Composite 1500® Index showed biotech outpacing the S&P 500 by an average of 16% in the year following the Federal Reserve’s first rate cut. Investor enthusiasm surged in 2024, with biotech stocks rising an average of 31% after positive clinical data readouts, compared to only 13% in 2022. These trends underscore the critical role of regulatory approval and market access in shaping both short-term sentiment and long-term value.

Biotechnology stock indices serve as a real-time barometer for regulatory sentiment, translating the outcomes of FDA decisions and market access policies into tangible shifts in valuation. Companies that anticipate and adapt to these regulatory forces position themselves for resilience and growth in a dynamic landscape.

Navigating Regulatory Uncertainty

Strategic Responses

Biotech companies face a landscape where regulatory uncertainty can disrupt even the most promising drug development programs. To navigate this environment, organizations deploy a range of strategic responses that blend technical expertise, proactive planning, and collaborative engagement. Many firms invest in scenario modeling to anticipate regulatory bottlenecks and optimize clinical trial timelines, ensuring that market access strategies remain resilient. By leveraging innovative trial designs and digital monitoring tools, companies can accelerate evidence generation and maintain compliance, even as requirements evolve.

A forward-thinking approach includes active participation in regulatory innovation programs, which often grants early market access advantages. Strategic partnerships and pipeline diversification help mitigate both regulatory and competitive risks, while digital integration streamlines development and evidence collection. Companies also prioritize ethical governance, establishing independent ethics committees to maintain public trust as new technologies emerge. Coordination with regulatory authorities, such as the FDA and ARPA-H, further streamlines approval processes and supports efficient drug development. Financial incentives, including R&D tax credits and accelerated depreciation, encourage continued investment in biomanufacturing and innovation.

Companies that foster specialized expertise and maintain early engagement with regulatory bodies consistently outperform peers in adapting to regulatory shifts and securing timely market access.

Best Practices

Best practices for managing the impact of regulatory changes on biotech valuations center on robust planning, data-driven decision-making, and quality assurance. Early engagement with regulatory bodies like the FDA and EMA allows companies to anticipate changes, reduce approval delays, and avoid costly overruns. The use of data analytics and AI technologies optimizes regulatory submissions, predicts safety issues, and enhances clinical trial data management, supporting both market access and evidence generation.

A comprehensive compliance strategy includes scenario analyses within valuation models, using methodologies such as risk-adjusted net present value and venture capital approaches. These models reflect how regulatory developments influence valuation at each stage of drug development. Incorporating qualitative factors, such as competitor analysis and industry trends, further sharpens valuation accuracy.

Quality control remains essential. Leading organizations establish formal supplier assessment processes, implement quality agreements, and apply risk-based approaches to focus on areas with the highest impact on product quality. Prompt identification and reporting of deviations, thorough root cause analysis, and corrective actions ensure regulatory compliance and safeguard patient safety. Continuous improvement, supported by trend analysis and personnel training, strengthens the overall quality system.

The most resilient biotech companies treat regulatory uncertainty as an opportunity for innovation, using evidence-driven strategies and early engagement to transform challenges into sustainable growth.

Regulatory changes shape biotech valuations through their influence on market access, clinical trial design, and capital flows. Companies that prioritize market access strategies, robust analytics, and compliance frameworks consistently outperform peers.

Firms integrating health equity into market access planning see improved patient outcomes and faster approvals.

Strategic use of data-driven market access insights, scenario planning, and adaptive risk management supports resilience.

Tools like BioCentury BCIQ and Cortellis help leaders monitor market access shifts and regulatory trends.

Ongoing scenario analysis and quality-controlled research optimize market access decisions.

Emphasizing market access in every phase of development ensures sustainable growth.

Adaptive market access strategies, informed by real-world evidence, drive valuation optimization.

Investors and companies should treat market access as a core pillar of long-term strategy.

In a dynamic landscape, those who embed market access into every decision unlock new opportunities for innovation and value.

FAQ

How do regulatory changes affect biotech company valuations?

Regulatory changes can shift investor sentiment and alter risk profiles. Companies may see valuations rise after positive policy updates or approvals. Delays, new requirements, or stricter standards often lead to lower valuations as investors reassess growth prospects and market access.

Regulatory clarity often boosts confidence, while uncertainty can dampen enthusiasm.

Why do equity reports focus on FDA approvals?

FDA approvals serve as key milestones for biotech firms. These decisions determine if a product can enter the market. Equity analysts track approvals closely because they directly impact revenue forecasts, competitive positioning, and long-term company value.

What role does intellectual property play in biotech valuation?

Strong intellectual property portfolios protect innovations and extend market exclusivity. Investors value companies with robust patents because these assets help secure future revenue streams and deter competition. Weak IP protection can limit growth and reduce valuation.

How do reimbursement policies influence investment decisions?

Reimbursement policies shape how quickly and widely new therapies reach patients. Favorable reimbursement increases market access and revenue potential. Challenging policies or delays can slow adoption, making investors more cautious about funding or acquiring biotech firms.

Factor | Impact on Investment |

|---|---|

Favorable reimbursement | Higher confidence, more funding |

Restrictive policies | Lower confidence, less funding |

What strategies help companies manage regulatory uncertainty?

Companies often engage early with regulators, invest in scenario planning, and diversify their pipelines. They use data analytics to anticipate changes and adapt quickly. These strategies help maintain momentum and support sustainable growth, even in unpredictable environments.

Adaptability and proactive planning remain essential for long-term success.

Turning Regulatory Complexity into Strategic Advantage

Navigating long-term wealth creation in biotechnology demands more than just optimism—it calls for clear-eyed strategy and deep understanding of how regulatory dynamics shape investment outcomes. In recent years, shifts in drug pricing laws, FDA funding, and state-level policies have fundamentally altered the valuation landscape for biotech firms, turning regulatory agility into a core competitive asset. As volatility becomes a fixture rather than an exception, investors and companies alike are leaning into precision tools, forward-looking analytics, and early regulatory engagement to find footing in this evolving terrain. At VASRO, we believe market intelligence isn't just about reacting—it's about reading the signals early, understanding their implications deeply, and turning complexity into clarity. With regulatory change continuing to redefine value in the biotech sector, smart investing means aligning long-term vision with adaptive, insight-driven strategies that anticipate both risk and opportunity.

Disclaimer: The information provided on www.vasro.de is for general informational purposes only and does not constitute investment advice or a recommendation to invest in any particular asset or market. VASRO GmbH does not offer personalized investment advice, and the content on this website should not be relied upon as such. Visitors are encouraged to seek independent financial advice tailored to their specific circumstances before making any investment decisions. VASRO GmbH disclaims any liability for investment decisions made based on the information presented on this website.