Pharma Pipeline Deep Dive: Equity Report Analysis for Drug Development

Equity report analysis offers a deep dive into the pharma pipeline, revealing actionable insights that shape investment and strategic decisions. Advanced analytics, such as those from CareSet, leverage over $1.1 trillion in Medicare claims and more than 100 external data sources to identify 15% more targets and 250% more individuals than traditional vendors. AI-driven models now predict revenue outcomes for over 90% of U.S. drug launches, reducing clinical trial costs by up to 70% and shortening timelines by as much as 80%. Distributional cost-effectiveness analysis further supports pharma leaders as they evaluate how therapeutic advances impact health equity and resource allocation. Market dominance in oncology, GLP-1, and asthma reflects both high revenue potential and unmet medical needs. The table below illustrates the financial scale and strategic focus of these therapeutic areas:

Therapeutic Area | Key Financial Metrics (FY2024) | Notable Drugs & Sales | Growth & Pipeline Focus |

|---|---|---|---|

Oncology | Keytruda ($29.5B), Darzalex ($11.7B, +19.8%), Verzenio ($5.3B, +37.4%) | Investment in novel combinations, ADCs, cell therapies | |

GLP-1 (Metabolic) | Significant sales growth: Ozempic (+25.8%), Mounjaro (+123.5%), Wegovy (+85.7%) | GLP-1 agonists reshaping diabetes and obesity markets | Pipeline includes next-generation incretins and oral options |

Asthma/Immunology | Dupixent generated >$8 billion in 2023, +22.1% growth | Biologics like Dupixent dominate respiratory and immunology | Focus on monoclonal antibodies and novel targets |

A deep dive into the pharma pipeline uncovers how leading drug developers drive innovation in treatment for asthma and other critical diseases. Strategic investment in these therapeutic areas continues to reshape the future of drug development, offering new hope and measurable impact.

Key Takeaways

Equity report analysis uses large data and AI to predict drug success, helping companies reduce costs and speed up development.

Clinical trial stages show increasing chances of drug approval and value, with late stages having higher success but still significant risks.

Innovation in pharma relies on new technologies like gene editing and AI to discover better treatments for diseases like asthma and cancer.

Market factors, including pricing and competition, greatly affect drug success, so companies must plan carefully for access and differentiation.

Investors benefit from data-driven strategies and must avoid biases to make smart decisions in the fast-changing pharma landscape.

Equity Report Analysis in Pharma

Purpose and Scope

Equity report analysis serves as a cornerstone for understanding the evolving landscape of the pharma pipeline. This approach enables investors, executives, and researchers to evaluate the health of biopharma companies by examining quantitative market research, investment patterns, and innovation metrics. Industry reports, such as those from DrugPatentWatch, highlight the surge in venture capital and private equity funding directed toward AI-driven pharma companies. These reports reveal that AI prediction accuracy for drug launch revenue now exceeds 90%, far surpassing traditional analyst consensus. Companies like Recursion Pharmaceuticals and Schrödinger have attracted significant investments due to their advanced AI capabilities, which accelerate clinical trials and reduce costs by up to 70%.

Quantitative market research, as emphasized by SIS International, empowers pharma leaders to understand patient needs, treatment efficacy, and market trends.

Major players, including Pfizer and Johnson & Johnson, rely on large-scale data analysis to inform product development and strategic planning.

This data-driven approach supports competitive positioning and enables more reliable pipeline analysis.

Impact on Pharma Pipeline

The impact of equity report analysis on the pharma pipeline extends across research, development, and commercialization. The following table illustrates key statistics that demonstrate the scope and influence of these analyses:

Metric | Description | Key Statistics |

|---|---|---|

Proportion of Drugs in Development to Marketed Drugs | Indicates innovation pipeline strength | Peaked at 2.66 in 2022, showing increased R&D focus (2019-2023) |

Clinical Trial Phases Trends | Number of trials in Phases I, II, III over 5 years | Phase I trials increased from 35 to 45; Phase III from 7 to 10 |

New Molecular Entities (NMEs) and Biologics Approvals | Number of new drug approvals | 2023 had highest approvals in 5 years |

R&D Spend and Revenue Relationship | Determinants of future revenue | Higher R&D spend and more Phase III trials correlate with higher future revenues |

Sample Size and Period | Data source and scope | 24 top pharma companies, 2019-2023, IDEA Pharma’s Innovation Index |

AI-powered pipeline analysis now enables biopharma companies to accelerate timelines by several years, optimize resource allocation, and diversify portfolios. Leading firms such as Sanofi, Novartis, and Roche use advanced platforms like Insilico Medicine’s Pharma.AI Suite and DeepMind’s AlphaFold to enhance decision-making and risk assessment. The Pharma 4.0 market, projected to reach $67.7 billion by 2033, reflects the sector’s commitment to digital transformation and innovation. As biopharma companies embrace these tools, they unlock new opportunities for growth and adaptability in a rapidly changing environment.

Reflecting on these trends, it becomes clear that robust equity report analysis not only guides investment but also shapes the future of drug development, ensuring that the pharma pipeline remains dynamic, data-driven, and responsive to global health needs.

Key Metrics in Pipeline Evaluation

Clinical Trial Pipeline Stages

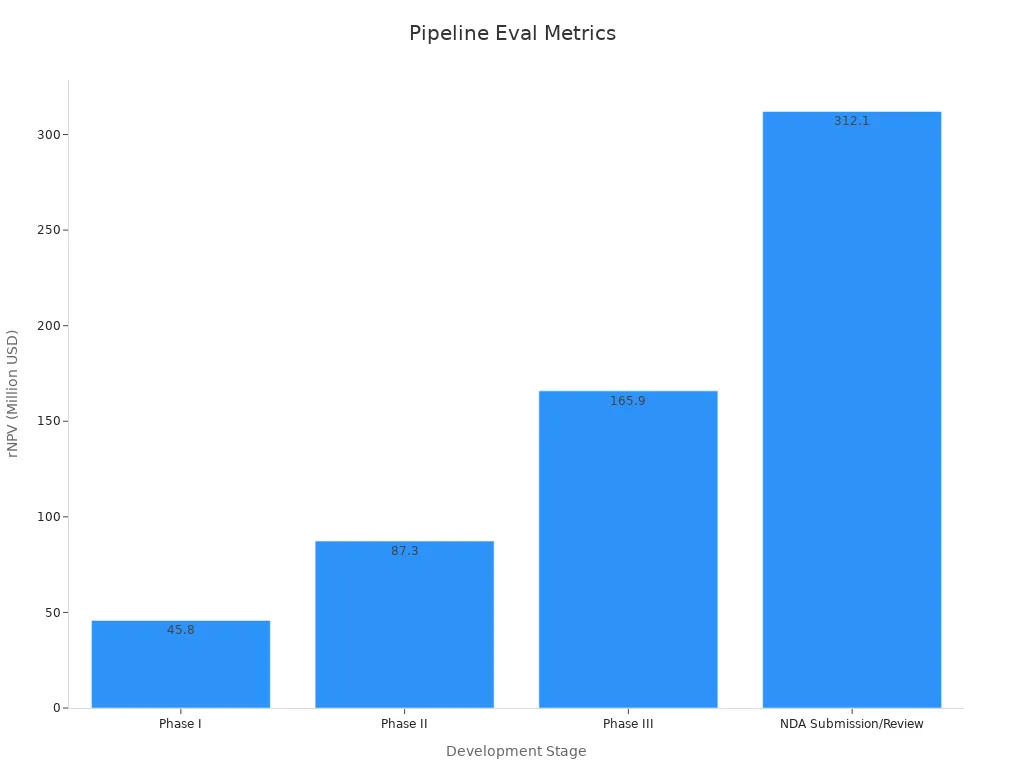

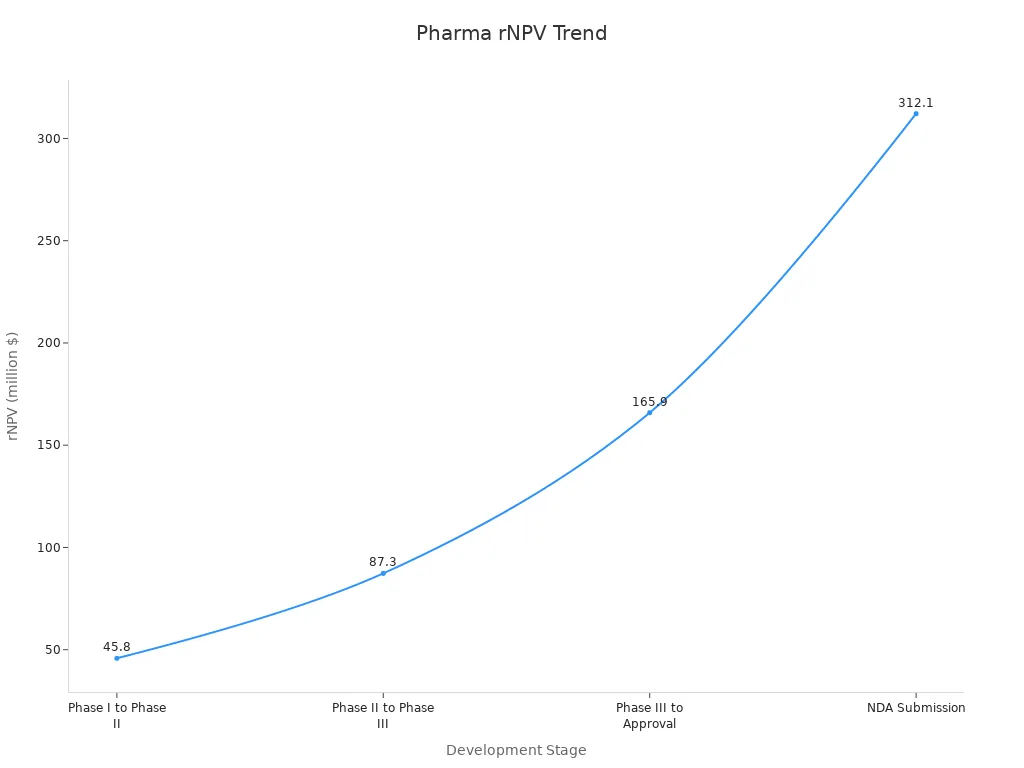

Understanding the clinical trial pipeline forms the backbone of any robust pharma pipeline evaluation. Each stage, from pre-clinical research to regulatory review, represents a critical milestone for drug candidates. The probability of success increases as candidates progress, while risk-adjusted net present value (rNPV) rises, reflecting both reduced uncertainty and greater proximity to market entry.

Development Stage | Probability of Success (%) | Approximate rNPV (Million USD) |

|---|---|---|

Pre-Clinical | 1 - 10 | N/A (high risk, minimal value) |

Phase I | 10 - 20 | 45.8 |

Phase II | 20 - 40 | 87.3 |

Phase III | 50 - 70 | 165.9 |

NDA Submission/Review | 80 - 90 | 312.1 |

The clinical trial pipeline not only quantifies risk but also highlights the value creation process in biopharma. For example, the probability of a drug candidate advancing from pre-clinical to Phase I in oncology stands at 24.2%, a notable improvement over historical averages. Discovery stage success rates can reach 51% when leveraging advanced research methods and strong partnerships. These figures underscore the importance of integrating both quantity and quality assessments—such as scientific novelty, market size, and clinical data quality—when evaluating the pipeline. Public-private partnerships and precision medicine tools further enhance trial efficiency, especially in rare disease research, where the number of active trials continues to grow.

The journey from discovery to approval remains arduous, but each successful transition through the pipeline brings new therapeutic options closer to patients and strengthens the foundation of biopharma innovation.

Mechanisms and Innovation

Innovation in pharma hinges on the mechanisms that drive therapeutic breakthroughs. Companies invest heavily in research to identify new therapeutic targets and develop first-in-class drugs that address unmet medical needs. High-throughput screening, gene editing technologies like CRISPR/Cas9, and single-cell analysis have transformed the way scientists discover and validate drug candidates. Artificial intelligence and machine learning now play a pivotal role, analyzing vast datasets to predict efficacy, assess safety, and accelerate the identification of promising compounds.

First-in-class drugs, such as GLP-1 receptor agonists for diabetes and immune checkpoint inhibitors for cancer, exemplify the impact of novel mechanisms. Although these drugs face lower success rates—often around 5%—they drive the industry forward by opening new therapeutic frontiers. Advances in genomics, proteomics, and analytical technologies have enabled the development of bispecific antibodies, PROTACs, and nucleic acid-based medicines, expanding the arsenal available to tackle complex diseases.

High-throughput screening rapidly identifies lead compounds.

Gene editing enables precise interventions for genetic disorders.

AI and machine learning streamline drug discovery and safety assessment.

Nanoparticle-based delivery systems improve targeting and reduce side effects.

Collaborative innovation platforms foster resource sharing and accelerate progress.

Sustained investment in basic research remains essential for uncovering future therapeutic targets and advancing the next generation of drugs. The relentless pursuit of innovation ensures that the pharma pipeline continues to evolve, offering hope for patients and new opportunities for biopharma growth.

Portfolio and Strategy

Strategic portfolio management stands at the heart of successful pharma operations. Companies must balance risk and reward, allocating resources to projects with the highest potential for return while maintaining a diversified pipeline. AI-powered portfolio management tools have revolutionized this process, improving prediction accuracy for drug launches and optimizing resource allocation. These tools have demonstrated the ability to reduce development timelines by several years and cut clinical trial costs by up to 70%, all while enhancing candidate selection and success rates.

Pharmaceutical firms rely on quantitative metrics such as Net Present Value (NPV), Internal Rate of Return (IRR), payback period, and risk-return curves to evaluate and prioritize projects. Simulation modeling and scoring systems help companies adapt to market changes and align R&D investments with organizational goals. Multifactor matrices and risk analysis models provide objective frameworks for assessing market attractiveness and balancing risk-return trade-offs.

Strategic prioritization, supported by real-world performance data, enables biopharma companies to maximize R&D returns, minimize financial losses, and remain agile in a dynamic market.

Reflecting on these metrics, it becomes clear that a data-driven approach to portfolio management not only supports sound investment decisions but also ensures that the pharma pipeline remains resilient and responsive to emerging therapeutic challenges.

Interpreting Pharma Pipeline Data

Risk and Success Factors

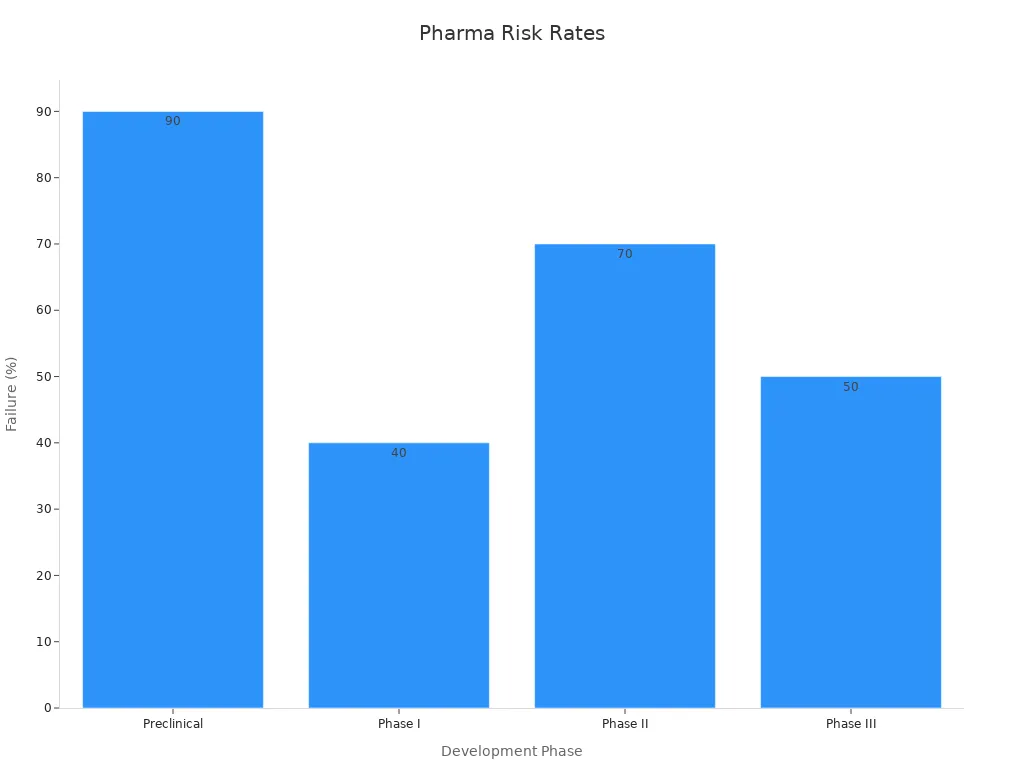

Pharmaceutical pipeline analysis demands a nuanced understanding of risk and reward, especially when evaluating the journey from discovery to market. Each stage of clinical development introduces unique challenges, and the probability of success shifts dramatically as candidates progress. The industry’s asymmetric risk-reward profile means that while the potential reward grows with each milestone, the risk of failure remains significant until late-stage trials or regulatory approval.

A closer look at the numbers reveals the daunting landscape. Less than 10% of compounds entering clinical trials reach commercialization, underscoring the high-risk nature of drug development. The attrition rate in the preclinical phase hovers around 90%, with nearly half of candidates failing in Phase I. Phase II presents the highest hurdle, where approximately 70% of drugs do not advance due to efficacy or safety concerns. Even in Phase III, late-stage risk persists, with about half of candidates failing to achieve the necessary endpoints or regulatory standards.

Development Phase | Typical Industry Attrition Rate (Failure %) | Interpretation |

|---|---|---|

Preclinical | ~90% | Very high risk; most candidates fail before clinical trials |

Phase I | ~40% | Significant risk; nearly half of candidates fail early clinical testing |

Phase II | ~70% | Highest attrition phase; major efficacy and safety hurdles |

Phase III | ~50% | Late-stage risk; regulatory and large-scale trial challenges |

The financial implications of these risks become clear when examining risk-adjusted Net Present Value (rNPV). For instance, a hypothetical drug’s rNPV may start at $45.8 million in Phase I and rise to $312.1 million by the time it reaches New Drug Application (NDA) submission. This progression illustrates how successful advancement through development stages enhances the expected financial reward, balancing the high attrition risk.

Market access factors add another layer of complexity. Pricing, reimbursement, and patient access quantitatively influence commercial success after FDA approval. More than one-third of new product launches fail to meet revenue forecasts, with over half of these failures attributed to limited market access. Even drugs with strong clinical efficacy, such as innovative severe asthma treatments, can underperform if market access strategies fall short. Incorporating these considerations into valuation models is critical, as poor access can significantly reduce expected returns despite regulatory approval.

Metric | Value/Range |

|---|---|

Number of compounds analyzed | 2,092 |

Number of clinical trials | 19,927 |

Number of companies studied | 18 |

Timeframe | 2006–2022 |

Average likelihood of approval | 14.3% (median 13.8%) |

Company-specific LoA range | 8% to 23% |

Industry benchmark (previous) | ~10% success rate |

The path to market for severe asthma drugs, as with other innovative therapies, requires not only scientific rigor but also strategic foresight. Companies that integrate risk assessment, market access planning, and real-world evidence into their pipeline evaluation stand a better chance of achieving both clinical and commercial success.

Market and Competition

Market dynamics play a decisive role in shaping the fate of new drugs, especially in competitive therapeutic areas like severe asthma. The U.S. market, in particular, demonstrates unique pricing and competition patterns that influence both branded and generic drug success. According to a 2024 RAND Corporation study, U.S. prescription drug prices remain substantially higher than those in other developed countries, especially for brand-name originator drugs. This pricing environment creates both opportunities and challenges for companies developing new asthma treatment drugs.

Drug Category | US Price Compared to Other Countries (%) |

|---|---|

All Prescription Drugs | 278% |

Brand-Name Originator Drugs | 422% |

Unbranded Generic Drugs | 67% |

Generic drug entry after patent expiration typically causes significant price reductions, increasing drug affordability and accessibility for patients with severe asthma. However, the expected price drop does not always materialize. In some cases, prices for both brand-name and generic drugs remain elevated, or even rise, due to factors such as marketing strategies, supply chain intermediaries, and brand loyalty. These complex behaviors highlight the importance of understanding market-specific forces when evaluating the commercial potential of new severe asthma treatments.

Companies must anticipate the impact of generic competition on revenue projections for severe asthma drugs.

Market access strategies, including payer negotiations and patient support programs, can determine the success of new asthma therapies.

Real-world data on patient outcomes and adherence inform both pricing and market positioning for severe asthma treatment options.

The competitive landscape for severe asthma treatments continues to evolve. Companies that monitor FDA approvals, track emerging clinical data, and adapt to shifting payer requirements position themselves for long-term success. The pipeline for severe asthma therapies remains robust, with numerous candidates in late-stage clinical trials. This environment fosters innovation but also intensifies competition, making strategic differentiation essential.

In the race to bring new severe asthma therapies to market, success depends on more than scientific achievement. Companies must navigate a complex web of regulatory, commercial, and competitive factors. Those who combine clinical excellence with market intelligence and adaptability will shape the future of asthma care.

A thoughtful approach to pipeline evaluation—one that balances risk, reward, and market realities—empowers organizations to make informed decisions. As the severe asthma landscape grows more crowded, the winners will be those who anticipate change, embrace innovation, and keep patient needs at the center of their strategy.

Trends Shaping the Pharma Pipeline

Therapeutic Areas: Oncology, Asthma, GLP-1

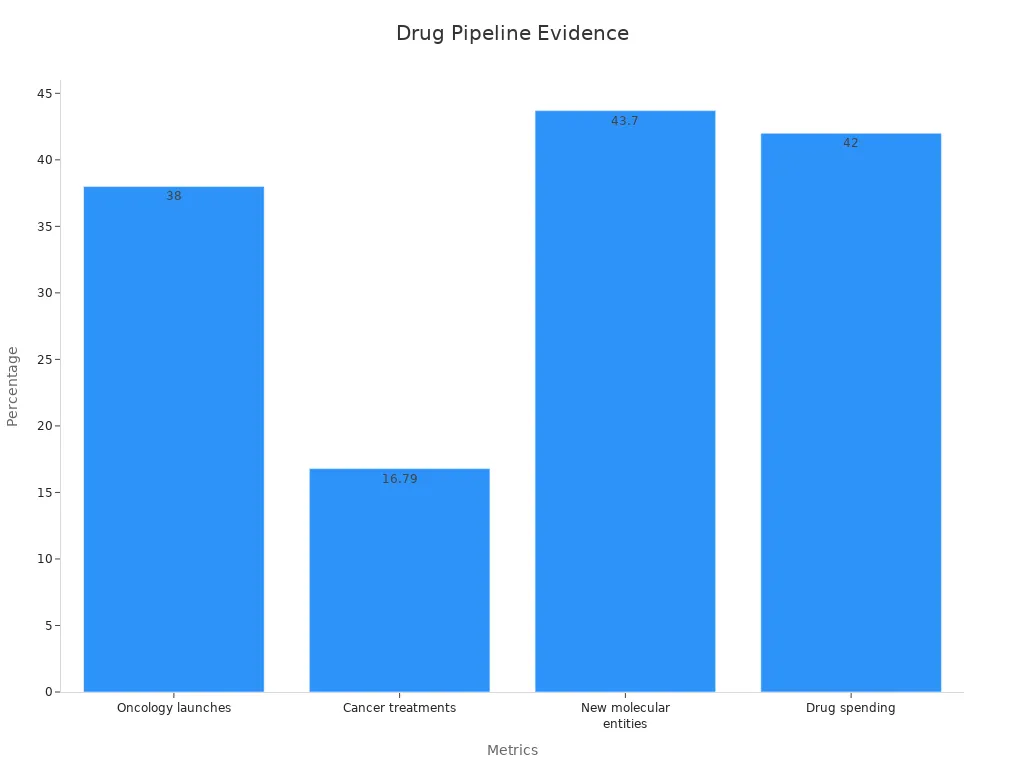

Oncology leads the pharma pipeline, with biopharma companies investing in next-generation drugs that target complex cancers. Recent years have seen a surge in approvals for bispecific antibodies, fusion proteins, and radioligand therapies, all of which expand the arsenal against cancer. Oncology now accounts for a significant share of new therapeutic approvals, reflecting both scientific progress and high unmet need. In parallel, severe asthma has emerged as a focal point for innovation. Companies have prioritized severe asthma treatments, introducing monoclonal antibodies and oligonucleotide therapies that address previously untreatable patient populations. The market for severe asthma continues to grow, driven by rising prevalence and the need for more effective asthma treatment drugs. GLP-1 therapies, initially developed for diabetes, now show promise in obesity and metabolic disease, further diversifying the therapeutic landscape. The pharma pipeline also features gene therapy approvals, which have transformed the outlook for rare diseases and severe asthma, offering hope where traditional treatments fell short.

Adoption of novel modalities such as oncolytic viruses and antibody drug conjugates accelerates progress in oncology and severe asthma.

Strategic focus shifts toward therapeutic targets in cardiovascular, metabolic, and neurodegenerative diseases, but severe asthma remains a top priority.

Technology and Outsourcing

Pharma companies increasingly rely on technology and strategic outsourcing to advance severe asthma research and development. Artificial intelligence and machine learning streamline clinical trial enrollment, improve patient recruitment, and reduce costs. Strategic partnerships with contract research organizations (CROs) and contract development and manufacturing organizations (CDMOs) enable biopharma firms to access advanced expertise and infrastructure. These collaborations have proven essential for severe asthma programs, where rapid innovation and regulatory compliance are critical. Outsourcing regulatory affairs to specialized firms increases the likelihood of first-cycle FDA approval, saving time and resources. Strategic partnerships also foster shared risk and deeper integration, which drive operational efficiency and innovation in severe asthma treatments.

Evidence Aspect | Description |

|---|---|

Cost and Timeline Reduction | Strategic outsourcing can reduce development costs and timelines by 15-20%. AI integration cuts early-stage discovery timelines by up to 4 years and reduces costs by 60%. |

Access to Advanced Technologies | Partnerships with AI-focused CROs enable leveraging AI and machine learning for drug discovery and optimization. |

Regulatory Outsourcing | Specialized regulatory outsourcing can increase first-cycle FDA approval likelihood by up to 25%. |

Strategic outsourcing and technology integration have become indispensable for biopharma companies seeking to deliver new severe asthma therapies efficiently and safely.

Regulatory and Market Shifts

Regulatory and market shifts continue to reshape the pharma pipeline, especially for severe asthma and oncology. The FDA has introduced draft guidance on AI in regulatory decision-making, emphasizing transparency and continuous monitoring. The European Union now mandates AI literacy and restricts certain AI practices, while new directives enforce sustainability and ethical business conduct. These changes affect how biopharma companies approach severe asthma drug development and submission. The FDA encourages advanced manufacturing and streamlined approval pathways, such as the Breakthrough Therapy program, which has benefited severe asthma and oncology drugs. Market data shows that a small number of companies drive most value growth, with a focus on prevention, personalization, and prediction. Pricing pressures, demographic shifts, and global volatility add complexity, but biopharma leaders adapt by evolving portfolios and commercial strategies. Severe asthma remains at the forefront, with companies leveraging real-world evidence and digital platforms to support FDA submissions and market access.

The evolving regulatory landscape and market dynamics demand adaptability and foresight. Biopharma companies that embrace innovation, strategic partnerships, and regulatory agility will continue to shape the future of severe asthma care and therapeutic advancement.

Case Studies and Valuation Impact

Positive Pipeline Developments

In the evolving landscape of pharma, positive pipeline developments often reshape the future for severe asthma therapies and drive significant value for both companies and patients. Companies that advance drug candidates for severe asthma through the clinical pipeline can see remarkable increases in value, especially when addressing high unmet needs or leveraging innovative mechanisms. For example:

Company A is developing a gene therapy for a rare genetic disorder with no current treatments. The small patient population does not limit the value, as the high unmet need and potential for premium pricing create substantial future profit and elevate company valuation.

Company B is pursuing a novel oral diabetes treatment targeting a vast global market. Even a modest share of this market can generate impressive sales, boosting the company’s value due to the scale of opportunity.

The journey from pre-clinical to Phase III for severe asthma therapies involves escalating investment and rising probability of FDA approval. Each milestone achieved in the pipeline increases value and attracts investor attention.

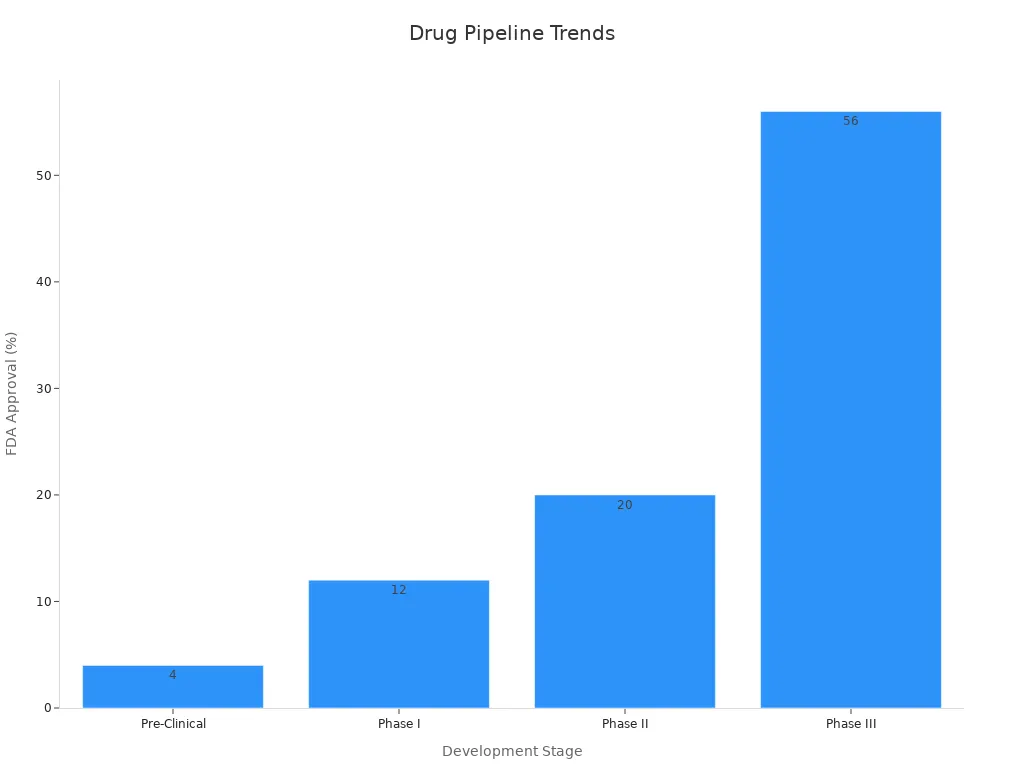

Development Stage | Probability of FDA Approval | Approximate Investment Required | Valuation Impact Summary |

|---|---|---|---|

Pre-Clinical | 4% | Included in total $520M | Highly speculative value; high risk but potential for high reward if addressing unmet needs or novel mechanisms |

Phase I | 12% | Increasing investment | Value increases due to demonstrated safety and milestone achievement |

Phase II | 20% | Significant investment | Critical inflection point; efficacy signals can substantially increase value or cause sharp declines if negative |

Phase III | 56% | Largest investment phase | Major value increase reflecting reduced risk and proximity to commercialization |

Total investment from pre-clinical to approval approximates $520 million, highlighting the capital intensity influencing value.

Specialized regulatory designations, such as Orphan Drug or Breakthrough Therapy, can accelerate severe asthma drug development, reduce costs, and improve risk-adjusted net present values. Drugs with multiple indications or label expansion potential command higher value, as they diversify risk and expand market reach. Platform technologies and therapies targeting severe asthma or other high unmet needs often achieve enhanced valuations, reflecting their strategic importance.

Setbacks and Strategic Shifts

Setbacks in the severe asthma pipeline can swiftly alter company value and prompt strategic shifts. Companies may face clinical trial failures, regulatory delays, or increased competition, all of which impact sales projections and overall value. For instance, Recursion’s decision to cut several pipeline programs, including those for severe asthma, led to a sharp decline in valuation as investors recalibrated expectations for future sales and growth.

Pharma companies use a range of analytical tools to navigate these challenges:

Statistical Analysis / Methodology | Purpose / Application |

|---|---|

Product Performance Analysis | Tracks sales trajectories, market share trends, and growth drivers to reveal competitive emphasis and shifts. |

Pipeline Analysis with Probability-Weighted Forecasts | Uses historical success rates to estimate likelihood of pipeline program success and future competitive landscape. |

Clinical Trial Success Prediction Models | Predicts probability of clinical development success based on historical data across therapeutic areas and phases. |

Launch Timing Models with Probability Distributions | Estimates potential market entry dates with confidence intervals, accounting for regulatory and development uncertainties. |

Scenario-Based Analytics | Simulates multiple interacting competitive factors to anticipate market dynamics and strategic shifts. |

AI and Machine Learning Techniques (NLP, Predictive Analytics, Network Analysis) | Extract patterns from large datasets, identify delays or accelerations, and model competitive dynamics over time. |

Real-World Evidence (RWE) and Real-World Data (RWD) Analyses | Supplement clinical trials with observational data to detect safety issues and inform regulatory and market strategies. |

Statistical Methods for Bias Correction in RWE | Includes propensity score matching, inverse probability weighting, and instrumental variable analysis to address confounding and bias. |

Scenario Planning and War Gaming | Models competitive responses to regulatory, technological, and market changes to anticipate strategic shifts. |

Real-world evidence and real-world data analyses now play a vital role in tracing severe asthma drug development outcomes. These methods supplement clinical trial data, helping detect safety issues and inform regulatory and market access strategies. Advanced statistical techniques, such as propensity score matching and inverse probability weighting, address confounding and bias, while AI and machine learning enhance the detection of delays, accelerations, and strategic shifts in severe asthma programs.

Reflecting on these case studies, one sees that every advance or setback in the severe asthma pipeline ripples through company value, sales forecasts, and strategic direction. The most resilient organizations adapt quickly, using robust analytics and real-world insights to guide their next move. In the end, the ability to anticipate change and respond with agility defines long-term success in the pharma sector.

Actionable Insights for Investors

Best Practices

Investors seeking to navigate the complex world of asthma drug development can benefit from a disciplined, data-driven approach. AI-powered portfolio management now enables investors to analyze vast datasets, improving the prediction accuracy of drug development outcomes and optimizing R&D investments. These advanced algorithms can forecast revenue outcomes for new asthma therapies with over 90% accuracy, outperforming traditional analyst consensus and providing a sharper lens for evaluating future sales potential. Predictive analytics also help forecast demand for asthma treatment, market potential, and the likelihood of clinical success, which supports more informed resource allocation.

Key financial ratios related to R&D expenditure, debt management, and profitability remain essential for evaluating pharma investments. Monitoring these metrics alongside operational and commercial KPIs ensures a comprehensive view of investment reliability. AI-enabled benchmarking further enhances this process by integrating syndicated market research data across countries and therapeutic areas, allowing investors to interpret commercial KPIs linked to launch success. Performance bands, rather than single benchmarks, offer a more accurate context for decision-making, especially in the dynamic asthma market.

Investors who foster a culture of continuous learning, prioritize data privacy, and partner with vendors that demonstrate robust protections position themselves to adapt to evolving asthma measurement and marketing landscapes.

Common Pitfalls

Despite the promise of innovation, several pitfalls can undermine investment strategies in the asthma sector. Confirmation bias often leads investors to focus on information that supports their existing beliefs about asthma competitors, distorting strategic decisions. Overconfidence bias may cause excessive certainty in predictions, even when the asthma industry faces inherent uncertainties. Recency bias can result in reactive moves, as investors overweight recent asthma events and overlook long-term trends.

Other warning signs include weak intellectual property protection for asthma therapies, overly optimistic clinical timelines, and unproven science. Inexperienced leadership teams and unclear regulatory strategies also raise concerns about execution and compliance. Information overload remains a challenge, as the sheer volume of asthma data can obscure critical signals, making it difficult to identify actionable insights for sales forecasting or treatment positioning.

Investors should remain vigilant for:

Unclear asthma patent ownership or expiring protections

Unrealistic expectations about asthma clinical trial durations

Lack of independent validation for new asthma science

Leadership teams without strong asthma expertise or track records

Vague regulatory or compliance plans for asthma therapies

The most successful investors in asthma drug development combine rigorous analysis with humility, recognizing both the opportunities and the risks that define this rapidly evolving field. By learning from past missteps and embracing best practices, they help shape a future where innovative asthma treatment and robust sales growth go hand in hand.

Equity report analysis remains essential for understanding the pharma pipeline and guiding strategic investment. Companies that embrace integrated evidence plans and risk-adjusted modeling achieve better outcomes for both patients and investors.

Clean, high-quality data and advanced analytics drive smarter decisions and operational efficiency.

The rise in FDA approvals, rapid adoption of AI, and evolving regulatory frameworks highlight the need for continuous monitoring.

A holistic, data-driven approach empowers organizations to adapt, innovate, and create lasting value in a dynamic healthcare landscape.

FAQ

What is the primary goal of equity report analysis in pharma?

Equity report analysis helps stakeholders understand the value and potential of a company’s drug pipeline. It highlights innovation, market trends, and risk factors, enabling informed decisions about resource allocation and strategic direction.

How do clinical trial stages affect a drug’s valuation?

Each clinical trial stage reduces uncertainty and increases a drug’s risk-adjusted value. As a candidate advances, investors see higher confidence in its success, which often leads to greater company valuation and market interest.

Why do companies focus on therapeutic areas like oncology and GLP-1?

Oncology and GLP-1 represent high unmet medical needs and strong revenue potential. Companies invest in these areas to drive innovation, address patient demand, and capture significant market share, which supports long-term growth.

How does technology influence pipeline development?

Advanced technologies, such as artificial intelligence and machine learning, accelerate drug discovery and streamline clinical trials. These tools help companies identify promising candidates faster, reduce costs, and improve the accuracy of success predictions.

What role does real-world evidence play in pipeline evaluation?

Real-world evidence provides insights beyond clinical trials. It helps companies understand how drugs perform in everyday settings, supports regulatory submissions, and informs market access strategies, ultimately shaping the success of new therapies.

Thoughtful analysis and a willingness to adapt remain essential for anyone seeking to understand or invest in the evolving world of pharmaceutical innovation.

Uncovering Value: How Equity Analysis Illuminates the Pharma Pipeline

Understanding where innovation meets opportunity in drug development is key to long-term financial success—and nowhere is this more evident than in the pharma pipeline. Equity report analysis brings clarity to a complex landscape, helping investors and leaders navigate everything from clinical trial risk to market dynamics with greater precision. With AI-driven tools forecasting launch revenue and optimizing portfolio decisions, the process of evaluating pharmaceutical assets has never been more data-rich or decision-ready. At VASRO, we see this as the heart of smart investing: combining clinical insight with market intelligence to assess not just what’s next in drug development, but what’s likely to succeed. In an industry where each milestone can reshape valuation and long-term growth, thoughtful analysis gives investors the confidence to act with purpose—and patience—in an evolving, high-stakes environment.

Disclaimer: The information provided on www.vasro.de is for general informational purposes only and does not constitute investment advice or a recommendation to invest in any particular asset or market. VASRO GmbH does not offer personalized investment advice, and the content on this website should not be relied upon as such. Visitors are encouraged to seek independent financial advice tailored to their specific circumstances before making any investment decisions. VASRO GmbH disclaims any liability for investment decisions made based on the information presented on this website.