Luxury Resale Trends focusing on Gucci and Dior in 2025

Luxury resale trends in 2025 reveal a dynamic shift in the luxury fashion market, with both Gucci and Dior capturing attention for different reasons. Gucci maintains a strong presence, though recent numbers show a 12% decline in revenue in 2024. Dior, while experiencing a modest 2% dip, sees its resale value steadily climb, fueled by renewed consumer interest and a focus on iconic pieces. The influence of sustainability, evolving technology, and economic uncertainty shapes these trends as buyers seek both value and authenticity in the ever-expanding luxury fashion market.

The pre-owned luxury sector continues to surge, reaching a projected $30 billion market size by 2025. E-commerce now claims 25% of luxury sales, signaling a profound change in how fashion lovers approach the luxury fashion market.

Brand/Metric | Statistic/Trend |

|---|---|

Pre-owned luxury market size | Projected to reach $30 billion by 2025 |

Gucci (Kering) revenue change | 12% decline in 2024 |

Dior (LVMH) revenue change | 2% decline in 2024 |

The LuxeExchange sales growth | |

E-commerce share of luxury sales | Expected 25% by 2025 |

Luxury resale trends not only reflect changing tastes but also a deeper commitment to sustainability and mindful fashion choices. This evolving landscape inspires both collectors and new entrants to the luxury fashion market to seek pieces that offer enduring value and personal expression.

Key Takeaways

The luxury resale market is growing fast, driven by younger buyers who want sustainable and affordable luxury.

Gucci and Dior remain top brands, with Dior’s resale value rising and Gucci focusing on trust through blockchain technology.

Technology like blockchain and virtual try-ons improves authenticity and shopping experience in luxury resale.

Sustainability matters more than ever, with many consumers willing to pay extra for eco-friendly luxury products.

Tariffs and counterfeits challenge the market, but brands fight back with certified programs and digital tools to protect value and trust.

Luxury Resale Trends 2025

Market Growth

The luxury fashion market in 2025 continues to evolve, shaped by shifting consumer values and the growing influence of digital platforms. Despite a 7% decline in overall luxury spending early in the year, the luxury resale segment stands out as a beacon of resilience and innovation. The second-hand luxury market is projected to reach $13.04 billion by 2030, with a compound annual growth rate of 7% from 2024 to 2030. Ecommerce resale platforms, in particular, are expanding at a remarkable pace of 20–30% annually, driven by the preferences of Millennials and Gen Z, who seek both accessibility and sustainability in their fashion choices.

Luxury resale trends reflect a broader shift in the luxury fashion market, where consumers increasingly value quality, authenticity, and environmental responsibility. Inflation concerns now influence 32% of global consumers, prompting many to seek value and affordability in their purchases. Over 75% of shoppers prefer lower-cost alternatives, and 86% of Gen Z and millennials prioritize value shopping. These economic pressures, combined with a growing demand for eco-friendly packaging and high-quality, long-lasting clothing, fuel luxury resale growth and reinforce the appeal of second-hand luxury.

Note: The luxury resale market’s robust expansion is not just a response to economic uncertainty but also a testament to the enduring allure of luxury fashion and the rising importance of conscious consumption.

Brand Rankings

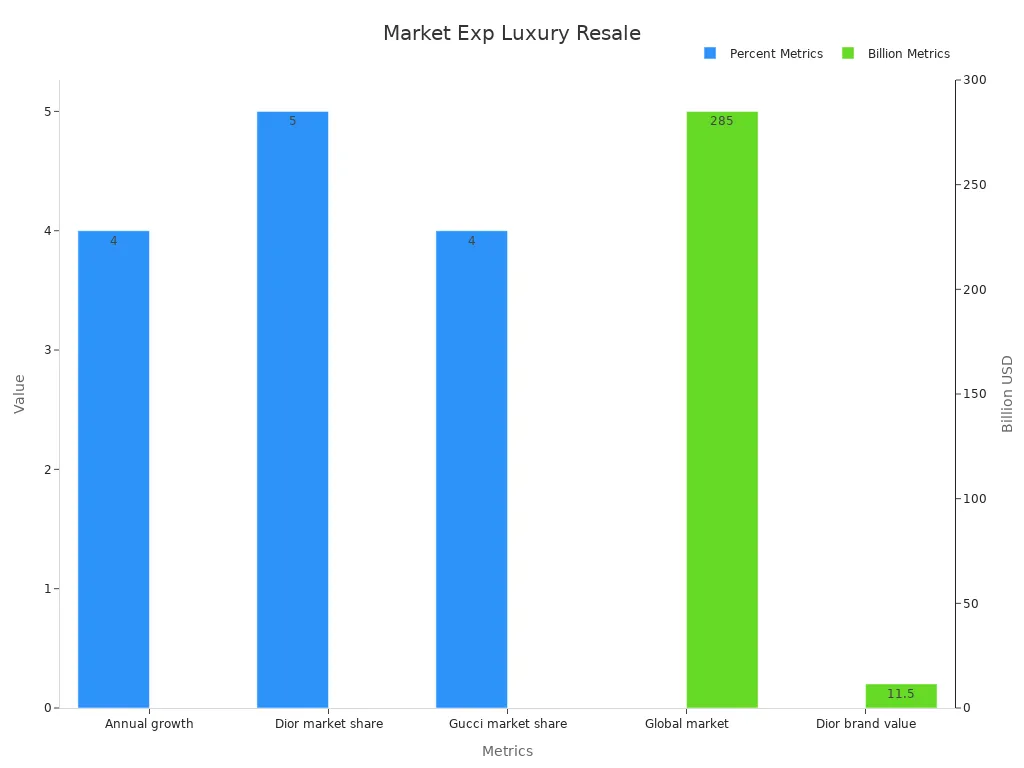

Within the luxury resale landscape, Gucci and Dior remain two of the most closely watched luxury fashion brands. Their positions in the luxury retail ecosystem reflect both the challenges and opportunities facing the industry in 2025.

Brand | Market Share | Brand Value (2023) | Key Strengths |

|---|---|---|---|

Dior | 5% | $13.2B | Broad appeal, strong growth in ready-to-wear and accessories, digital strategy |

Gucci | 4% | $17.9B | Iconic accessories, social media influence, pop culture relevance |

Dior commands a 5% share of the luxury resale market, with a brand value estimated between $11–12 billion. Its growth extends beyond couture, with strong performance in ready-to-wear, accessories, and sneakers. Dior’s digital investments and collaborations have broadened its appeal across age groups, while its sustainability initiatives—such as material sourcing verification and supplier audits—enhance its competitive edge.

Gucci, holding a 4% market share, continues to captivate with its iconic designs and strong presence across fashion, fragrance, and jewelry. However, Gucci faces share losses among high-income shoppers, reflecting the shifting dynamics of luxury retail. Despite these challenges, Gucci’s commitment to balancing exclusivity with transparency and sustainability helps maintain its leadership status in the luxury fashion market.

Consumer Shifts

Consumer behavior in the luxury fashion market reveals a nuanced story in 2025. Both Gucci and Dior have seen their consumer consideration scores decline—Gucci from 13.4% to 11.9%, and Dior from 12.9% to 11.1%—mirroring a broader trend among major luxury brands. The percentage of Americans likely to purchase luxury items in the next year has also dropped, from 18.3% to 16.3%. Yet, the motivations behind luxury purchases remain deeply rooted in quality, emotional satisfaction, and personal reward.

61% of consumers cite superior quality as the main reason for choosing luxury goods.

Emotional satisfaction motivates 56% of buyers, while 41% see luxury as a personal reward.

32% view luxury as an investment, highlighting the enduring value of second-hand pieces.

The shift toward online channels continues to reshape luxury retail, with online sales projected to rise from 15.5% in 2024 to 17.1% in 2025. This digital migration reflects evolving luxury trends 2025, as consumers seek convenience, transparency, and a wider selection of second-hand treasures. The luxury fashion market’s embrace of technology, coupled with a heightened focus on sustainability, signals a new era where luxury resale trends are defined by both innovation and timeless appeal.

As the luxury market adapts to these changes, buyers and sellers alike find new opportunities to express their individuality and invest in pieces that tell a story—each item a testament to the enduring power of fashion and the promise of a more thoughtful, sustainable future.

Digital Shift

Technology in Resale

Luxury resale in 2025 stands at the forefront of digital transformation, as platforms embrace a wave of innovation that redefines how buyers and sellers interact with pre-owned treasures. This transformation brings a seamless blend of technology and style, making the experience both intuitive and engaging. Shoppers now expect more than just listings—they seek immersive journeys, where every detail, from product discovery to checkout, feels tailored and trustworthy.

NFT certificates and blockchain tools now verify product authenticity and provenance, building confidence and deterring counterfeiters.

Augmented reality features, such as virtual fitting rooms and 3D previews, allow buyers to visualize pieces in their own space.

Mobile-first experiences streamline checkouts and integrate shipping, catering to the fast-paced lives of modern consumers.

Social commerce thrives, with Instagram Shops and TikTok Live connecting niche communities and sparking real-time conversations.

AI detection systems and expert authenticators work together to combat counterfeits, while high-quality images and detailed descriptions enhance transparency.

Generous return policies and money-back guarantees further reassure buyers, making luxury resale more accessible than ever.

A closer look at platform features reveals the depth of this digital transformation:

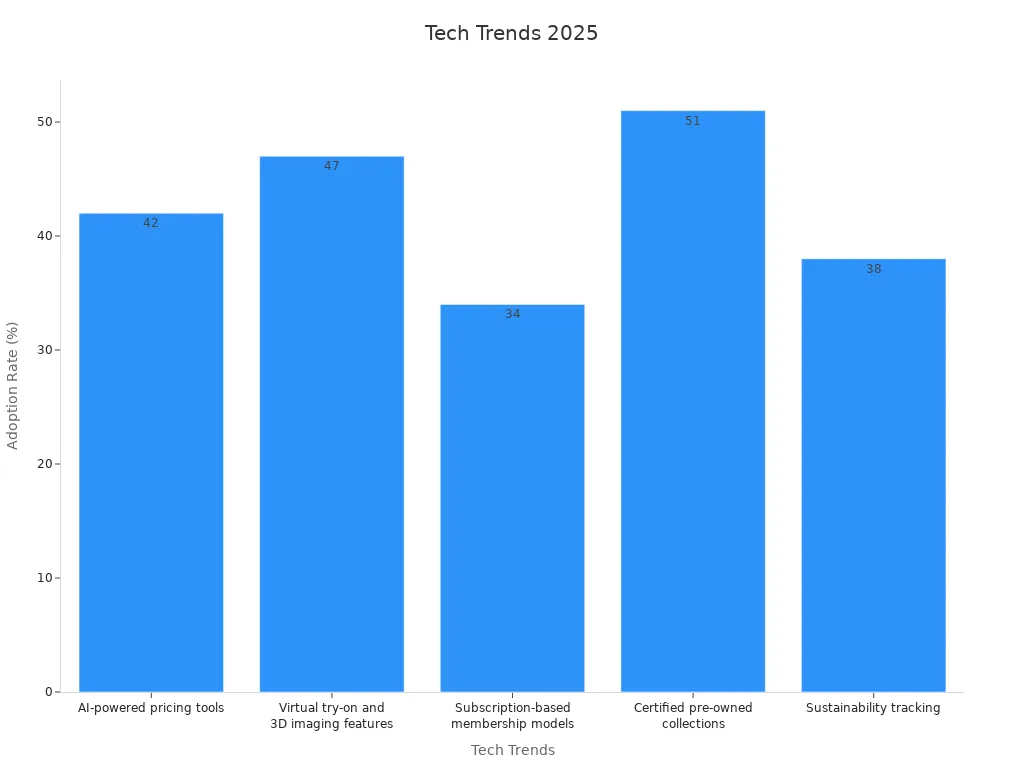

Technological Trend / Feature | Adoption Rate / Impact | Example / Outcome |

|---|---|---|

AI-powered pricing tools | Improved pricing precision, boosting listing conversions by 22%. | |

Virtual try-on and 3D imaging | Nearly 47% of platforms | Enhanced engagement and buyer experience. |

Subscription-based membership models | 34% of platforms | Early access, discounts, and exclusive collections for members. |

Certified pre-owned collections | Over 51% of platforms | Detailed grading and warranty-backed assurance, increasing buyer trust. |

Sustainability tracking | Over 38% of platforms | Carbon impact offset information for eco-conscious shoppers. |

In-house authentication labs | N/A | Increased authentication capacity, reducing counterfeit returns. |

Video listing features | N/A | 360-degree video listings reduce returns and improve satisfaction. |

Mobile-first user experience | N/A | One-click checkouts and streamlined mobile shopping. |

Social commerce integration | N/A | Platforms reach niche buyers through social channels. |

Case studies highlight this transformation in action. The LuxeExchange’s AI-powered recommendations boost engagement by tailoring suggestions to each shopper’s style. Virtual try-on technology at PremierRetailer creates lifelike digital fitting rooms, while AI-driven repair tools promote circular fashion and sustainability. These innovations reflect a broader digital transformation, where technology and luxury resale move hand in hand.

Blockchain and Authentication

Blockchain technology now plays a pivotal role in the luxury resale market, offering a new level of transparency and trust. By tracing each item’s journey from manufacturer to end user, blockchain reduces counterfeiting and ensures every transaction upholds the highest standards of authenticity. This digital transformation addresses one of the industry’s greatest challenges—information asymmetry—by providing a decentralized, tamper-proof record for every luxury piece.

Platforms that adopt blockchain see tangible benefits. AuthenticWardrobe, for example, has experienced rapid growth and consumer acceptance, with hundreds of thousands of app downloads in recent months. Research shows that blockchain not only reduces uncertainty for buyers but also supports effective pricing strategies and supply chain optimization. As North American resale revenue climbs past $2.6 billion, the need for reliable authentication grows ever more urgent.

Blockchain’s transparent database structure inspires confidence, allowing buyers to invest in luxury with peace of mind. This transformation signals a new era for resale, where trust and technology walk side by side, and every purchase tells a story of craftsmanship, provenance, and enduring value.

Gucci Strategy

Back-to-Basics Approach

Gucci enters 2025 with a renewed focus on its core values and heritage, responding to a rapidly changing luxury landscape. The brand, under Kering, faced a 12% revenue decline and a 15% drop in profit during 2024. To address these challenges, Gucci implemented double-digit price increases across its collections. This move aligns with a broader industry trend, where luxury houses raise prices to reinforce exclusivity, maintain global pricing parity, and protect profit margins.

These price adjustments have a ripple effect throughout the luxury resale market. As new Gucci items become less accessible, demand for pre-owned pieces intensifies. Entry-level items, in particular, see a surge in popularity, as buyers seek attainable ways to experience the allure of luxury. Many consumers now view luxury goods as investment assets, turning to authenticated resale platforms for both value and peace of mind. This shift highlights a growing appreciation for timeless design and craftsmanship, as well as a desire to participate in the luxury world without the barriers of rising retail prices.

Gucci’s strategy demonstrates a thoughtful balance between tradition and innovation, inviting a new generation of collectors to discover the brand’s enduring appeal through the lens of luxury resale.

Blockchain for Trust

Trust remains the cornerstone of the luxury resale experience, and Gucci recognizes the importance of transparency in every transaction. The brand invests in blockchain technology to authenticate products and trace their journey from creation to resale. This digital ledger provides buyers with verifiable proof of authenticity, reducing the risk of counterfeits and enhancing confidence in the secondary market.

Blockchain integration also supports Gucci’s commitment to sustainability and responsible luxury. By offering detailed provenance records, the brand empowers consumers to make informed choices and invest in pieces with lasting value. As the luxury market evolves, Gucci’s embrace of blockchain sets a new standard for trust and accountability, ensuring that every item tells a genuine story.

For style enthusiasts and collectors, this approach offers both reassurance and inspiration. The fusion of heritage, technology, and conscious fashion invites everyone to explore the world of luxury with confidence and curiosity.

Dior in Luxury Retail

Value Growth

Dior stands as a beacon of innovation and tradition in the luxury retail landscape. Over the past five years, Dior's resale value has climbed by 12%, a testament to the brand's enduring appeal and the growing sophistication of the luxury resale market. This upward trend signals a shift in consumer priorities, where buyers now seek not only the thrill of newness but also the assurance of lasting value. Dior’s commitment to quality and artistry resonates with a new generation of collectors who view luxury as both a personal statement and a wise investment.

Luxury retail platforms have responded by spotlighting Dior’s most coveted pieces, making them more accessible to discerning shoppers. The brand’s focus on refined materials, meticulous craftsmanship, and timeless silhouettes ensures that each item retains its allure long after its initial debut. As more consumers embrace the circular economy, Dior’s presence in luxury resale continues to grow, reinforcing the brand’s reputation for excellence and desirability.

Note: The rise in Dior’s resale value reflects a broader movement toward conscious consumption, where luxury retail becomes a space for both self-expression and sustainable style.

Lady Dior Bag

The Lady Dior bag has emerged as an icon within luxury retail, captivating style enthusiasts and collectors alike. In IconicBags’s 2024 Clair Report, the Lady Dior ranks among the most searched bag styles, highlighting its strong demand in the luxury resale market. Several factors contribute to this enduring popularity:

The Lady Dior’s timeless silhouette and refined design set it apart from fleeting trends.

Exceptional craftsmanship and exclusivity enhance its desirability among luxury connoisseurs.

Celebrity endorsement, especially by Princess Diana, elevates its status to legendary.

These qualities combine to support its robust resale value and continued relevance.

Luxury retail platforms frequently showcase the Lady Dior as a centerpiece, drawing attention from both seasoned collectors and those new to the world of luxury. The bag’s history, elegance, and versatility make it a favorite for those seeking a meaningful addition to their wardrobe. As the luxury resale market evolves, the Lady Dior remains a symbol of enduring style and thoughtful investment.

For those considering their next luxury purchase, the Lady Dior offers more than just a beautiful accessory—it represents a connection to fashion history and a commitment to timeless elegance. Choosing such a piece invites confidence and inspires a more intentional approach to personal style.

Consumer Trends in Luxury

Sustainability Demand

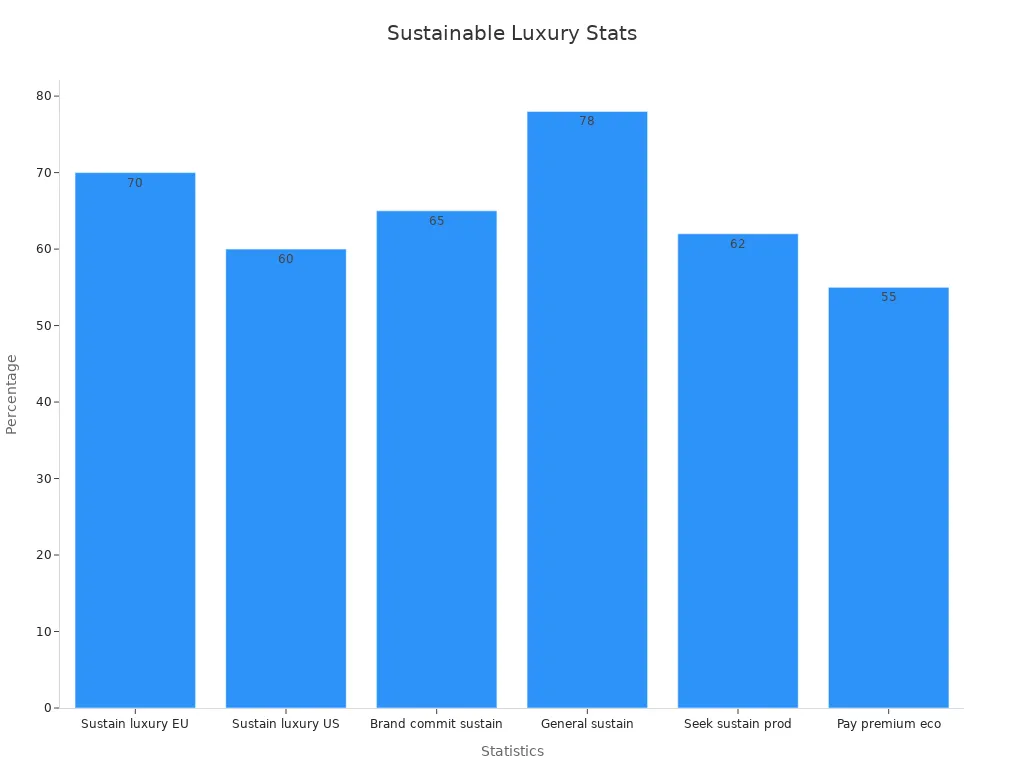

In 2025, the luxury fashion market experiences a profound transformation as sustainability and ethical values become central to consumer decision-making. Shoppers now expect brands to demonstrate ethical sourcing and sustainable sourcing, seeking transparency in every step of the fashion journey. A recent survey reveals that 78% of consumers consider sustainability important, while 62% always or often look for sustainable products. In Europe, 70% of luxury shoppers rate sustainable luxury policies as very or somewhat important, compared to 60% in the United States. Over half of all consumers willingly pay a premium for eco-friendly brands, and 84% say poor environmental practices will alienate them from a brand. These figures highlight a growing demand for circularity and ethical practices in the luxury fashion market.

Luxury brands now recognize that ethical sourcing and sustainability are not just trends but essential pillars for long-term success. The market share of sustainable products has reached 17%, with growth outpacing non-sustainable goods by nearly threefold. As the luxury fashion market evolves, second-hand and circular models gain traction, offering both value and a sense of responsibility.

Gen Z and Millennials

Gen Z and Millennials shape the future of the luxury fashion market through their values and shopping habits. These generations drive the rise of second-hand luxury, motivated by a desire for authenticity, ethical choices, and unique style. Over 40% of Millennials and Gen Z actively embrace second-hand clothing, signaling a cultural shift toward eco-conscious fashion. In China and Southeast Asia, Gen Z’s appetite for luxury remains strong, focusing on product quality and hyper-personalization. In Western countries and Japan, younger buyers prefer cost-effective purchases and second-hand platforms, viewing luxury as both an investment and a statement of individuality.

Luxury brands respond by launching digital initiatives and collaborating with influencers, meeting younger consumers where they spend their time. The luxury fashion market sees resale growing three times faster than traditional retail, with these demographic groups at the forefront. Their commitment to ethical and sustainable fashion encourages brands to extend product lifecycles and enhance loyalty through innovative resale programs.

Regional Growth

Regional differences shape the luxury fashion market’s evolution, with Europe leading in both demand and innovation. The growth of high-net-worth individuals in Switzerland, Germany, and the United Kingdom fuels luxury resale, supported by stable economies and a tradition of craftsmanship. Italy’s dominance in luxury fashion, rooted in artisanal excellence, influences second-hand market dynamics across the continent. Economic uncertainties, such as inflation and geopolitical tensions, create cautious spending patterns, yet luxury resale platforms thrive by offering rigorous authentication and quality assurance.

Luxury brands increasingly introduce certified pre-owned programs and refurbishment services, appealing to European consumers who prioritize sustainability and quality. These regional trends reinforce the importance of ethical and sustainable practices, ensuring the luxury fashion market remains vibrant and resilient.

As the luxury fashion market continues to evolve, thoughtful choices and a commitment to ethical values empower every shopper to build a wardrobe that reflects both personal style and a vision for a more responsible future.

Challenges in Luxury Fashion Market

Tariffs and Pricing

Tariffs continue to shape the landscape of luxury fashion in 2025, creating ripple effects across both primary and resale markets. When governments impose high tariffs on imported apparel—sometimes reaching up to 145%—the retail prices of new luxury goods climb sharply. This shift drives many buyers to seek value in the secondary market, where pre-owned luxury fashion becomes more attractive and accessible. According to recent market data, the U.S. luxury resale market reached $8.65 billion in 2024 and is projected to grow at a 7.07% CAGR through 2030, hitting $13.04 billion. A consumer survey found that 59% of Americans would consider secondhand shopping if tariffs push primary market prices higher.

Metric/Insight | Value/Description |

|---|---|

U.S. Luxury Resale Market Size (2024) | USD 8.65 billion |

Projected CAGR (2024-2030) | 7.07% |

Market Size Projection (2030) | USD 13.04 billion |

Tariff Impact on New Luxury Goods | Increased prices leading to higher demand for resale market |

Consumer Survey (ReturnPro) | 59% of American consumers would consider secondhand shopping if primary market prices rise due to tariffs |

Tariff Rate on Imported Apparel (e.g., from China) | Up to 145% |

Consumer Behavior Shift | Movement toward more affordable pre-owned luxury items due to tariff-driven price increases |

Luxury fashion brands respond to these pressures by harmonizing prices globally and investing in local marketing. However, inflated prices can sometimes cause resale values to stagnate or even decline if tariffs are later reversed. Retailers often shift their focus to pre-owned luxury fashion, where margins and consumer price sensitivity differ, ensuring the market remains dynamic and resilient.

Counterfeits

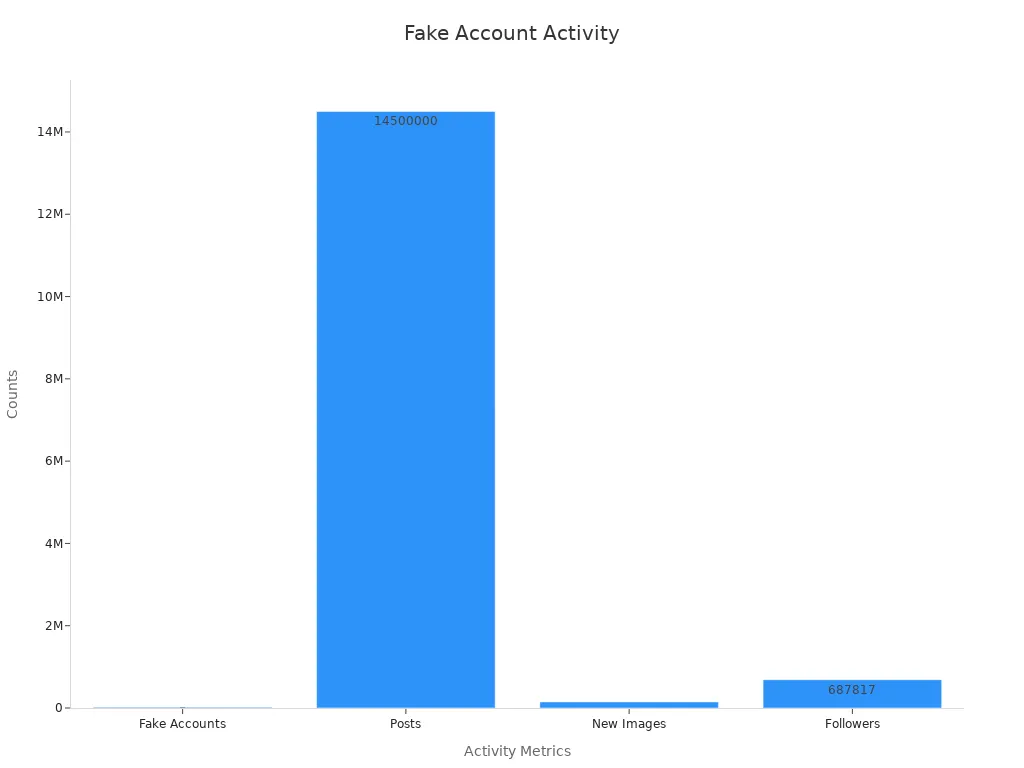

The prevalence of counterfeit goods poses a persistent challenge for the luxury fashion resale sector. Social media platforms, especially Instagram, have become hotspots for counterfeit activity, with studies revealing that 20% of all luxury brand-tagged items are fake. Chanel, Prada, and Louis Vuitton face the highest rates of counterfeiting, but no luxury fashion house remains untouched. In just three days, fake accounts can generate nearly 15 million posts and attract hundreds of thousands of followers, using advanced spambots and AI to evade detection.

Aspect | Details |

|---|---|

Prevalence on Instagram | |

Top Affected Brands | Chanel (13.9%), Prada (9.69%), Louis Vuitton (8.51%) |

Fake Accounts Identified (3-day period, 2016) | 20,892 |

Posts by Fake Accounts (3-day period) | 14.5 million posts, 146,958 new images |

Followers Gained by Fake Accounts (3-day period) | 687,817 |

Geographic Origin of Sellers | China, Russia, Malaysia, Indonesia, Ukraine |

Counterfeiting Methods | Use of spambots, AI, automatic account creation to evade detection |

Enforcement Challenges | Limited law enforcement initiatives, need for cross-sector collaboration |

Suggested Solutions | Social media surveillance, enforcement measures, postal screening, payment processor best practices, third-party cooperation |

Luxury fashion brands now invest in blockchain authentication, social media surveillance, and partnerships with payment processors to combat this threat. These efforts help protect both brand reputation and consumer trust, but the battle against counterfeits remains ongoing and complex.

Brand Control

Maintaining control over brand image and product experience presents another significant challenge in the luxury fashion resale market. When brands do not directly manage resale, they risk losing influence over how their products are presented and perceived. For example, Gucci handbags have lost over 50% of their value on some resale platforms, which can erode the sense of exclusivity that defines luxury fashion. To address this, brands like Gucci and Rolex have launched certified pre-owned programs and partnered with trusted platforms to authenticate and restore items, ensuring quality and consistency.

Challenge Aspect | Evidence / Example |

|---|---|

Brand image and product control | Brands risk losing control over image and product experience when resale is not managed by them. |

Price depreciation | Gucci handbags have lost over 50% of their value on resale markets, impacting perceived exclusivity. |

Authentication and quality | Gucci partnered with AuthenticWardrobe to authenticate and restore items, maintaining brand integrity. |

Certified pre-owned programs | Rolex launched a certified pre-owned program emphasizing durability and style to regain control. |

Sustainability and younger consumers | Growing resale demand from Gen Z and Millennials adds complexity to brand control strategies. |

Counterfeit risks remain a major concern, prompting brands to invest in blockchain for authenticity.

The 'price paradox' challenges brands to justify new product prices when similar items appear at lower prices in the resale market.

Direct involvement in resale, as seen with Gucci and Burberry, helps maintain brand image and authenticity.

Collaborations, such as Balenciaga’s partnership with RenewStyle, allow brands to oversee resale and address sustainability expectations.

Luxury fashion brands must balance exclusivity, authenticity, and sustainability while adapting to the evolving demands of Gen Z and Millennial shoppers. By embracing innovation and direct engagement, they can protect their legacy and inspire confidence in every transaction.

Thoughtful stewardship of brand identity, combined with a commitment to authenticity and innovation, ensures that luxury fashion continues to enchant and endure—even as the market evolves.

Gucci and Dior stand at the forefront of the luxury fashion market in 2025, each adapting to a landscape shaped by digital innovation, sustainability, and shifting economic realities. The luxury fashion market continues to evolve as brands balance exclusivity with accessibility, using technology to enhance trust and engagement.

The luxury fashion market faces economic pressures, digital transformation, and sustainability demands.

Gucci and Dior strengthen control over the luxury resale space, leveraging digital engagement and live-streaming.

The global luxury fashion market lost nearly 50 million customers between 2022 and 2024, highlighting the need for resilience.

Aspect | Key Insight |

|---|---|

Digital Sales | 20% of luxury goods sold online; live-shopping on the rise |

Sustainability | Consumers pay more for eco-conscious luxury; brands integrate green practices |

Brand Control | Gucci and Dior lead in managing luxury resale and digital experiences |

As the luxury fashion market grows, buyers and sellers discover new ways to express style and invest in meaningful pieces. Thoughtful choices and a focus on authenticity ensure that the future of luxury remains both inspiring and enduring.

FAQ

What makes Gucci and Dior stand out in the luxury resale market?

Gucci and Dior consistently attract attention for their iconic designs, enduring craftsmanship, and strong brand heritage. Their pieces often retain value, offering both style and investment potential for discerning collectors and new buyers alike.

How does sustainability influence luxury resale trends?

Sustainability drives demand for pre-owned luxury. Shoppers seek ethical sourcing, eco-friendly materials, and circular fashion models. Many buyers now view resale as a responsible way to enjoy high-end style while reducing environmental impact.

Why do younger generations prefer buying pre-owned luxury items?

Gen Z and Millennials value authenticity, individuality, and conscious consumption. They often choose second-hand luxury for its unique finds, lower environmental footprint, and the opportunity to express personal style without compromise.

How do platforms ensure authenticity in luxury resale?

Most reputable platforms use a combination of expert authenticators, blockchain technology, and detailed provenance records. These measures help guarantee that every item is genuine, building trust and confidence for buyers and sellers.

Which Dior and Gucci pieces hold the highest resale value?

Lady Dior bags and classic Gucci accessories, such as the Marmont and Jackie lines, consistently rank among the most sought-after items. Their timeless appeal and limited editions often command premium prices in the resale market.

Luxury Redefined: Timeless Style Meets Conscious Elegance

In 2025, the landscape of luxury fashion is gracefully shifting toward a new standard—one where thoughtful style meets mindful choices, and timeless elegance is valued alongside sustainability. Gucci and Dior remain emblematic of this evolution, each telling a story not just of heritage and iconic design, but also of how luxury can be reimagined through conscious consumption. At PlushPast, we see firsthand how this shift encourages shoppers to invest in pieces that transcend trends—items authenticated with care, chosen for their quality and enduring appeal, and embraced as part of a circular fashion future. It’s about cultivating a wardrobe that feels deeply personal yet connected to a larger purpose—where trust in authenticity and comfort in knowing your choices support a more sustainable industry become the true luxury. In this modern era, style is no longer just what you wear, but how you wear it—with intention, confidence, and respect for the craftsmanship that stands the test of time.

Disclaimer: The information provided on www.plushpast.com is for general informational purposes only and does not constitute professional fashion, legal, or authenticity advice. While PlushPast strives to ensure all content is accurate and trustworthy, visitors should exercise personal judgment and conduct their own research when making purchasing decisions. PlushPast does not guarantee the accuracy of third-party information and disclaims any liability for decisions made based on the content presented on this website.