Biotech IPOs 2025: Equity Report Predictions and Market Opportunities

Biotech IPOs 2025 present a landscape marked by cautious optimism as investors continue to prioritize clinical maturity and robust science over sheer volume. Recent equity reports reveal that, while early-stage biotech companies once dominated, all biotech IPOs in 2023 featured clinical-stage assets, with nearly a third already in Phase III. Investors now reward biotech IPO candidates that demonstrate clear clinical milestones and asset differentiation at the time of their initial public offering. This shift signals a maturing market where strong clinical data and disciplined valuation drive confidence, shaping both opportunity and strategy for biotech companies seeking to go public in 2025.

Key Takeaways

Biotech IPOs in 2025 will focus on companies with strong clinical data and clear commercial potential, favoring quality over quantity.

Investors prefer mid to late-stage biotech firms with proven science and realistic development plans to reduce risk and improve returns.

Funding is more competitive, so companies must build differentiated pipelines and prepare early with clear strategies to attract capital.

Innovation in areas like cell and gene therapy, mRNA vaccines, and AI-driven drug discovery offers exciting growth opportunities.

Market conditions remain selective and volatile, so adaptability, strong management, and clear communication are key to IPO success.

Biotech IPOs 2025 Outlook

Key Predictions

The outlook for biotech IPOs 2025 reflects a landscape shaped by both historical lessons and evolving investor priorities. Recent equity reports suggest that the market will continue its slow thaw, with a measured return of IPO activity rather than a rapid resurgence. Analysts expect a positive IPO trajectory, but with a clear focus on quality over quantity. This shift stems from the experiences of previous years, where a surge in preclinical-stage offerings led to disappointing after-market performance and a subsequent cooling of the biotech IPO market.

The number of biotech IPOs 2025 is expected to remain below the highs of 2020 and 2021, signaling a more disciplined approach.

In 2021, nearly one-third of IPOs involved preclinical-stage companies, which correlated with poor returns and a decline in sector ETFs.

By 2023, every biotech IPO featured clinical-stage assets, with about one-third already in Phase III, highlighting a preference for mature, derisked candidates.

Investors now prioritize companies with differentiated pipelines, robust clinical data, and clear commercial potential.

The market rewards realistic development plans and strong scientific validation, moving away from volume-driven IPOs.

Historical IPO performance data reinforces these predictions. Over the past 25 years, the U.S. IPO market has seen a long-term decline, with average annual IPOs in the last decade at just a third of 1990s levels. Structural challenges, such as increased regulatory costs and the rise of private capital, have contributed to this trend. After-market performance for IPOs often lags behind the broader market, prompting investors to demand profitability and sustainable growth from new offerings. Healthcare and biotech remain among the most promising sectors, but macroeconomic factors like interest rates and market volatility continue to influence IPO filings and outcomes.

Note: The outlook for 2025 anticipates improved performance and increased filings if structural barriers ease, but the market will likely favor companies that demonstrate maturity and commercial readiness.

Market Sentiment

Investor sentiment toward biotech IPOs 2025 has shifted from skepticism to cautious optimism, supported by both survey data and expert analysis. The Jefferies 2024 Temperature Check survey reveals a marked increase in confidence: 20% of respondents expect IPOs and equity raising to dominate transactional activity in 2025, up from just 6% the previous year. Furthermore, 64% of participants anticipate a rise in IPO activity, representing the most bullish outlook since the survey began in 2018.

Industry experts highlight investor optimism as a key catalyst for reopening the IPO window in biotech.

EY’s recent report notes a steady progression in IPO activity and confidence, even as uncertainties like the US presidential election loom.

The market’s renewed focus on clinical maturity and differentiated science aligns with investor demand for lower-risk, higher-reward opportunities.

This sentiment does not suggest a return to the exuberance of past cycles. Instead, it reflects a more discerning and strategic approach, where investors seek out companies with proven science, clear milestones, and realistic paths to commercialization. Market conditions in 2025 will likely continue to favor mid to late-stage biotech companies that can demonstrate both innovation and execution.

Tip: Companies considering a biotech IPO in 2025 should focus on building a compelling clinical and commercial story, as investors increasingly reward substance over hype.

Biotech IPO Market Trends

Recent Activity

The biotech ipo market has experienced a pronounced slowdown since its record-setting pace in 2021. A quick glance at the numbers reveals the extent of this shift:

Metric | 2021 | 2022 | 2023 |

|---|---|---|---|

Number of Biotech IPOs | 120+ (record) | 40-50 (~50% drop) | 30-50 (expected) |

Total Funds Raised (in billions USD) | > $20 billion | $6-$7 billion | < $5 billion |

Average First-Day Return | 30-40% | Below 10% | N/A |

Percentage of IPOs Priced Below Range | N/A | ~60% | N/A |

NASDAQ Biotech Index Change | N/A | ~ -20% | N/A |

Percentage of IPOs Underperforming Post-Listing (2020-2023) | N/A | ~70% | N/A |

This contraction reflects more than just numbers. Market volatility, inflation, and rising interest rates have made investors more cautious. The end of the pandemic-driven boom reduced urgency, while increased regulatory scrutiny and poor post-IPO performance led to skepticism. Many startups now delay their IPO plans, facing misaligned valuations and unpredictable rewards. Even companies with strong clinical data often do not see the expected gains, making the process less attractive. Venture investors have responded by focusing on fewer, larger private rounds, further slowing public offerings.

Note: The disappearance of large offerings since early 2025 underscores the impact of the current market environment, where only the most mature and differentiated biotech companies can attract public capital.

Investor Focus

Despite the slowdown, signs of gradual recovery have begun to emerge. Licensing and M&A activity have increased, providing alternative exit routes for companies and liquidity for investors. The influence of macroeconomic and geopolitical factors remains strong, shaping both the timing and structure of deals. Data from recent years shows that IPO investors now prefer companies with scale, profitability, and cash flow, rather than speculative growth. This risk aversion has shifted the focus toward mid to late-stage biotech companies with de-risked assets.

In 2024, private venture funding to clinical-stage companies accounted for 62% of the total, a notable increase from previous years. Meanwhile, funding to preclinical-stage companies dropped to 28%. Most IPOs in 2024 involved companies with robust clinical validation, reflecting this new investor preference. The pipeline for 2025 continues to build, but deal flow depends on stabilized equity markets, improved valuations, and controlled volatility. Interest rate outlooks and geopolitical events will remain key factors shaping the biotech ipo market as 2025 unfolds.

Investors now reward companies with clear clinical milestones and commercial potential.

The current market environment favors strategic patience and adaptability, as both companies and investors navigate uncertainty.

A thoughtful approach, grounded in strong science and realistic expectations, will serve as the foundation for success in the evolving landscape of biotech ipos.

Drivers and Challenges

Funding and Capital

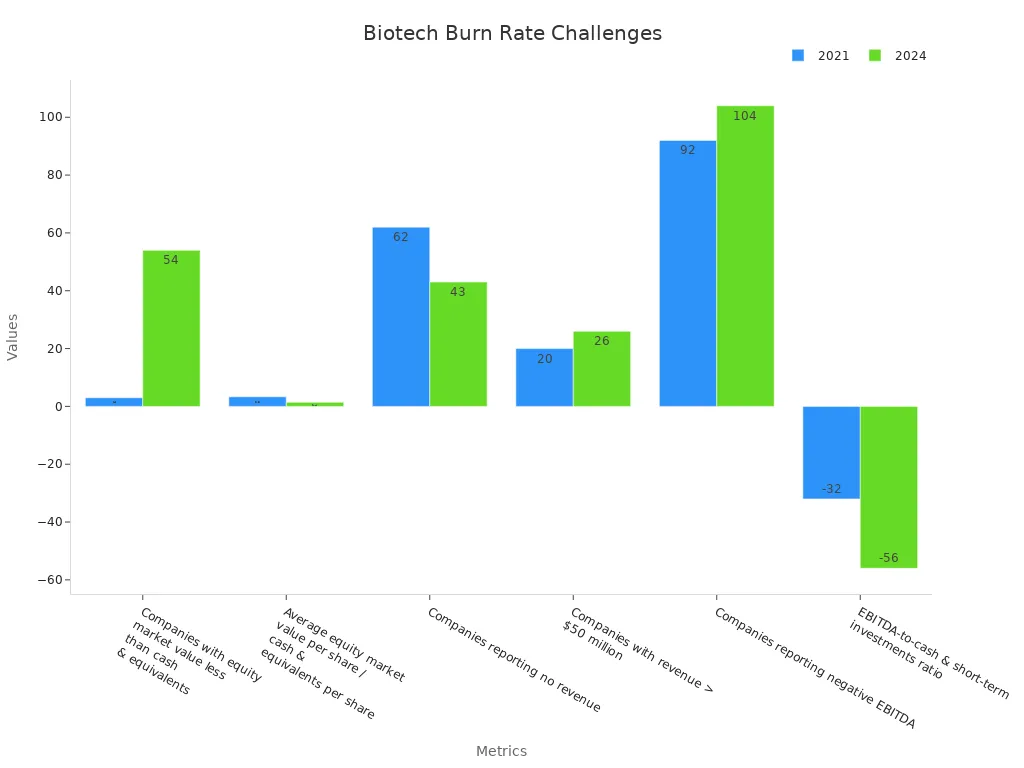

Biotech startups face a complex funding landscape as they prepare for IPOs. The slowdown in public funding, combined with high burn rates, has created significant hurdles for companies seeking to scale. Many drug startups struggle to maintain momentum, often relying on smaller private offerings as bridge financing. The following table highlights the financial pressures these companies encounter:

Metric | 2021 | 2024 | Commentary |

|---|---|---|---|

Companies with equity market value less than cash & equivalents | 3 | 54 | Undervaluation signals market skepticism |

Average equity market value per share / cash & equivalents per share | 3.3 | 1.4 | Valuation compression evident |

Average cumulative stock price return since 2021 | N/A | -65% | Persistent negative returns |

Companies reporting negative EBITDA | 92 | 104 | Losses remain widespread |

EBITDA-to-cash & short-term investments ratio | -32% | -56% | Burn rates worsening |

These numbers reveal that nearly 40% of public biotech companies still report no revenue, and most remain unprofitable. As a result, funding for startups now depends on demonstrating strong science and a clear path to commercial growth. Venture funding has shifted toward later-stage companies, making capital access more competitive and reinforcing the need for robust clinical progress.

Regulation

Regulatory developments continue to shape the biotech IPO landscape. Uncertainty at agencies like the FDA, combined with evolving global standards, has intensified the challenges for companies aiming to go public. Regulatory delays or shifting requirements can impact both valuation and investor confidence. In Europe, regulatory uncertainty and market volatility contributed to a 13% drop in the MSCI Europe Pharma & Biotech Index, further limiting access to public markets. Many companies now adopt creative deal structures, such as hub-and-spoke models or combination mergers, to navigate these obstacles and extend their financial runway.

Economic Factors

Market conditions in 2025 reflect a delicate balance of economic and geopolitical influences. Interest rate changes, tax policy, and the US presidential election all play a role in shaping investor sentiment. The IPO market has shown signs of recovery, with a 16% increase in US IPO numbers and an 86% rise in proceeds through Q3 2024 compared to the previous year. However, the environment remains highly selective. Companies must align their IPO timing with favorable market conditions and communicate clinical progress and regulatory milestones clearly to attract investors. Private equity and venture capital continue to provide essential support, but only for those with validated science and a compelling commercial story.

Takeaway: Biotech companies that combine scientific rigor with strategic adaptability will be best positioned to overcome funding, regulatory, and economic challenges as they pursue public offerings in 2025.

Equity Report Insights

Sector Performance

Equity reports reveal that the biotech sector continues to attract attention, yet its performance remains complex and nuanced. Analysts observe that biotech companies with multiple Phase 2 drug candidates tend to present lower risk profiles compared to those focused on a single product. The market value of these firms often depends on their disease focus. Companies targeting cancer, for example, operate in large markets but face intense competition, while those developing orphan drugs for rare diseases may benefit from market exclusivity and less rivalry. Strategic choices also shape outcomes. Some biotech companies license their drugs early, while others build internal sales teams, each approach affecting shareholder value and risk. The sector stands out for its high-risk, high-reward nature, with binary outcomes tied to clinical trial success or failure. Unlike traditional pharmaceuticals, most biotech firms do not pay dividends and rely on ongoing financing, which adds another layer of complexity for investors.

Innovation Trends

Recent equity reports highlight a surge in innovation across the biotech sector. The Nasdaq Biotechnology Index climbed nearly 5% year-to-date as of Q1 2025, reflecting renewed investor optimism. Healthcare companies raised over $800 million through Nasdaq IPOs in January 2025 alone, and the number of healthcare listings on Nasdaq has grown by more than 50% since 2015. Despite an 11% dip in global biotech funding in 2024, early-stage mega-rounds remain active, fueling research in areas such as obesity, immunology, inflammatory diseases, and radiotherapy. Notably, AI-driven drug discovery is gaining traction, with emerging biotech firms like Insilico Medicine and Exscientia securing significant funding. The pipeline for 2025 features nearly 30 healthcare-related IPOs in the U.S., spanning biotech, medtech, diagnostics, and digital health. Companies like Apimeds Pharmaceuticals, Cuprina Holdings, and Advanced Biomed Inc. exemplify this wave, focusing on advanced therapies for cancer, innovative wound care, and early cancer detection. The sector also sees continued momentum in mRNA vaccines and next-generation therapeutics.

Global Comparison

The global landscape for biotech IPOs shows marked contrasts. The U.S. remains the preferred listing destination for both domestic and international biotech companies, thanks to deeper capital pools and robust investor appetite. During the peak pandemic years, the U.S. saw 131 biotech IPOs in 2020 and 154 in 2021. By Q3 2024, the number dropped to 17, yet capital raised approached $1.1 billion, with an initial boost in Q1 2024. Globally, capital raised in 2023 reached $90 billion, with projections for 2024 climbing to $130 billion. This growth signals a significant increase in global investor interest, even as the volume of IPOs remains lower than previous highs. The U.S. continues to set the pace for innovation and capital access, but international markets are catching up, especially in areas like cancer research and mRNA technology.

Investors and industry leaders should watch for shifts in innovation focus and capital flows, as these trends will shape the next generation of biotech breakthroughs.

Biotech Opportunities

Promising Subsectors

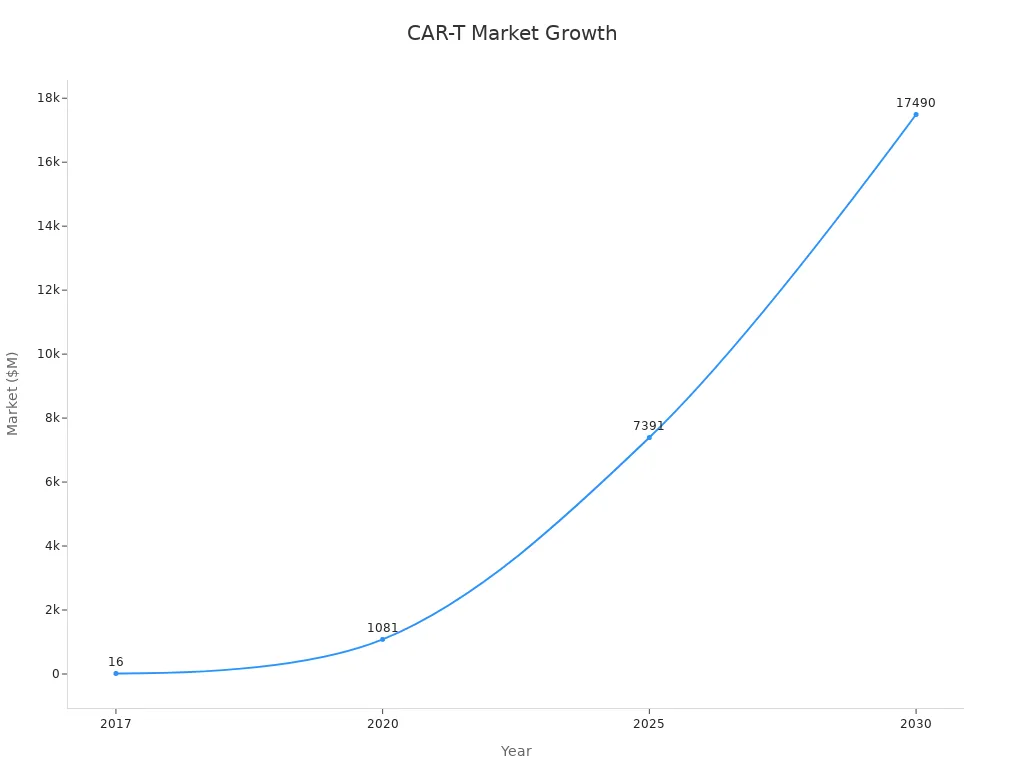

The biotech sector in 2025 stands at the forefront of scientific innovation, offering a clear and compelling opportunity for both investors and companies. Several subsectors have emerged as engines of growth, driven by robust investments and transformative therapies. Cell and gene therapy (CGT) leads this wave, attracting $35 billion in investments in 2023 and maintaining strong momentum with $5 billion in the first quarter of 2024. Market sales for CGT surpassed $10 billion last year, and analysts project double-digit growth through 2029. The CAR-T therapy market, a subset of CGT, illustrates this trajectory. In 2017, the market size reached only $16 million, but by 2020, it soared to $1,081 million. Projections for 2025 estimate a leap to $7,391 million, with further expansion to $17,490 million by 2030. Blood cancer treatments dominate CAR-T sales, accounting for 68% in 2020 and expected to rise to 80% by 2025.

Metric/Segment | Value/Projection | Notes/Context |

|---|---|---|

CGT Investments (2023) | $35 billion | Total annual investment in cell and gene therapy |

CGT Investments (Q1 2024) | $5 billion | Investment in first quarter 2024 |

CGT Market Sales (2023) | > $10 billion | Market sales exceeded this value |

CGT Market Growth Forecast | Double-digit growth through 2029 | Indicates sustained strong growth |

CAR-T Therapy Market (2017) | $16 million | Market size in 2017 |

CAR-T Therapy Market (2020) | $1,081 million | Market size in 2020 |

CAR-T Therapy Market (2025 Projection) | $7,391 million | Projected market size |

CAR-T Therapy Market (2030 Projection) | $17,490 million | Projected market size |

Blood Cancer Share of CAR-T Sales (2020) | 68% | Dominant segment |

Blood Cancer Share Projection (2025 & 2030) | 80% | Expected to increase |

US Market Share (2020) | 77% | Largest regional market |

Europe Market Share (2020) | 19% | Second largest market |

Monthly VC and Private Funding Deals | 10 to 20 deals | Despite tighter funding environment |

mRNA cancer vaccines represent another high-potential area. The success of mRNA vaccines during the pandemic has accelerated research into personalized cancer therapies, with several late-stage trials underway. Startups focusing on mRNA cancer vaccines and next-generation immunotherapies have attracted significant venture capital, reflecting investor confidence in their clinical promise. Advanced biopharma innovation, including AI-driven drug discovery and gene editing technologies, continues to reshape the landscape. Companies leveraging artificial intelligence to streamline clinical trials and identify novel drug targets have gained traction, while regulatory frameworks now support faster development of gene therapies.

Note: Increased mergers and acquisitions, advancements in gene editing, and the integration of AI all contribute to a dynamic environment where biotech investing can yield outsized returns for those who identify the right subsectors.

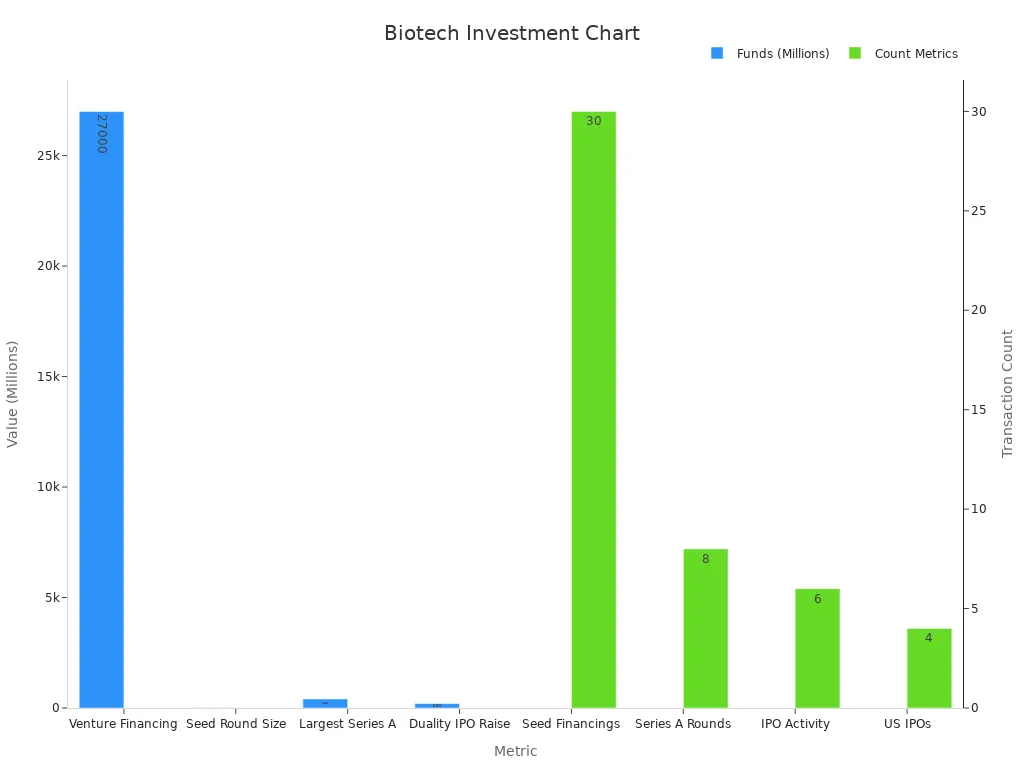

Investment Strategies

Biotech investors in 2025 face a market that rewards selectivity and scale. Data shows that total venture financing is projected to reach nearly $27 billion, on par with 2024, signaling sustained investment levels. The average seed round size now exceeds $15 million, almost double the average of the previous four years. However, the number of seed financings has dropped to the lowest in a decade, with only 30 disclosed by mid-May 2025. This trend highlights a shift toward fewer, larger investments in startups with strong scientific foundations.

Metric | Numerical Data | Context/Implication |

|---|---|---|

Total venture financing (2025 projected) | Nearly $27 billion | On track with 2024, indicating sustained investment levels |

Average seed round size (2025) | Over $15 million | Almost double the average of the previous four years, showing increased early-stage funding |

Number of seed financings (mid-May 2025) | 30 disclosed | Lowest in 10 years, indicating fewer but larger seed rounds |

Number of Series A rounds > $100 million (2025) | 8 rounds | Reflects large capital injections in early growth stages |

Largest Series A round | $411 million (Verdiva Bio) | Example of significant funding in hot sectors like obesity therapeutics |

Average Series A size | Roughly doubled since 2015 | Demonstrates trend toward bigger early-stage investments |

IPO activity (1Q25) | 6 biopharma/platform IPOs | Limited but notable; Chinese IPOs outperform US IPOs |

Duality Biotherapeutics IPO raise | Over $200 million | Hong Kong debut with >100% price surge on first day, indicating strong investor interest |

US biopharma IPOs (1Q25) | 4 IPOs, all declined in price | Shows weaker US public market performance |

Public biotech valuation trend | 40% trading below cash value; preclinical biotechs lost 90% value over 4 years | Highlights market selectivity favoring late-stage or approved drug companies |

Successful biotech investing strategies in this environment focus on companies with late-stage or approved drugs, strong clinical data, and diversified pipelines. Investors increasingly favor startups that demonstrate resilience, platform breadth, and a clear path to regulatory approval. The failure rate for biotech ventures remains high—between 85% and 95%—and average returns over five years stay below 5%. However, the probability of regulatory approval for assets that reach late-stage trials rises to about 85%. This underscores the importance of targeting companies with de-risked assets and robust clinical validation.

Tip: Investors should prioritize management quality, strategic partnerships, and adaptive trial designs. Early regulatory engagement and co-creation with stakeholders can improve trial efficiency and reduce costly amendments.

Best Practices

For drug startups and established companies planning IPOs in 2025, several best practices have emerged from recent market experience:

Build a differentiated product pipeline with lead assets that show clear efficacy, safety, and market potential.

Focus on impactful drugs that can change the standard of care or address unmet medical needs, especially in cancer and rare diseases.

Assemble an experienced management team with a proven track record in biotech.

Communicate a clear and compelling vision and strategy to both investors and the broader market.

Cultivate a supportive investor base that provides not only capital but also feedback and endorsement through clinical progress.

Prepare early by developing a detailed roadmap and understanding public market expectations well before the IPO process begins.

Monitor market conditions closely and adjust IPO timing and strategy as needed.

Align valuations with key derisking milestones to maintain investor demand and post-IPO performance.

Execute clinical and strategic milestones on or ahead of schedule to build credibility and sustain momentum.

Companies that follow these practices position themselves to capture the most promising opportunities in biotech, even as the market remains highly selective.

A thoughtful approach to biotech investing, grounded in scientific rigor and strategic adaptability, will help both investors and companies navigate the evolving landscape of 2025. The sector’s complexity and risk demand discipline, but the rewards for those who identify and execute on the right opportunities can be transformative. As innovation accelerates in areas like mRNA cancer vaccines and cell and gene therapy, the next wave of breakthroughs will likely come from those who combine vision with execution.

Risks and Uncertainties

Policy and Regulation

Policy shifts and regulatory changes continue to shape the landscape for biotech IPOs, introducing both opportunities and significant risks. Recent developments, such as the launch of the Technology Enterprises Channel (TECH) in Hong Kong, have simplified listing requirements and introduced confidential filing options, reducing compliance costs and accelerating IPO preparation for biotech companies. In contrast, the United States has raised Nasdaq listing thresholds, creating new barriers for small and medium-sized enterprises. This change has contributed to a 62% decrease in IPO proceeds, despite a 44% increase in deal numbers. These evolving regulatory environments directly impact financing efficiency and the feasibility of public listings. Industry data shows that while biopharma funding reached a decade high in 2024, increasing complexity from economic, social, and geopolitical factors has heightened uncertainty in research and development. Companies now rely on advanced decision frameworks and technologies to navigate these challenges, underscoring the need for adaptive strategies in a shifting policy landscape.

Market Volatility

Market volatility remains a defining feature of the current biotech IPO environment. Statistical measures highlight the unpredictable nature of recent offerings:

Statistical Measure | Value / Description |

|---|---|

Number of IPO deals (early 2024) | |

IPOs trading above issue price | 4 out of 18 IPOs |

Average performance by year-end | Down 27% |

These figures reveal that, although deal volume has increased slightly, only a small fraction of IPOs trade above their issue price. Average returns have declined, reflecting persistent uncertainty and risk aversion among investors. Factors such as rising inflation, higher treasury yields, and shifting monetary policy contribute to this volatility. Trade protectionism, labor shortages, and geopolitical tensions—especially between the US and China—further complicate the outlook. Companies must remain agile, adopting robust risk management and financial strategies to weather these unpredictable market conditions.

M&A Impact

Mergers and acquisitions (M&A) have become a dominant force in the biotech sector, reshaping the pool of companies eligible for IPOs. The following table illustrates the trend:

Year | Number of Biotech M&A Deals | M&A Dollar Volume (Billion $) | Number of Biotech IPOs | IPO Dollar Volume (Billion $) |

|---|---|---|---|---|

2023 | 79 | 62.7 | 16 | 3.3 |

2024 | 73 | 109 | 23 | 3.8 |

Despite a slight decrease in deal count, M&A dollar volume reached a record high in 2024. Many biotech firms now opt for earlier-stage sales through M&A, driven by the collapse of the IPO market and reduced equity funding. This trend has led to a shrinking pool of IPO candidates, as promising companies choose acquisition over public listing. The result is a more consolidated market, where fewer, but often more mature, companies reach the IPO stage. Scientific setbacks and the binary nature of clinical trial outcomes add another layer of uncertainty, reinforcing the need for careful due diligence and strategic foresight.

In this climate, adaptability and a clear-eyed assessment of risk become essential. Companies and investors who understand the interplay of policy, market forces, and consolidation will be best positioned to navigate the evolving biotech IPO landscape.

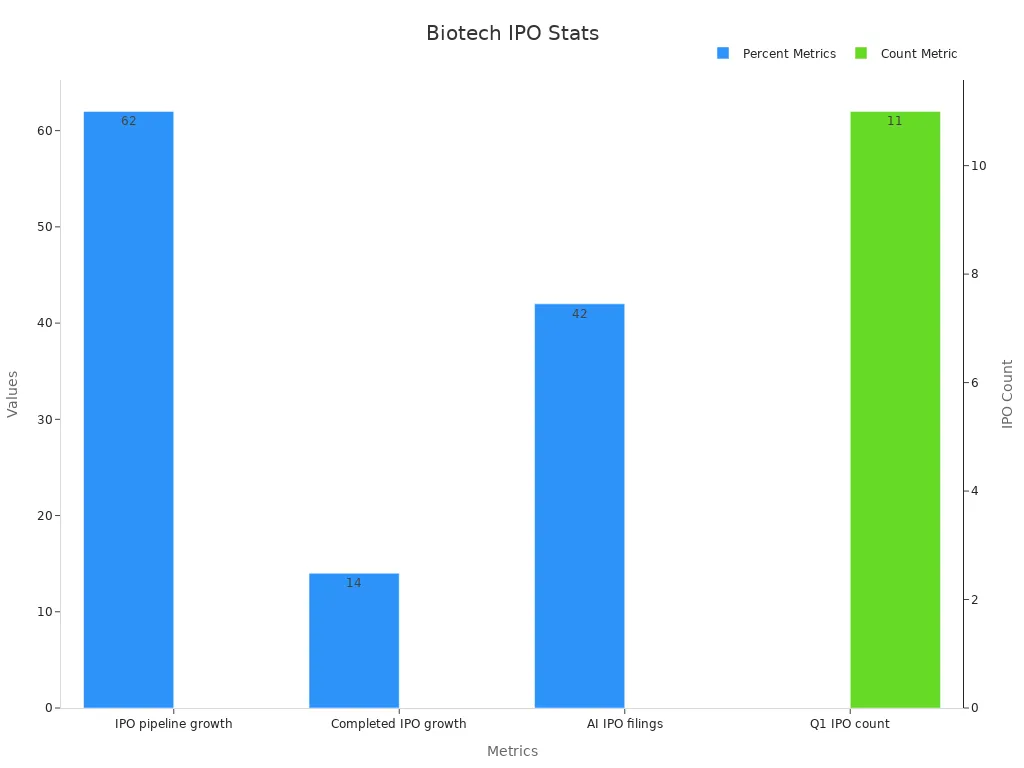

The outlook for 2025 reveals a robust opportunity for investors and companies, with a 62% increase in the IPO pipeline and a 14% rise in completed listings. AI-driven innovation now shapes 42% of filings, while Q1 saw the highest IPO count in two decades, especially in emerging markets.

Metric | Value | Interpretation |

|---|---|---|

Year-over-year IPO pipeline growth | 62% | Strong increase in candidates |

Completed IPOs growth | 14% | Rising market confidence |

Filings referencing AI | 42% | Technology drives growth |

Q1 IPOs (2025) | 11 | Geographic expansion |

Investors and leaders should prioritize due diligence and remain adaptable. By focusing on clinical maturity and innovation, they can navigate risks and capture the next wave of growth.

FAQ

What makes a biotech company a strong IPO candidate in 2025?

Investors look for companies with late-stage clinical assets, clear scientific differentiation, and a credible path to commercialization. A strong management team and transparent communication also build trust. Companies that show resilience and adaptability often stand out in a selective market.

How do macroeconomic factors influence biotech IPO activity?

Interest rates, inflation, and global events shape investor sentiment and capital availability. When economic conditions stabilize, IPO activity tends to increase. Companies must monitor these trends closely and adjust their strategies to align with shifting market dynamics.

Why do investors favor mid to late-stage biotech companies now?

Mid to late-stage companies usually have clinical data that reduces risk. Investors prefer these firms because they offer more predictable outcomes and clearer commercial potential. This shift reflects a broader demand for quality and maturity in the biotech sector.

What role does innovation play in biotech IPO success?

Innovation drives value in biotech. Companies that leverage new technologies, such as AI-driven drug discovery or advanced gene therapies, attract more attention. Investors reward firms that combine scientific breakthroughs with practical business strategies.

How can companies prepare for a successful IPO in this environment?

Preparation starts with building a differentiated pipeline and assembling an experienced team. Companies should engage early with investors, communicate milestones clearly, and remain flexible. Strategic planning and adaptability help navigate uncertainty and position the company for long-term growth.

Thoughtful preparation and a focus on innovation empower both investors and companies to thrive in the evolving biotech landscape.

Biotech IPOs 2025

The biotech IPO landscape in 2025 is taking shape around a new kind of discipline—one that favors clinical maturity, differentiated science, and credible paths to commercialization over sheer momentum. After years of volatility and unmet expectations, investors are sharpening their focus, backing companies with real-world data and robust development strategies. It’s a sign of a market growing wiser, not weary. At VASRO, we see this evolution as a natural outcome of a maturing sector—where smart investing means asking the right questions early, weighing risk with precision, and finding value where vision meets execution. For those looking to participate in biotech’s next chapter, the opportunities are compelling—but success will favor those who align insight with patience and strategy with substance.

Disclaimer: The information provided on www.vasro.de is for general informational purposes only and does not constitute investment advice or a recommendation to invest in any particular asset or market. VASRO GmbH does not offer personalized investment advice, and the content on this website should not be relied upon as such. Visitors are encouraged to seek independent financial advice tailored to their specific circumstances before making any investment decisions. VASRO GmbH disclaims any liability for investment decisions made based on the information presented on this website.